Regulatory reporting means you collect, prepare, and submit data to meet rules set by authorities. In 2025, this process shapes how you manage transparency and build trust with stakeholders. Regulatory reporting is essential for organizations, especially those in finance and manufacturing, where you face strict oversight and evolving standards. The market for regulatory reporting solutions is projected to reach USD 7.61 billion in 2025, reflecting its growing importance. You see rapid adoption of technology in these sectors, with finance showing a 20% rise in automated reporting tools. Platforms like FineReport help you streamline reporting, improve accuracy, and keep up with regulatory demands.

Regulatory reporting in 2025 means you collect, organize, and submit data to meet specific regulatory requirements set by authorities. You use regulatory reporting to show transparency, maintain trust, and demonstrate that your organization follows the law. The core objectives of regulatory reporting include:

You see regulatory reporting as a foundation for compliance and operational integrity. In finance and manufacturing, regulatory reporting helps you manage risk, protect sensitive information, and respond to evolving regulations. You must adapt to new regulatory requirements quickly, especially as authorities introduce new rules for data protection, artificial intelligence, and financial disclosures.

FineReport supports your regulatory reporting needs by connecting to multiple data sources, automating report generation, and ensuring your reports meet the latest regulatory requirements. You can use FineReport to create detailed, accurate reports that satisfy both internal and external regulatory reporting guidelines.

You must follow strict regulatory reporting guidelines to ensure compliance and avoid penalties. These guidelines shape how you collect, process, and submit your data. In 2025, the most significant regulatory reporting guidelines include:

Regulatory reporting guidelines create systematic processes for data submission. You must ensure your organization meets legal standards and maintains transparency. In the financial sector, regulatory reporting guidelines help you build customer trust and protect sensitive information. These guidelines also demonstrate your commitment to ethical practices, which fosters trust with customers and investors. If you fail to comply with regulatory reporting guidelines, you risk severe legal and financial consequences.

FineReport helps you stay compliant with regulatory reporting guidelines by automating data collection, validation, and report generation. You can schedule reports, manage permissions, and access your regulatory reporting data on any device. FineReport’s flexible design lets you adapt quickly to new regulatory requirements, so you always meet the latest regulatory reporting guidelines.

Note: Regulatory reporting guidelines change frequently. You need a solution that adapts to new requirements and supports ongoing compliance. FineReport provides the tools you need to keep up with evolving regulations and maintain effective regulatory reporting processes.

Regulatory reporting in 2025 follows a clear process. You need to collect and validate data, generate reports, and submit them to meet regulations. Each step requires careful attention to detail and the right technology to ensure compliance and efficiency.

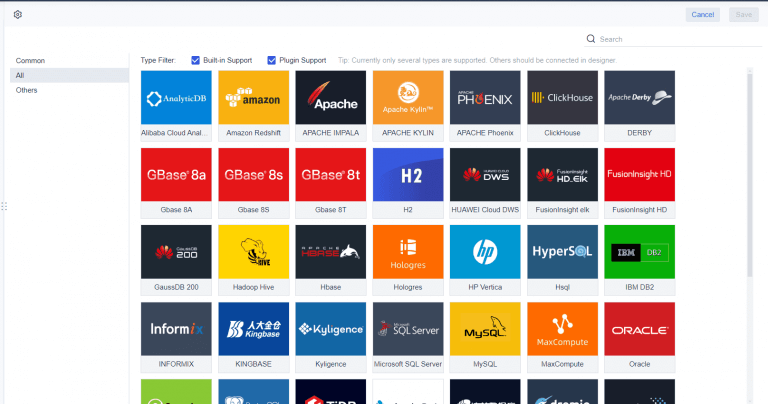

You start regulatory reporting by gathering data from many sources across your organization. You need a systematic strategy to make sure every stakeholder knows their responsibilities. FineReport helps you connect to databases, spreadsheets, and external systems, so you can collect all the necessary information in one place.

