The record to report process captures financial transactions, organizes them, and turns data into actionable insights for your business. You need accuracy and strong internal controls to meet compliance standards and respond quickly to regulatory inquiries. Timely reporting supports your ability to close books efficiently and maintain reliable financial records. Clear documentation and well-defined procedures help your organization generate reports that regulators and stakeholders trust.

You encounter the record-to-report process every time you manage financial data in your organization. This process is a systematic approach that collects, processes, and presents financial information. You use it to analyze and review financial activities, which is essential for accurate financial reporting.

The record-to-report process includes several main stages. Each stage plays a critical role in transforming raw financial transactions into meaningful reports. The table below outlines these stages and their descriptions:

| Stage | Description |

|---|---|

| Record | Document all financial transactions, including revenues, purchases, and expenditures. |

| Entity Close | Close the general ledger at the end of an accounting period and transfer balances to permanent accounts. |

| Consolidation | Review recorded transactions and sort them into appropriate categories. |

| Corporate Close | Match documents between consolidation units and prepare data for final consolidation. |

| Reporting | Generate financial reports after reviewing data for accuracy. |

| Regulatory Submissions | Produce reports to meet state and federal agency requirements based on production data. |

You follow these steps to ensure that your financial data is complete and reliable. The record-to-report process helps you aggregate existing data for performance reporting, rather than just processing transactions. You gain insights into financial performance, key performance indicators, and reconciliations.

Global organizations structure the record-to-report process by defining financial structures, managing budgets, maintaining cash and bank transactions, recording financial transactions, closing financial periods, complying with tax and audit requirements, and managing fund accounting. You use these business process areas to create a strong foundation for financial management.

You rely on the record-to-report process to achieve several key objectives in finance. These objectives guide your efforts to maintain accuracy, support decision-making, and ensure compliance.

The table below highlights the primary objectives and their descriptions:

| Objective | Description |

|---|---|

| Accurate Financial Reporting | Ensure that all financial data is recorded and reported correctly. |

| Strategic Planning and Decision-Making | Provide essential data for management to make informed decisions. |

| Financial Compliance | Maintain adherence to regulations and standards. |

| Process Optimization | Enhance efficiency and effectiveness in financial processes. |

You benefit from timely and accurate accounting data, which supports strategic analysis. Well-documented audit trails help you avoid legal issues and protect your organization's reputation. The record-to-report process also helps you identify risks and make strategic decisions.

You measure the success of your record-to-report objectives by establishing a measurement system and regularly reviewing and adjusting standards. The table below shows key steps to measure success:

| Key Steps to Measure Success | Description |

|---|---|

| Establish a Measurement System | Implement tracking tools and reporting structures to gather reliable data. |

| Regularly Review and Adjust Standards | Conduct annual reviews to ensure alignment with changing market conditions. |

You use accurate information from record-to-report reports for tax preparation. Timely payment of taxes becomes easier with reliable R2R data. You can develop intelligent tax-saving strategies based on insights from the R2R process.

By documenting the record-to-report process effectively, you achieve significant value through process optimization. You experience more efficient operations and shorter completion cycles, which enhance overall business performance.

You begin the record-to-report process by gathering financial data from multiple sources. These sources include accounts payable, accounts receivable, and the general ledger. You record transactions using journal entries, which automatically post to the ledger. Automation plays a key role in this stage. Automated systems reduce manual data entry errors by up to 80% and lower labor costs by as much as 75%. You see fewer mistakes and faster processing when you use automated account reconciliation tools. The table below shows common methods for data collection and entry in the r2r process:

| Method | Description |

|---|---|

| Data Gathering | Collect financial data from accounts payable, accounts receivable, and general ledger. |

| Journal Entry | Record transactions in the general ledger using journals. |

| Account Reconciliation | Compare data from different sources for consistency and accuracy. |

| Financial Reporting | Prepare statements like balance sheets and income statements. |

You improve accuracy and speed by using automation and structured templates. This step sets the foundation for the rest of the r2r process.

You validate and reconcile financial data to ensure accuracy in the record-to-report process. Top-performing finance teams experience only three control violations per 1,000 employees, compared to 18 for median performers. You use technologies such as ai-driven financial reconciliation and bots to match general ledger data with source systems. These tools identify mismatches and adjust entries before uploading data back into ERP systems. You also automate complex reconciliations and trial balance calculations. This approach normalizes data and posts it to the correct ledger accounts. You maintain compliance and establish audit trails by automating controls and validation.

You move to the financial close step in the r2r process after validation. Top-performing organizations complete their monthly close in 4.5 days or less, while median performers take about 6.4 days. Most businesses close their books in six days. You face bottlenecks such as manual processes, data entry errors, reconciliation delays, incomplete data, compliance pressures, communication gaps, and limited system integration. You overcome these challenges by streamlining workflows and integrating systems. Automation helps you reduce errors and speed up the financial close.

