Data governance financial services defines how you control and use data assets in a financial organization. This practice helps you manage data according to strict regulations and supports your compliance efforts. Financial institutions face unique challenges, such as complex regulatory requirements, data quality standards, and the need for strong risk management. You need reliable tools to handle these demands. Modern data integration platforms like FineDataLink help you synchronize, transform, and protect your data, making your governance processes more efficient.

You need to understand data governance as the set of processes, policies, and standards that help you manage and control your organization’s data. In the financial services industry, data governance in financial services means you establish clear rules for how you collect, store, use, and protect data. This approach ensures you meet both business and regulatory needs.

The primary objectives of data governance in financial institutions include:

You rely on data governance to create a foundation for trustworthy data. This foundation supports your compliance efforts, risk management, and business decision-making. When you implement strong data governance, you gain confidence that your data is accurate, secure, and ready for analysis.

Financial institutions face unique challenges that make data governance more complex than in other industries. You must manage vast amounts of data from multiple product lines, such as loans, investments, and insurance. This complexity increases the risk of data silos and inconsistencies.

Regulatory requirements add another layer of difficulty. You must comply with frameworks like GDPR, CCPA, Basel III, and anti-money-laundering (AML) laws. These regulations demand strict controls over personal information, financial data, and transaction records. The table below highlights some of the most important regulatory frameworks and their key features:

| Regulatory Framework | Region | Key Features |

|---|---|---|

| GDPR | EU | Data privacy laws, cross-border data flow compliance |

| DORA | EU | Data storage, access, and security requirements |

| CCPA | US | Data privacy, strict data sharing requirements |

| HIPAA | US | Healthcare data protection regulations |

| GCC Data Protection | Middle East | GDPR-inspired, local adaptations, extraterritorial |

| Saudi Arabia Localization Rules | Middle East | Data localization, limited international transfers |

You must also address operational challenges. You handle thousands of regulatory reports, which often require manual reconciliation due to poor data visibility. Legacy technology can create bottlenecks, making it hard to adapt to new rules. Evolving regulations across different regions add to the complexity.

Data quality impact is another major concern. Poor data quality leads to incomplete or inaccurate information, which can affect your compliance and operational efficiency. The table below shows how common data quality issues impact risk management:

| Data Quality Issue | Impact on Risk Management |

|---|---|

| Poor data quality | Incomplete, inconsistent, or inaccurate data affects compliance and efficiency. |

| Data validation challenges | Incorrect data can enter systems, impacting decisions. |

| Regulatory compliance | Failed audits and penalties can result from poor data quality. |

| Risk management | High-quality data is essential for accurate risk assessments and decisions. |

To overcome these challenges, you need robust data governance frameworks. You must harmonize data from various sources and ensure a unified view. Real-time monitoring and alerts help you address data quality issues quickly. You also need to track data lineage, so you can trace information back to its source and maintain accountability.

You face constant regulatory changes in the financial services industry. Data governance financial services helps you keep pace with these changes and avoid costly mistakes. When you build a strong data governance program, you create clear policies and procedures that align with complex regulations. You can interpret compliance laws more easily and address compliance needs before they become problems. Data governance in financial institutions establishes data governance roles, such as data stewards, who maintain consistency and accountability.

Regulatory pressures force you to prioritize data governance initiatives. You must show regulators that your data management practices meet expectations for risk management and consumer protection. Financial institutions have increased compliance spending by 20% to 30% in recent years. New regulations continue to drive up costs and complexity. You need to adapt quickly to avoid penalties and reputational damage.

| Compliance Risk Type | Description |

|---|---|

| Operational compliance risks | Internal processes fail to align with regulations, leading to fraud and vulnerabilities. |

| Reputational compliance risks | Compliance failures impact customer trust and market valuation. |

Data governance helps you manage data-related risks. You can track data lineage, monitor data integrity, and ensure that only authorized users access sensitive information. This approach reduces the risk of fraud, data breaches, and failed audits. You protect your organization and your customers by maintaining high standards for data quality and security.