To validate your data, you use automated tools and cross-referencing methods. FineReport’s built-in validation features check for accuracy and completeness, reducing the risk of errors. You also keep detailed records of how you acquire and process each piece of data. This documentation supports your regulatory reporting and helps you respond to audits or questions from regulators.

Best practices for data collection and validation include:

FineReport streamlines these steps by providing a unified platform for data integration and validation. You can automate routine checks and ensure your data is ready for reporting.

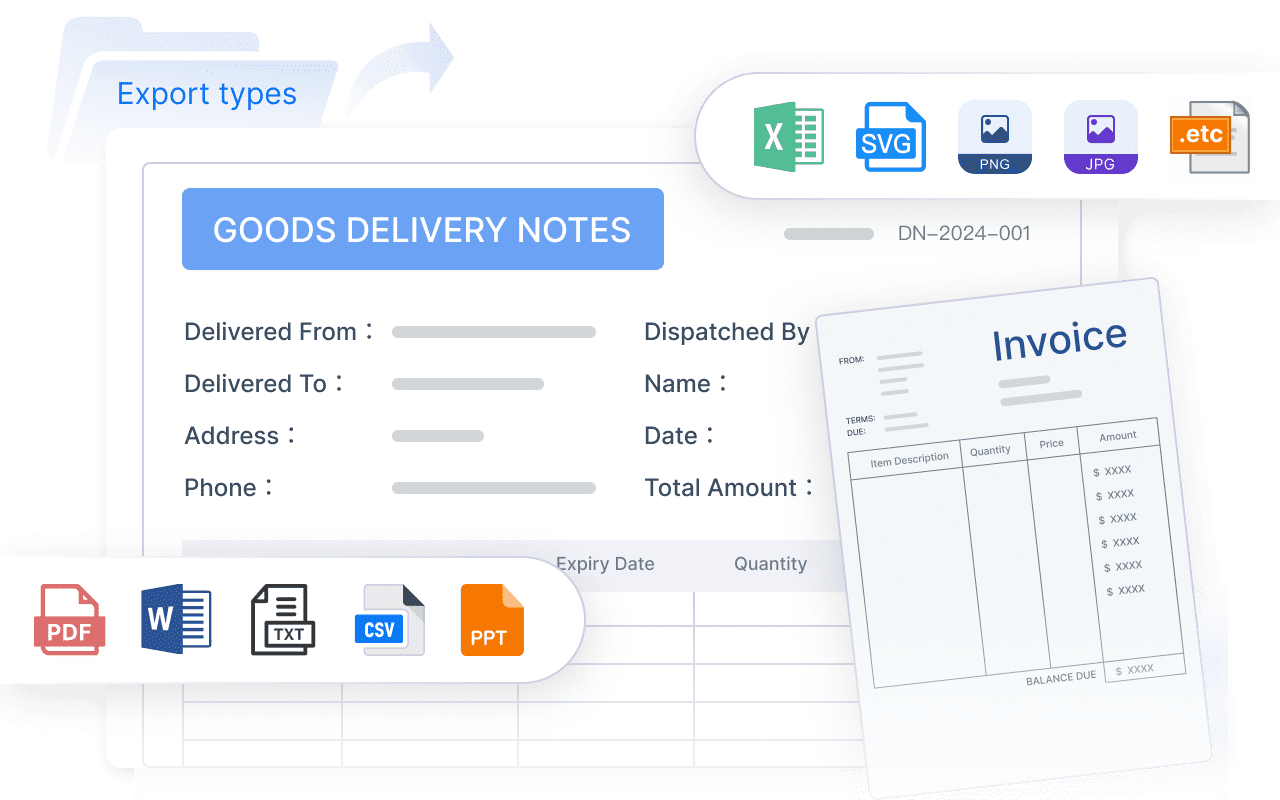

Once you validate your data, you move to report generation. You need to create reports that meet the format and standards set by regulations. FineReport offers standardized templates and customizable layouts, so you can present information clearly and concisely.

