Sean, Industry Editor

Oct 15, 2025

Accounting conventions help you make financial statements. These rules help you fix problems when there is no clear rule. They are important because they make data easy to compare and keep it the same. The table below shows how they do this:

| Principle or Guideline | Description |

|---|---|

| Accounting conventions | Rules that fix problems and keep statements the same. |

| Uniformity in reporting | Helps investors compare how companies do. |

| Consistency principle | Keeps accounting ways the same for good comparisons. |

Good accounting is very important today. Tools like FanRuan help you keep your financial data right and honest.

Accounting conventions help you decide how to make financial statements. These are not official rules, but they guide you when rules are not clear. They help you record business transactions in a way people can trust. Using them keeps your accounting work the same each year.

To see how accounting conventions are applied in practice, explore the interactive Financial Dashboard above.

Built with FineReport, this report demonstrates how consistent accounting principles shape financial reporting accuracy and transparency. You can adjust entries, view real-time updates, and understand how standardized conventions ensure reliable and comparable statements across fiscal periods.

Accounting conventions are important for financial reporting. They help you make statements that are easy to compare with other companies. This helps investors, managers, and regulators understand your business. When you use these conventions, people trust your financial data.

Accounting conventions have changed over time. In 1973, the International Accounting Standards Committee started making international rules. Later, International Financial Reporting Standards made accounting more the same worldwide. Now, many countries use IFRS so financial statements are clear and easy to compare.

Tip: Using accounting conventions helps your business keep up with global changes in accounting.

You might ask how accounting conventions are different from standards. Conventions are informal guidelines, but standards are official rules from authorities. You use conventions when standards do not cover something. Standards are official and must be followed by law.

Here is a table that shows the main differences:

| Aspect | Accounting Conventions | Formal Accounting Standards |

|---|---|---|

| Nature | Informal guidelines | Set by authorities |

| Legal Binding | Not legally binding | Legally binding |

| Purpose | Help with recording transactions | Make reporting clear and consistent |

Different countries have their own rules and standards. For example:

| Country | Regulatory Body | Accounting Standards Used |

|---|---|---|

| Saudi Arabia | ZATCA | IFRS |

| United States | SEC | GAAP |

Accounting conventions help when standards do not give enough help. As rules change, conventions also change. The move from International Accounting Standards to IFRS shows how accounting keeps up with the world. New rules for revenue, leases, and credit losses help you give better information to investors and make your statements more reliable.