You rely on accurate data to make decisions and report to regulators. Data governance in financial institutions ensures that your data is trustworthy, accessible, and secure. When you involve stakeholders in your data governance program, you foster engagement and buy-in. This participatory approach promotes fairness, inclusivity, and transparency.

Trust is essential in the financial services industry. You must demonstrate that your data management practices support customer trust and regulatory compliance. Data governance roles help you maintain accountability and traceability for every data asset. You can address data quality impact by monitoring and improving data at every stage. When you maintain high data integrity, you strengthen relationships with customers and regulators.

You unlock significant business value when you invest in data governance financial services. Organized and secure data management allows you to update and add metadata, create relationships, and maintain data quality. You accelerate decision making by analyzing data quickly and confidently. You decrease reporting errors and improve data access, which increases transparency and confidence in your decisions.

| Evidence Type | Description |

|---|---|

| Quantified Cost Savings | Data governance demonstrates cost savings through efficient data management. |

| Accelerated Decision Making | Quick analysis leads to better strategic and investment decisions. |

| Decreased Reporting Errors | Reliable data reduces errors and standardizes reporting. |

| Improved Data Access | Uniform and reliable data makes decisions more transparent. |

| Heightened Business Intelligence | Advanced analytics enable new products and better customer service. |

| Optimized Marketing Techniques | Better data governance drives targeted marketing and revenue growth. |

| Reduced Duplicate Data Acquisition | Centralized control minimizes redundant data collection. |

| Minimized Integration Points | Fewer integration points lower costs and improve data synergy. |

| Improved Compliance | Strong data privacy protocols enhance regulatory adherence. |

| Effective Risk Management | Improved data integrity and security support risk management. |

You support digital transformation by establishing robust data governance. You ensure that data is trustworthy, accessible, and secure. You set policies, standards, and processes for effective data management. You avoid risks from inconsistent or siloed data, which enables you to use technology and data-driven applications more effectively.

Industry trends show a surge in regulatory frameworks, increased compliance spending, and a push for unified third-party solutions. The maturity of digital infrastructure and the rise of AI adoption also drive the need for strong data governance. You must align your data governance initiatives with corporate objectives and integrate them into your overall governance framework. This alignment ensures that data-related activities contribute to your mission and objectives.

Data governance financial services gives you the tools to innovate, respond to market changes, and deliver better customer experiences. You gain a competitive edge by making informed decisions, reducing costs, and improving operational efficiency.

You gain the ability to make better decisions when you implement data governance financial services. You establish a clear data strategy that transforms raw data into reliable insights. You support the adoption of AI, which enhances predictive capabilities and helps you anticipate market changes. You reduce operational risks, leading to more confident decision-making. Data governance ensures that your data is available, coherent, and accurate across departments. You rely on enhanced data quality for more reliable data-driven choices. Improved compliance supports strategic growth, and increased operational efficiency allows you to make quicker decisions.

Data governance in financial institutions has been shown to significantly enhance decision-making capabilities by ensuring data availability, coherence, and accuracy.

You improve operational efficiency and security through data governance financial services. You proactively manage your data assets, ensuring accuracy, consistency, and reliability. This approach is crucial for informed decision-making and streamlines your workflows. You automate routine tasks, which allows your data professionals to focus on strategic work. You comply with regulatory requirements, reducing the risk of penalties and protecting sensitive customer data. Strong data governance frameworks improve data quality by ensuring information is accurate and complete. You build trust and safeguard customer trust by maintaining high standards for data integrity.

| Measurement Method | Description |

|---|---|

| Tangible Benefits | Evaluate improvements in efficiency, risk reduction, and data quality. |

| Cost Savings | Track savings from avoiding fines or operational errors. |

| Operational Efficiency Gains | Measure time saved in data handling and error correction. |

| Data Quality Metrics | Monitor data accuracy rates and consistency measures. |

| Compliance Cost Reduction | Reduce costs from compliance penalties and legal consequences. |

You see the impact of data governance financial services in action at Founder Securities. The company faced challenges with operational efficiency and data-driven decision-making. By implementing a robust data governance program, Founder Securities empowered employees to access and analyze data independently. The solution streamlined workflows and improved customer management. During a merger, the company successfully migrated 50,000 user accounts without disrupting client trading activities. Employees now retrieve data faster and make more precise decisions. Founder Securities demonstrates how data governance initiatives drive efficiency, support compliance, and strengthen customer trust in the financial services industry.