Many organizations face challenges during report generation. The table below shows common issues and their impact:

| Challenge Description | Impact on Report Generation |

|---|---|

| Lack of system integration | Difficulties in obtaining a comprehensive view of regulated entities, hindering informed decision-making. |

| Inefficient processes due to outdated technology | Increased administrative burden from manual workflows and duplicate data entry, leading to inaccuracies in reports. |

| Inability to access necessary information quickly due to legacy systems | Delays in report generation as staff struggle to find required data in a timely manner. |

| Need for transparent decision-making to build trust | Challenges in achieving consistent and informed decisions without adequate supporting systems. |

FineReport addresses these challenges by automating report generation. You can consolidate data from multiple systems, reducing manual workloads and improving speed and accuracy. Automated reporting lets you focus on higher-value tasks, such as analyzing trends and making strategic decisions. Real-time monitoring features help you detect anomalies and ensure your reports reflect current conditions.

You should also include supporting documentation, such as policies and audit results, to substantiate your reports. FineReport makes it easy to attach these materials and ensure your reporting meets all regulatory requirements.

The final step in regulatory reporting is submitting your reports to the appropriate authorities and ensuring compliance with regulations. You must meet deadlines and follow the specific requirements for each type of report.

Key requirements for submission and compliance in regulatory reporting include:

| Reporting Type | Purpose |

|---|---|

| Financial Reporting | Ensure transparency of financial position and risk (GAAP, IFRS) |

| Prudential Reporting | Monitor capital adequacy, liquidity, and solvency (Basel III, Solvency II) |

| ESG and Sustainability | Disclose non-financial metrics and climate risk (CSRD, ISSB, TCFD) |

| Operational Risk Reporting | Manage and disclose internal risk and compliance controls |

| Tax and Regulatory Filings | Ensure tax compliance and jurisdictional reporting (FATCA, CRS) |

| Cybersecurity/Data Privacy | Report breaches and data handling processes (GDPR, NIS2 Directive) |

You face challenges such as data fragmentation, changing requirements, and manual processes. Many companies use legacy systems that do not integrate well, making it hard to compile accurate, real-time data. Regulations change quickly, so you need to stay updated and adapt your reporting processes.