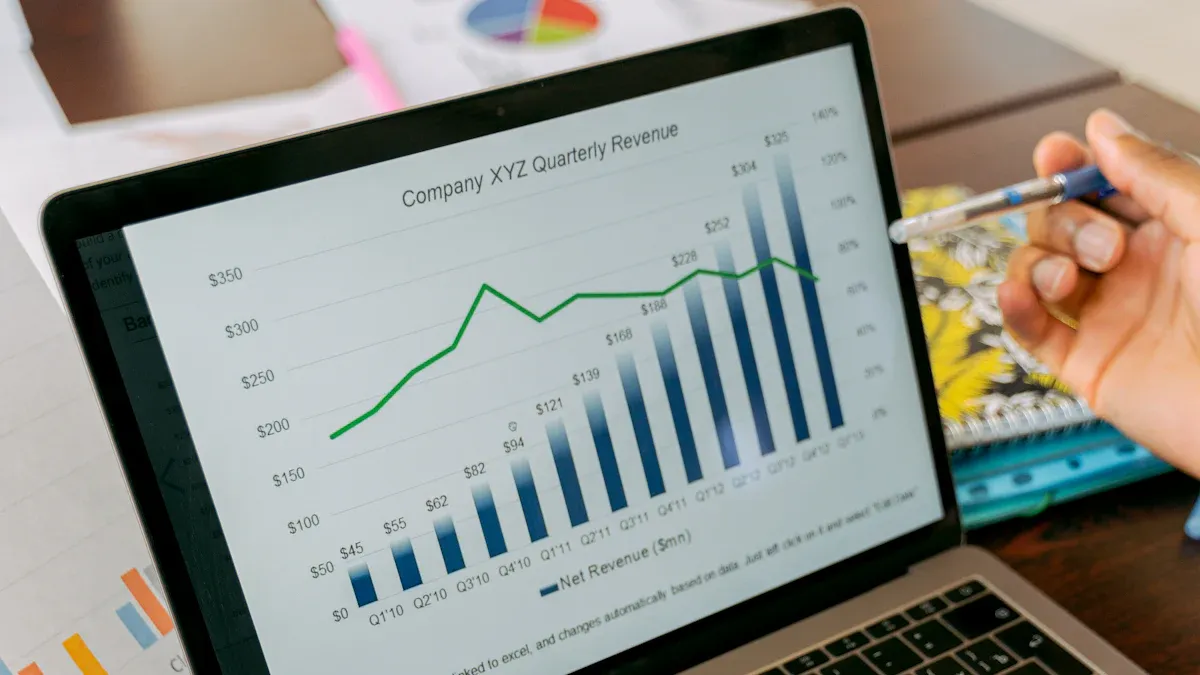

You finalize the record-to-report process with reporting and analysis. You generate financial reports and analyze data for insights. You stay updated on regulatory changes to ensure compliance. You review and approve reports in stages to reduce errors. You use historical data for benchmarking and focus on key metrics for stakeholders. You maintain a centralized repository for documentation and reconcile accounts consistently. You communicate openly across departments and set clear roles and responsibilities. You implement robust internal controls and encourage continuous improvement in reporting processes. You use tools like Xero, QuickBooks, NetSuite, and Dynamics 365 Finance for financial reporting and analysis. These platforms provide real-time insights and automate reporting tasks.

You rely on the record-to-report process to maintain accuracy and compliance in your financial operations. Accurate records form the backbone of financial reporting and help you meet regulatory requirements. The record-to-report process ensures that your data aligns with accounting standards and internal controls. This accuracy directly leads to higher regulatory compliance rates. When you follow a structured r2r process, you reduce compliance risks and strengthen your audit and compliance posture.

Note: The record-to-report process is essential for maintaining compliance with financial regulations. It ensures that records are accurate, which is critical for adhering to accounting standards and internal controls. This accuracy is directly linked to higher regulatory compliance rates.

If you experience compliance failures in your r2r process, you may face serious consequences:

You can see how a strong record-to-report process protects your organization from regulatory penalties and audit issues. Reliable data and clear audit trails help you respond quickly to regulatory inquiries and demonstrate legal compliance.

The record-to-report process gives you the visibility you need for effective decision-making. When you generate accurate and timely financial reports, you provide leaders with the information they need to identify areas of performance and ensure legal compliance. You also build trust with stakeholders and enable better planning and cost savings.

Here is how the r2r process supports executive decision-making:

You benefit from periodic reviews and summaries of financial records. These activities create financial statements that inform you about your organization's financial condition and performance. Improved record-to-report processes lead to better business outcomes, such as cost-saving, better process outcomes, and improved operations. Advanced reporting gives you visibility into customer behaviors and market demands, helping you identify new business opportunities. Informed decisions based on r2r data drive strategic actions that support growth.

A robust record-to-report process increases visibility across your organization. You gain a clear view of your financial position, compliance status, and audit readiness. This visibility helps you manage compliance risks and supports continuous improvement in your financial reporting.