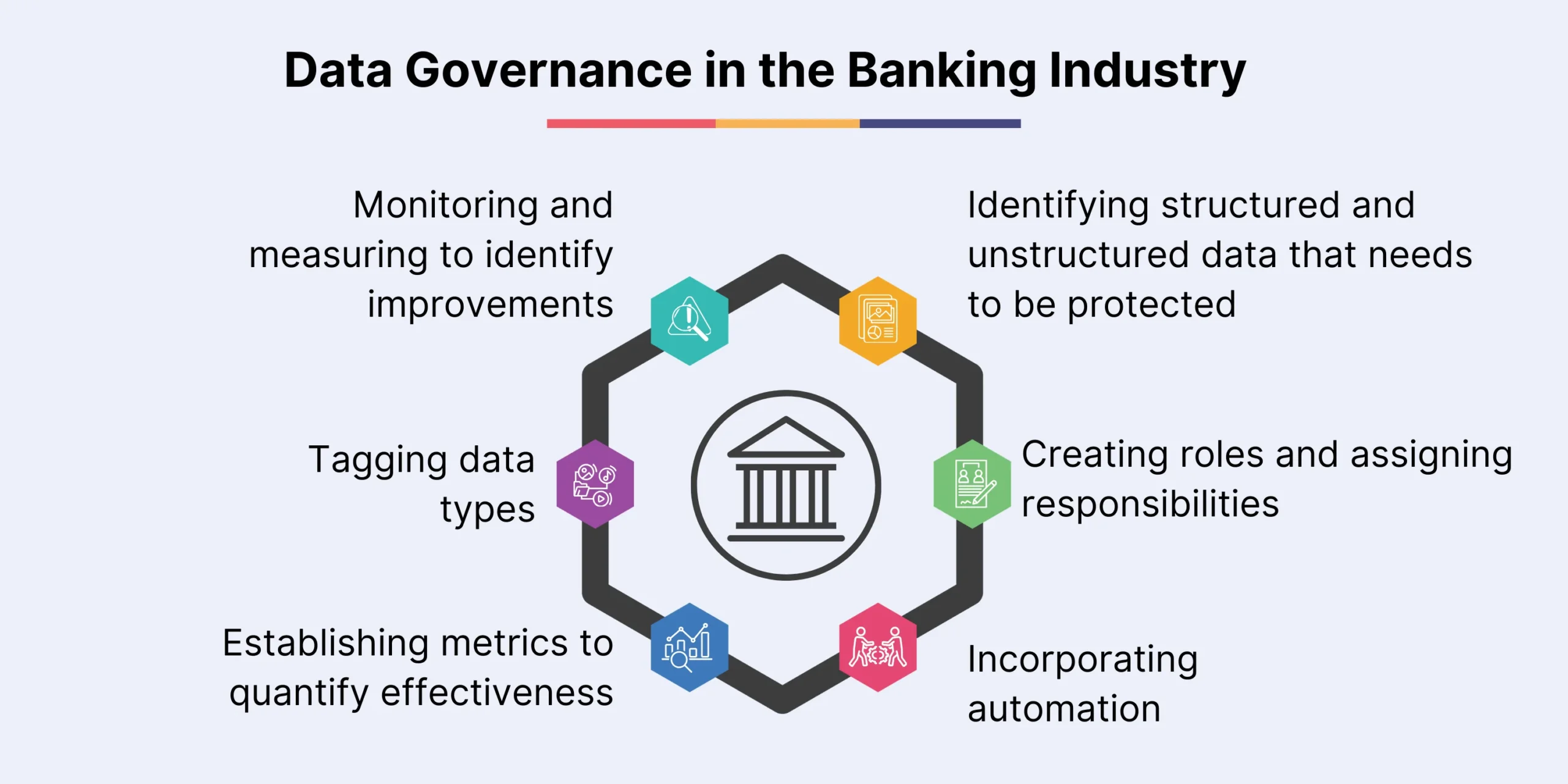

You need to understand the essential components that make data governance successful in the financial services industry. A strong data governance framework helps you manage data governance procedures and policies effectively. Here are the key elements you should focus on:

These components help you build trust in your data and ensure that your data governance in financial institutions meets regulatory and business needs.

You can strengthen your data governance financial services program by following industry best practices. Start by implementing access controls to restrict who can view or change confidential data. Use data encryption to protect sensitive information both at rest and in transit. Involve all stakeholders, including executive leadership, business managers, IT professionals, and data users, to foster a culture of data governance. Establish robust data security and privacy protocols, such as data masking and regular audits.

| Industry | Critical Practice | Regulatory Driver | Real-World Example |

|---|---|---|---|

| Banking/Finance | Choose smart metrics and apply them to real-time data | Complex regulatory framework requires risk management and reporting | American Express |

| Insurance | Conduct a maturity assessment to develop an objective view of current capabilities | Siloed information results from decentralized regulation | Property and Casualty Insurance Carrier |

You should also select data governance metrics that align with your business goals. Regularly assess your data governance framework to identify areas for improvement. These data governance best practices help you maintain compliance and support ongoing data governance initiatives.

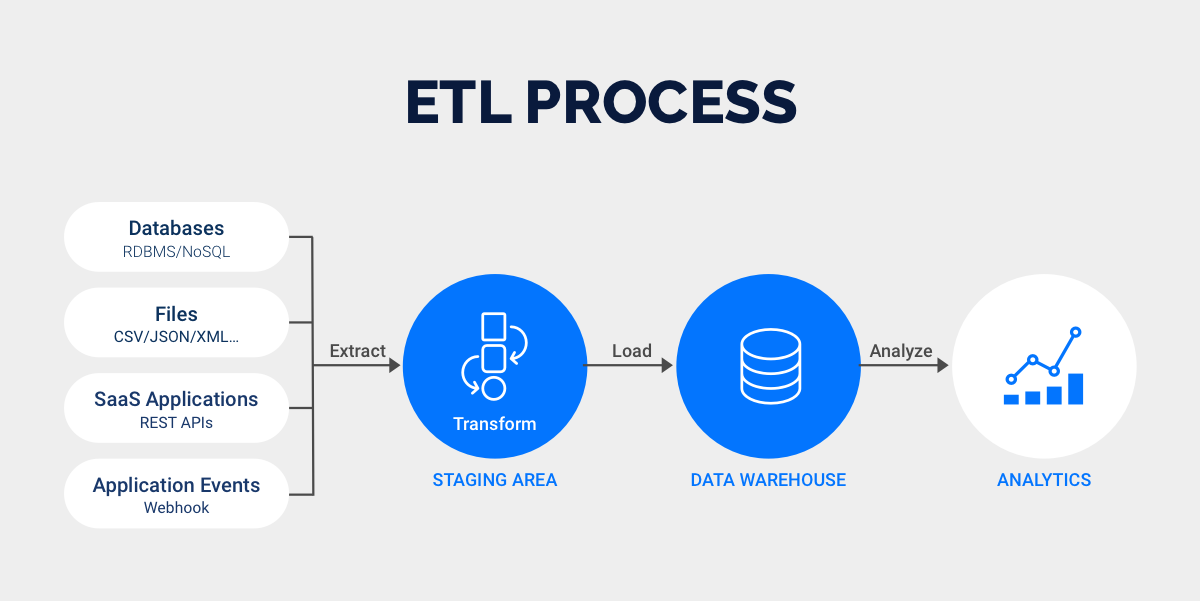

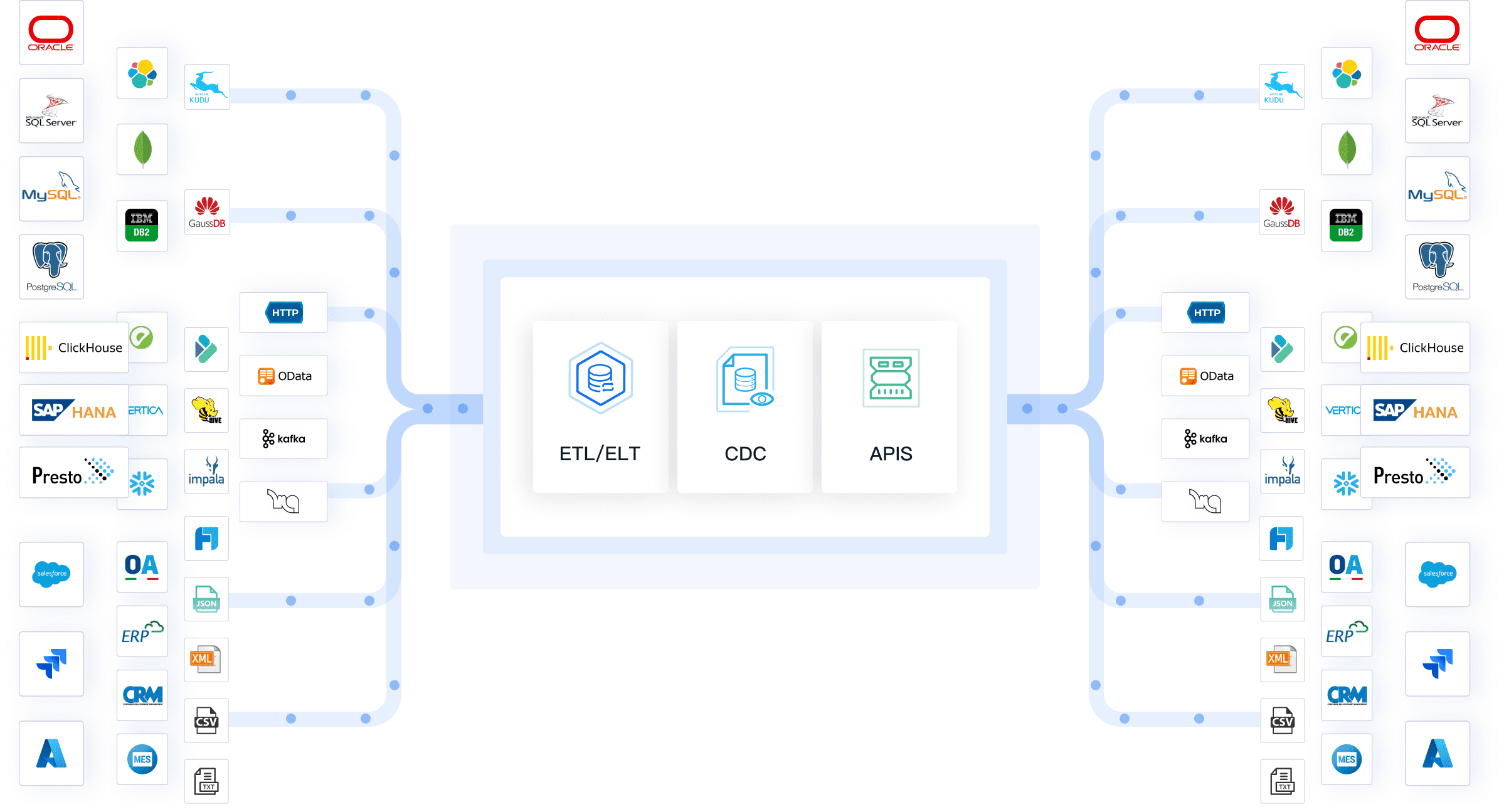