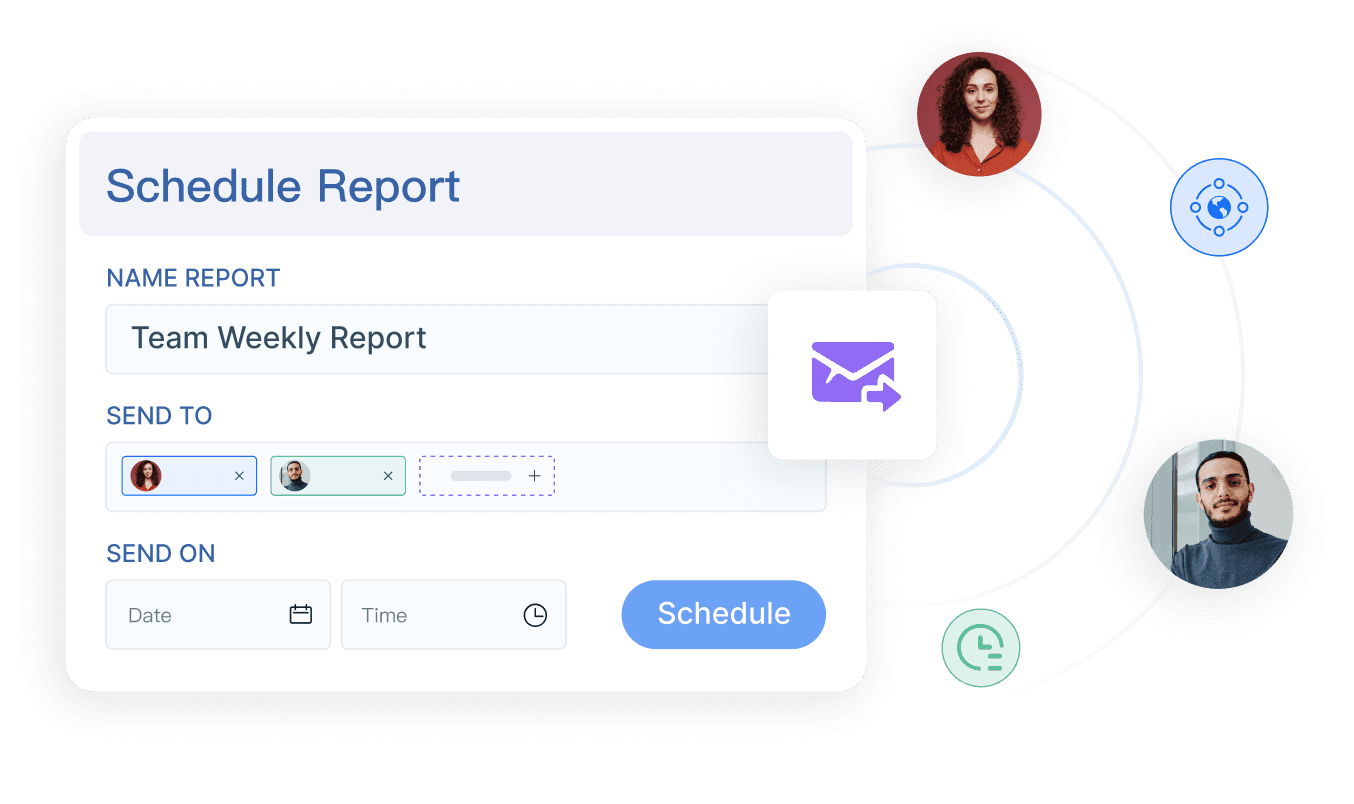

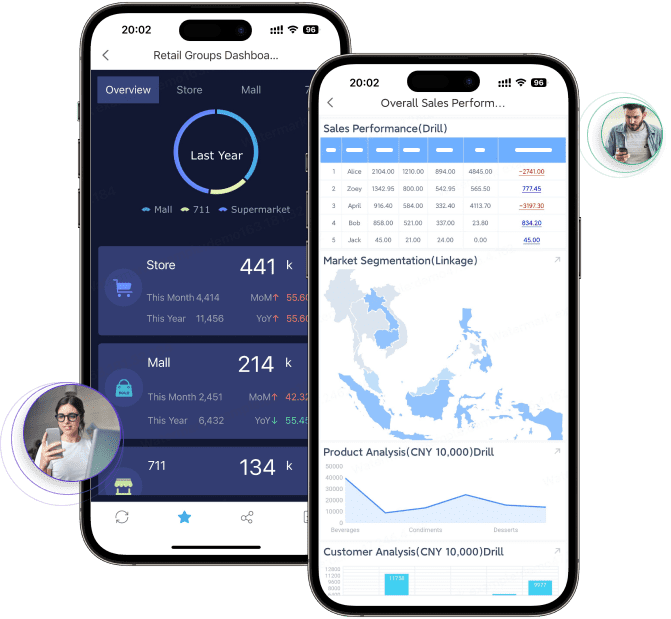

FineReport helps you overcome these challenges with end-to-end workflow automation, real-time dashboards, and scheduled reporting. You can automate routine compliance tasks, freeing up resources for strategic management. Mobile access allows you to address compliance issues on-the-go, enhancing responsiveness and ensuring timely submissions. Real-time notifications alert you to potential regulatory violations, helping you prevent breaches before they occur.

Scheduled reporting ensures you never miss a deadline. FineReport lets you set up automated report generation and distribution, so your reports reach regulators on time. Mobile scheduling tools improve employee engagement and make it easier to manage compliance tasks.

Tip: Use a centralized reporting platform like FineReport to automate your regulatory reporting process. This approach improves accuracy, reduces manual effort, and helps you stay compliant with evolving regulations.

In 2025, you must prepare several types of regulatory reports to meet evolving regulatory reporting standards. These reports help financial institutions and organizations in highly regulated industries demonstrate compliance, manage risk, and maintain transparency. You need to understand the requirements for each report type and use technology to streamline your reporting process.