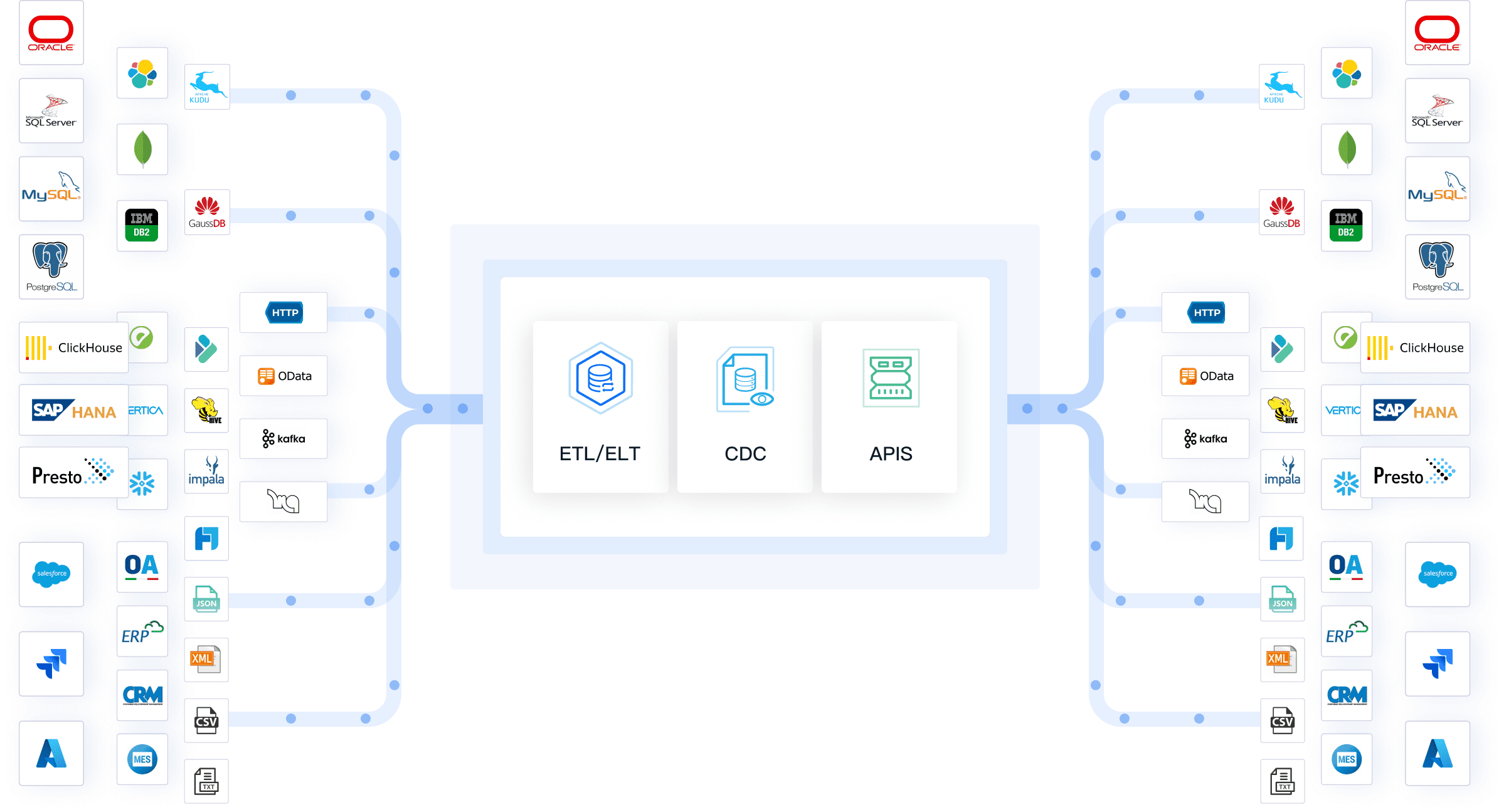

FanRuan helps you follow both conventions and standards. With tools like FineReport and FineDataLink, you can keep your accounting data correct and current. These tools help you use the right rules and make your financial reporting easier and more trusted.

You need to be consistent in accounting. This makes your financial statements clear and easy to compare. When you use accounting conventions, you follow the same rules each time. This helps people trust your financial information.

Accounting conventions give everyone a common way to do things. You can see how your company is doing compared to others. Investors and managers use your financial statements to make choices. If you change your methods every year, people will not trust your numbers. Using the same accounting ways makes your reports reliable.

Here are some ways accounting conventions help with consistency:

When you keep your accounting methods the same, lenders and creditors can understand your financial health. They use your financial statements to decide if they should lend you money or set loan terms. Consistent accounting conventions help people trust your company and see it as stable.

Note: Using the same accounting practices also helps stop fraud. Forensic accounting skills help auditors find problems early and keep your financial reports honest.

Trust and transparency are important in accounting. You want people to believe your financial statements. Accounting conventions help you show all the important details, so nothing is hidden. When you follow these conventions, your reports are honest and complete.

Companies that use accounting conventions show their data clearly. This helps investors, managers, and regulators make smart choices. Ethical standards in accounting mean you must show all the facts. When you do this, you build trust with everyone who reads your financial statements.

The table below shows how accounting standards and conventions help with trust and transparency:

| Impact Type | Description |

|---|---|

| Enhanced Investor Confidence | Using accounting conventions the same way builds trust with investors, so they may invest more. |

| Improved Financial Analysis | Consistent data makes it easier to see trends and ratios, giving clearer insights for everyone. |

| Stability in Financial Reporting | Following accounting practices regularly keeps financial results steady, helping with long-term planning. |

| Increased Credibility with Stakeholders | Being consistent helps you build better relationships with investors, creditors, and regulators, making your company more trusted. |

You can also use digital tools to keep your accounting clear. FanRuan’s FineReport gives you strong reporting and dashboard features. FineDataLink helps you connect and update your data in real time. These tools make your financial statements more correct and easier to understand.

| Product | Contribution to Financial Data Transparency |

|---|---|

| FineReport | Gives you strong reporting and dashboard features. |

| FineDataLink | Helps you connect and update your data in real time. |

When you use these tools, your accounting conventions work better. You keep your financial data correct and up to date. This helps you meet the needs of investors, managers, and regulators. Clear reporting also helps you make better choices for your business.