You gain significant advantages when you optimize the record to report process. An efficient record-to-report process streamlines your financial management, improves accuracy, and boosts operational efficiency. The impact of r2r extends across your organization, helping you close books faster and make better decisions.

Here is a table summarizing the main benefits organizations report after improving their record-to-report process:

| Benefit | Description |

|---|---|

| Efficiency | Simplifies the finance close process and reduces errors. |

| Accuracy | Ensures greater compliance with regulatory requirements. |

| Quick Decision-Making | Enables faster financial close and easy reporting. |

| Cost Reduction | Optimizes financial reporting and reduces operational costs. |

| Resource Allocation | Frees up valuable resources and time for core activities. |

| Competitive Advantage | Enhances financial reporting capabilities leading to market advantages. |

You can see these benefits in real-world results. Many organizations have reduced their days to close from nine to seven. Some achieved revenue growth of over 3,700% while keeping headcount flat. Others cut cash specialist headcount by nearly half and reached 90% auto-reconciliation for quick issue resolution. Intercompany transactions now net to zero almost every month.

Despite these benefits, you may face several challenges in the record-to-report process. These obstacles can slow down your r2r process and affect your compliance and audit readiness.

| Challenge | Description |

|---|---|

| Maintaining Accuracy | Issues arise when recording transactions in multiple ledgers, leading to potential inaccuracies. |

| Processing a High Number of Transactions | Increased transaction volume raises the likelihood of errors, necessitating automation. |

| Regulatory Compliance | Keeping up with new requirements from regulatory agencies can be challenging. |

| Lack of Integration | Multiple software applications can lead to data being recorded in various systems, complicating accuracy. |

You might also encounter problems such as errors in data entry, manual record-to-report challenges, and limited resources. Manual processes increase the risk of mistakes and slow down your r2r process. A lack of integration between financial reporting tools can hinder efficiency and make compliance more difficult. Smaller companies often struggle with limited resources, making it harder to keep up with changing regulations and audit requirements.

Note: Addressing these challenges is essential for maintaining data integrity, ensuring compliance, and supporting a smooth audit process.

FineReport helps you overcome these common r2r pain points. You can integrate data from multiple sources, automate repetitive tasks, and generate real-time reports. FineReport’s platform streamlines your record-to-report process, reduces manual errors, and supports compliance with regulatory standards. You gain a unified view of your financial data, making it easier to prepare for audits and respond quickly to regulatory changes.

You can achieve an efficient record-to-report process by following industry best practices. These practices help you streamline your r2r process, reduce errors, and improve audit readiness. Consider the following steps:

You should also embrace automation in your r2r process. Automated r2r process solutions enhance precision and reduce costs. Regular reviews by key stakeholders before finalizing reports help you avoid miscommunication and errors. These best practices support real-time visibility and ensure your financial data remains reliable.

FineReport empowers you to optimize your r2r process with advanced features designed for automation and integration. You gain real-time data entry, automated financial reporting, and dynamic dashboards that provide instant insights. FineReport connects to multiple data sources, allowing you to unify information from various systems for a seamless automated r2r process.

The table below highlights how FineReport supports your compliance, audit, and decision-making needs:

| Feature | Description |

|---|---|

| Reporting and Dashboard Capabilities | You create, distribute, and engage with dynamic reports and dashboards for better r2r outcomes. |

| Data Integration | You integrate data from various sources, which is essential for accurate reporting and audit. |

| Compliance Support | You facilitate compliance through structured reporting and analytics tailored to your business. |

FineReport gives you real-time visibility into your financial data. You can collaborate across departments, maintain strong audit trails, and make data-driven decisions with confidence. By automating your r2r process, you reduce manual work, improve accuracy, and support continuous improvement in your record to report process.

A strong r2r process supports your financial health and business growth. Automation and integration bring faster processing, accurate data, and real-time insights, as shown below:

| Benefit | Result |

|---|---|

| Automation and integration | Faster processing, accurate financial data |

| Intelligent automation | Improved efficiency and accuracy |

| Real-time insights | Informed decision-making |

You gain these advantages when you use tools like FineReport. This platform helps you meet compliance needs and gives you reliable, timely information. By evaluating and improving your record to report process, you set your organization up for success.

What Is a Quarterly Report and Why Investors Should Care

How to Use Inventory Report for Better Business Decisions

How to Build a Service Report Template for Your Business

What Is a Research Report and Why Does It Matter

What Is an Interview Report and Why Does It Matter

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Top 10 Best Automation Reporting Tool Picks for Businesses

Compare the top 10 best automation reporting tool options to streamline business data, automate reports, and boost decision-making efficiency.

Lewis

Jan 03, 2026

Top 10 Reporting Systems and Tools for Businesses

See the top 10 reporting systems that help businesses automate data, build dashboards, and improve decision-making with real-time analytics.

Lewis

Jan 03, 2026

What is integrated reporting and why is it important

Integrated reporting combines financial and non-financial data, offering a full view of value creation, transparency, and stakeholder trust.

Lewis

Dec 12, 2025