Financial regulatory reports remain essential for financial institutions. You must follow strict instructions and deadlines. The table below highlights key requirements for financial regulatory reports in 2025:

| Requirement | Description | Compliance Date |

|---|---|---|

| SAR Filing Instructions | Financial institutions must follow specific SAR filing instructions from FinCEN alerts. | Ongoing |

| Beneficial Ownership Reporting | Only foreign reporting companies must report BOI; domestic companies are exempt. | Extended to 30 days from March 21, 2025 |

| Geographic Targeting Order | MSBs in certain ZIP codes must file CTRs at a $200 threshold. | Effective March 11, 2025 |

| Compliance Date Extension | FDIC compliance date for digital sign display postponed. | Extended to March 1, 2026 |

You need to keep up with these changes and ensure your regulatory reports meet all requirements. FineReport supports multi-format and multi-source reporting, allowing you to collect data from various systems and generate accurate financial reports quickly.

Compliance regulatory reports are vital in industries with strict safety and operational standards. You must address requirements such as:

You must also manage compliance by:

FineReport helps you integrate data from multiple sources, automate compliance checks, and generate reports that meet regulatory standards. You can schedule compliance reports and track changes in regulations using dashboards and alerts.

ESG and industry-specific regulatory reports have gained importance. You see a rise in sustainability and climate-related reporting. Most large US companies continue or increase investments in ESG initiatives. Many executives view sustainability as a competitive advantage. Technology adoption for ESG reporting is growing, with most organizations planning to enhance tracking of ESG metrics.

You also notice updates to reporting standards, such as those proposed by the IFRS Foundation for extractives and minerals processing industries. These revisions align industry guidance with climate-related content in SASB Standards.

FineReport enables you to create ESG and industry-specific regulatory reports using multi-source data integration. You can customize report formats, visualize trends, and automate the reporting process. This flexibility helps you respond to new regulatory requirements and maintain compliance.

Tip: Use FineReport to manage all your regulatory reporting needs. You can create, schedule, and distribute financial, compliance, and ESG reports efficiently, ensuring you meet every regulatory requirement.

You need regulatory compliance to protect your organization from risk and maintain business transparency. In 2025, regulations shape how you operate and interact with stakeholders. Regulatory compliance reporting helps you meet legal obligations and build trust. The table below shows why regulatory compliance is essential:

| Evidence | Description |

|---|---|

| Excellent corporate compliance programs are essential to protect against risk | You safeguard your reputation and operations by following regulations. |

| Compliance trends are shaping the culture of businesses | You adapt to regulatory changes and create a culture of integrity. |

| Compliance professionals need to be vigilant | You face complex regulations and must stay alert to avoid conflicts. |

You must adapt your compliance strategies as regulations evolve. You protect your reputation and stakeholder interests by mitigating risks. Ethical standards in business practices help you maintain trust and integrity.

Effective regulatory reporting gives you several advantages. You anticipate risks and respond quickly to disruptions. You reduce the chance of costly incidents and minimize resources needed for recovery. Regulatory compliance reporting helps you adapt to legal changes and maintain compliance. You protect your organization from financial losses, reputational damage, and operational risks. Proper regulatory reporting supports business transparency and strengthens stakeholder confidence.

Improved regulatory reporting helps you operate efficiently and maintain compliance with regulations.

You face challenges such as fragmented data, changing regulations, and manual reporting processes. Legacy systems often slow down regulatory reporting and make compliance difficult. You need a regulatory reporting solution that streamlines compliance and improves accuracy.

FineReport helps you overcome these challenges. You automate data collection, validation, and report generation. You reduce costs and build confidence in your regulatory compliance. FineReport transforms compliance from a reactive obligation to a proactive strategic advantage. You centralize data, schedule reports, and access regulatory reporting dashboards on any device. This approach supports improved regulatory reporting and ensures you meet all regulations.