Tip: Clear accounting practices help you build good relationships with lenders and investors. This can help you get better loan terms and more investment for your company.

Accounting conventions help you understand business numbers. You use them to make financial statements people trust. Each accounting convention has a special job. They make accounting clear and reliable.

The conservatism convention teaches you to be careful. You record expenses and losses right away. You wait to record profits until you are sure. This way, you show a true picture of your company’s health.

| Aspect | Impact of Conservatism |

|---|---|

| Income Statement | Shows less income because expenses are counted early and revenue is delayed. |

| Balance Sheet | Assets look smaller, showing lower values for old or damaged items. |

| Provision and Loss | You set aside money for possible losses early, so your company is ready for risks. |

You help investors trust you when you use this rule. You show your company does not hide risks. FanRuan’s FineDataLink lets you track expenses and losses fast. Your reports stay correct.

The consistency convention asks you to use the same methods every year. This makes it easy to compare your company’s results over time. If you change your ways a lot, people may not trust your numbers.

FanRuan’s FineReport lets you set up templates and rules. You keep your accounting ways the same, even with data from many places.

The full disclosure convention tells you to share all important facts. You do not hide anything that could change decisions. This rule protects investors and others.

FanRuan’s tools help you collect and show key data. You make sure your reports are clear and honest.

The materiality convention helps you choose what to include. You only add items that matter to decision-makers. Small details that do not change the big picture can be left out.

FanRuan’s FineDataLink helps you pick and highlight material items. Your reports become more useful and easier to read.

Tip: When you use these accounting conventions, you fix many problems with hard financial data. FanRuan’s tools help you use these rules, so your accounting stays clear and reliable.

Accounting conventions change how you show numbers in reports. These rules help you organize your financial statements. IAS 1 tells you to present your data so others can compare it. When IAS 1 changes, you must show debts and assets in new ways. The Disclosure Initiative asks you to share more details. This helps people trust your reports.

| Accounting Standard | Description |

|---|---|

| IAS 1 | Makes sure financial statements are easy to compare and stay the same. |

| Amendments to IAS 1 | Explains how to show old data and sort debts, which changes how you present numbers. |

| Disclosure Initiative | Adds new rules for sharing details, making reports clearer. |

You also need to follow rules from groups like the SEC. US GAAP says you must keep your reports the same and share your main accounting policies. This helps people know how you handle your numbers.

Accounting conventions help you make smart choices for your company. You use financial statements to check your business health and plan ahead. Managers read these reports to decide where to spend money and when to invest.

In factories, you might use job costing to see what each product costs. This helps you know if you need new machines or better ways to work. Good accounting gives you facts to make strong choices.

FanRuan gives you tools to make accounting simple and correct. FineReport lets you build clear reports and dashboards. You can show your financial data in ways everyone understands. FineDataLink helps you bring together data from many places. You can update your numbers fast and keep your reports right.

Tip: Using FanRuan’s tools helps you follow accounting conventions easily. You save time, make fewer mistakes, and help your team choose better.

With these tools, you meet the needs of investors, managers, and regulators. You keep your accounting data right and your financial statements easy to read.

You help keep financial reports right and easy to read. Studies show good accounting rules and checks build trust. Being open also helps people believe your numbers.

| Key Finding | Description |

|---|---|

| Consistency and Standardization | Using the same rules lets you compare and find patterns. |

| Verification and Internal Controls | Checking and auditing often makes your accounting strong. |

| Transparency and Disclosure | Clear reports help everyone see and understand your data. |

| Regulatory Compliance | Following rules like GAAP or IFRS keeps your business safe. |

Many companies use digital accounting tools now. You see more computers and online systems every year. These tools help you handle data, follow rules, and keep your accounting current.

You might have problems with data or learning new tools. But modern solutions like FanRuan help you connect data and keep reports right. Using good tools helps your accounting and helps your business grow.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

Accounting conventions help make your financial statements clear. They let people compare your numbers easily. These rules help you record business deals in a way people can trust.

Accounting standards are official rules you must follow. Accounting conventions are used when standards do not cover something. Conventions guide you, but standards are required by law.

Digital tools help you save time and make fewer mistakes. FanRuan lets you collect, organize, and report financial data fast. Your reports stay correct and up to date.

The conservatism convention helps you record expenses and losses early. You wait to record profits until you are sure. This keeps your financial statements honest.

You should not change your accounting methods each year. The consistency convention says to use the same ways every year. This helps people trust and compare your financial statements.