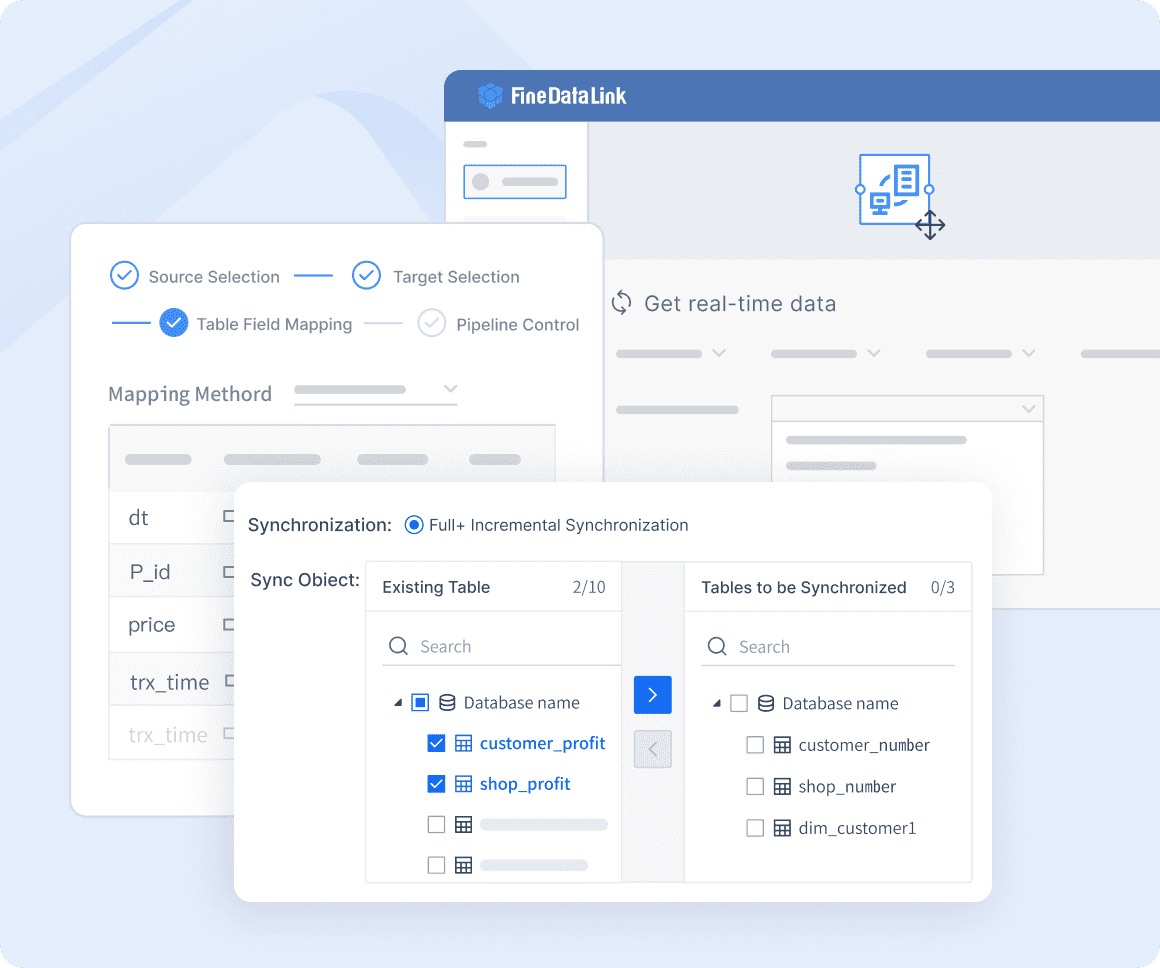

You can enhance your data governance financial services program by using advanced technology like FineDataLink. FineDataLink supports real-time data integration, ETL/ELT, and API connectivity, which are critical for effective data governance in financial institutions. The platform offers scheduling strategies, such as time-based and event-triggered options, to automate data flows. Fault tolerance mechanisms, including retry after failure and dirty data tolerance, ensure reliable data governance procedures. You can compare source and target data to maintain consistency and accuracy. Permission control features let you manage who can create and run scheduled tasks, supporting strong data governance policies.