Tip: Choose a regulatory reporting solution that adapts to new regulations and supports ongoing compliance. FineReport provides the tools you need for effective regulatory reporting and business transparency.

You can improve regulatory reporting by focusing on automation and data accuracy. Automation reduces manual work and helps you avoid errors that often occur in traditional reporting processes. When you automate, you ensure reports are timely, accurate, and traceable. Automated systems also help you meet regulatory deadlines by managing tasks and sending notifications. This approach allows you to generate reports in real time, which is important for regulations that require immediate action.

The table below highlights best practices for automating regulatory reporting and ensuring data accuracy:

| Best Practice | Description |

|---|---|

| Establishing Robust Data Governance Frameworks | Assign clear data ownership for consistent management and regulatory compliance. |

| Enhancing Data Quality Across Business Lines | Use strategies to improve data accuracy, consistency, and completeness. |

| Fostering Collaboration | Encourage teamwork between compliance, IT, and business units. |

| Aligning Data Governance Across Jurisdictions | Harmonize policies to handle different regulations internationally. |

| Measuring Performance | Monitor key metrics to find areas for improvement. |

| Streamlining Workflows | Use automation tools to make reporting more efficient and accurate. |

| Maintaining Data Lineage and Traceability | Keep data transformations transparent and traceable for regulatory needs. |

| Leveraging Emerging Technologies | Use AI and other tools to enhance analysis and automate reporting. |

Automation in regulatory reporting ensures you collect and process data accurately. You can integrate data from different sources, which improves the quality of your reports and reduces compliance risks.

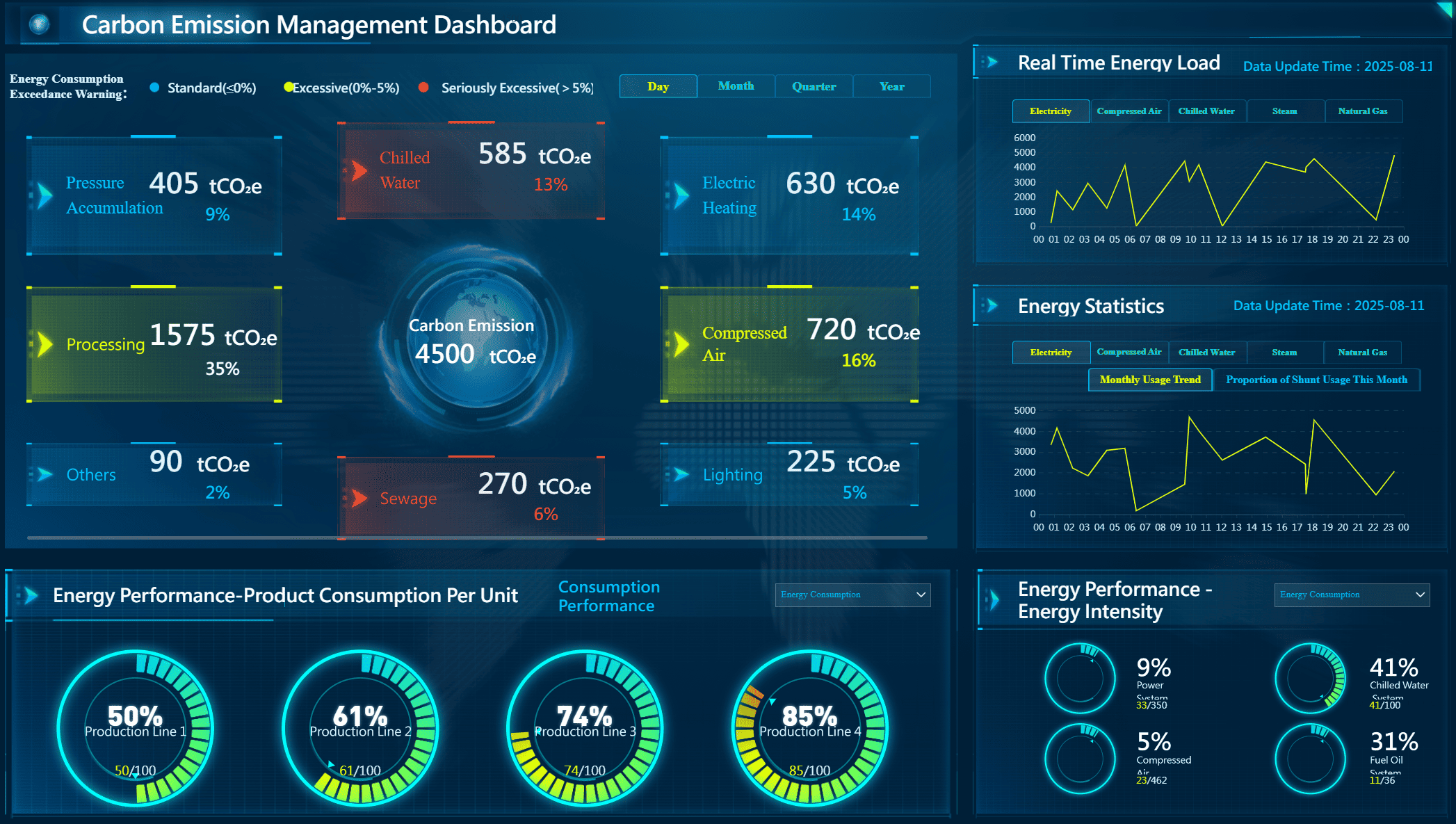

Technology plays a key role in modern regulatory reporting. In 2025, you see advancements such as artificial intelligence, machine learning, blockchain, and cloud-native solutions. These technologies help you process large data sets, detect risks, and monitor compliance in real time. Real-time regulatory reporting allows you to respond quickly to new regulations and improve data accuracy.

FineReport supports your regulatory reporting needs by offering seamless integration with your existing systems. You can deploy report projects on a web server, making reports accessible through a simple URL. FineReport connects user accounts between your reporting platform and business systems using single sign-on. This integration streamlines your workflows and ensures secure, efficient data management. FineReport also provides dashboards, mobile access, and a decision-making platform, giving you real-time insights and control over your regulatory reporting process.

Regulations change often, so you need strategies to stay current. You can use cloud-based solutions to manage updates and automate reporting. Continuous monitoring helps you track new legislation and avoid compliance gaps. Building strong relationships with regulatory bodies lets you clarify expectations and influence industry standards.

Tip: Regularly review your data processes and reporting tools to ensure you meet the latest regulations. Staying proactive helps you avoid penalties and maintain trust with stakeholders.

You have seen major changes in regulations over the past decade. Automation now streamlines reporting, and data integrity remains a top priority. New requirements, such as self-reporting breaches, add complexity. The table below highlights these shifts:

| Aspect | Description |

|---|---|

| Automation | Technology streamlines reporting processes. |

| Data Integrity | High standards for data quality are essential. |

| Regulatory Requirements | New rules increase operational demands. |

| Staffing Challenges | Skilled professionals are harder to find. |

| Industry Changes | Recent updates create new hurdles. |

To improve your compliance, follow these steps:

You can use FineReport to simplify reporting and stay ahead of regulatory changes.

What Is a Quarterly Report and Why Investors Should Care

How to Use Inventory Report for Better Business Decisions

How to Build a Service Report Template for Your Business

What Is a Research Report and Why Does It Matter

What Is an Interview Report and Why Does It Matter

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Top 10 Best Automation Reporting Tool Picks for Businesses

Compare the top 10 best automation reporting tool options to streamline business data, automate reports, and boost decision-making efficiency.

Lewis

Jan 03, 2026

Top 10 Reporting Systems and Tools for Businesses

See the top 10 reporting systems that help businesses automate data, build dashboards, and improve decision-making with real-time analytics.

Lewis

Jan 03, 2026

What is integrated reporting and why is it important

Integrated reporting combines financial and non-financial data, offering a full view of value creation, transparency, and stakeholder trust.

Lewis

Dec 12, 2025