FineDataLink helps you unify data from multiple sources, automate data governance processes, and monitor data quality in real time. This approach supports your data governance framework and ensures your data governance financial services program delivers value, compliance, and trust.

You may encounter several obstacles when you try to implement data governance in your organization. Financial institutions often struggle with regulatory compliance, data silos, and fragmented systems. Manual processes can slow down operations and introduce errors. You need to address these barriers to build a strong data governance program.

| Barrier | Description |

|---|---|

| Regulatory Compliance | Financial institutions face challenges in keeping up with evolving regulations like GDPR and CCPA. |

| Data Silos and Fragmentation | Data stored across multiple systems complicates effective data management and governance. |

| Data Transparency and Integrity | Ensuring data traceability and visibility is crucial for audits and compliance. |

| Operational Efficiency | Manual processes can lead to errors and inefficiencies in managing data governance. |

You must break down data silos and unify your data sources. You should automate routine tasks to improve operational efficiency. You need to establish clear policies and procedures to keep up with changing regulations. When you focus on transparency and integrity, you build trust with customers and regulators.

You can strengthen your data governance by adopting proven strategies for ongoing improvement. Start by establishing a governance framework that aligns people, processes, and technology. Populate your data catalog with updated information to reflect your organization’s complexity. Empower business stewards to drive awareness and participation in data governance initiatives. Curate your data assets to enhance user insight and trust. Apply policies and controls to manage entitlements and monitor data sources. Foster collaboration across departments to encourage continuous governance. Monitor and measure your curation efforts using reliable tools.

You need to measure the success of your data governance initiatives. Use metrics such as accuracy rate, completeness, and consistency rate. Track data usage growth and access patterns to understand how your data governance supports business goals. Implement data literacy programs to ensure employees can handle data effectively.

| Metric | Description |

|---|---|

| Accuracy Rate | Ensures that data entries correctly represent real-world values, guaranteeing reliable data for decisions. |

| Completeness | Tracks the percentage of required data fields populated, reducing the risk of incomplete data sets. |

| Consistency Rate | Measures alignment across data sources, ensuring consistent data usage in analytics and reporting. |

| Data Usage Growth | Analyzes trends in data utilization across departments to assess the effectiveness of data governance. |

| Data Access Patterns | Reviews data access requests and usage metrics to reveal frequently used data sets. |

| Data Literacy Programs | Implements training to ensure employees can handle data effectively, improving overall data accuracy. |

You must review these metrics regularly to identify areas for improvement. When you focus on continuous improvement, you ensure that your data governance in financial institutions remains effective and supports your organization’s long-term success.

You see how data governance financial services shapes compliance, risk management, and business value. Data governance enhances data quality, improves decision-making, and ensures regulatory compliance. You reduce risks and protect your organization from fines and reputational damage. FineDataLink helps you centralize data, automate processes, and build trust. To improve your data governance, you should define objectives, select a maturity model, and implement clear strategies. Regularly review your practices and promote a data-driven culture for lasting success.

Enterprise Data Integration: A Comprehensive Guide

What is enterprise data and why does it matter for organizations

Understanding Enterprise Data Centers in 2025

Enterprise Data Analytics Explained for Modern Businesses

The Author

Howard

Engineer Data Management & Ahli Data Research Di FanRuan

Related Articles

What is a data management platform in 2025

A data management platform in 2025 centralizes, organizes, and activates business data, enabling smarter decisions and real-time insights across industries.

Howard

Dec 22, 2025

Top 10 Database Management Tools for 2025

See the top 10 database management tools for 2025, comparing features, security, and scalability to help you choose the right solution for your business.

Howard

Dec 17, 2025

Best Data Lake Vendors For Enterprise Needs

Compare top data lake vendors for enterprise needs. See which platforms offer the best scalability, integration, and security for your business.

Howard

Dec 07, 2025