You use ebita to see how well a company earns money. It looks at money made from the main business. Ebita means earnings before interest, taxes, and amortization. You look at this number because it shows profit from daily work. It does not count extra costs like loans or taxes. If you compare ebita to ebitda, you see ebitda also takes out depreciation. This helps you see cash flow better.

| Metric | Excludes | Description |

|---|---|---|

| EBITA | Interest, Taxes, Amortization | Shows profit from business without some costs. |

| EBITDA | Interest, Taxes, Depreciation, Amortization | Shows profit and cash flow by removing more costs. |

| Knowing about ebita helps you compare companies in the same field. It helps you find strong or weak parts in their business. |

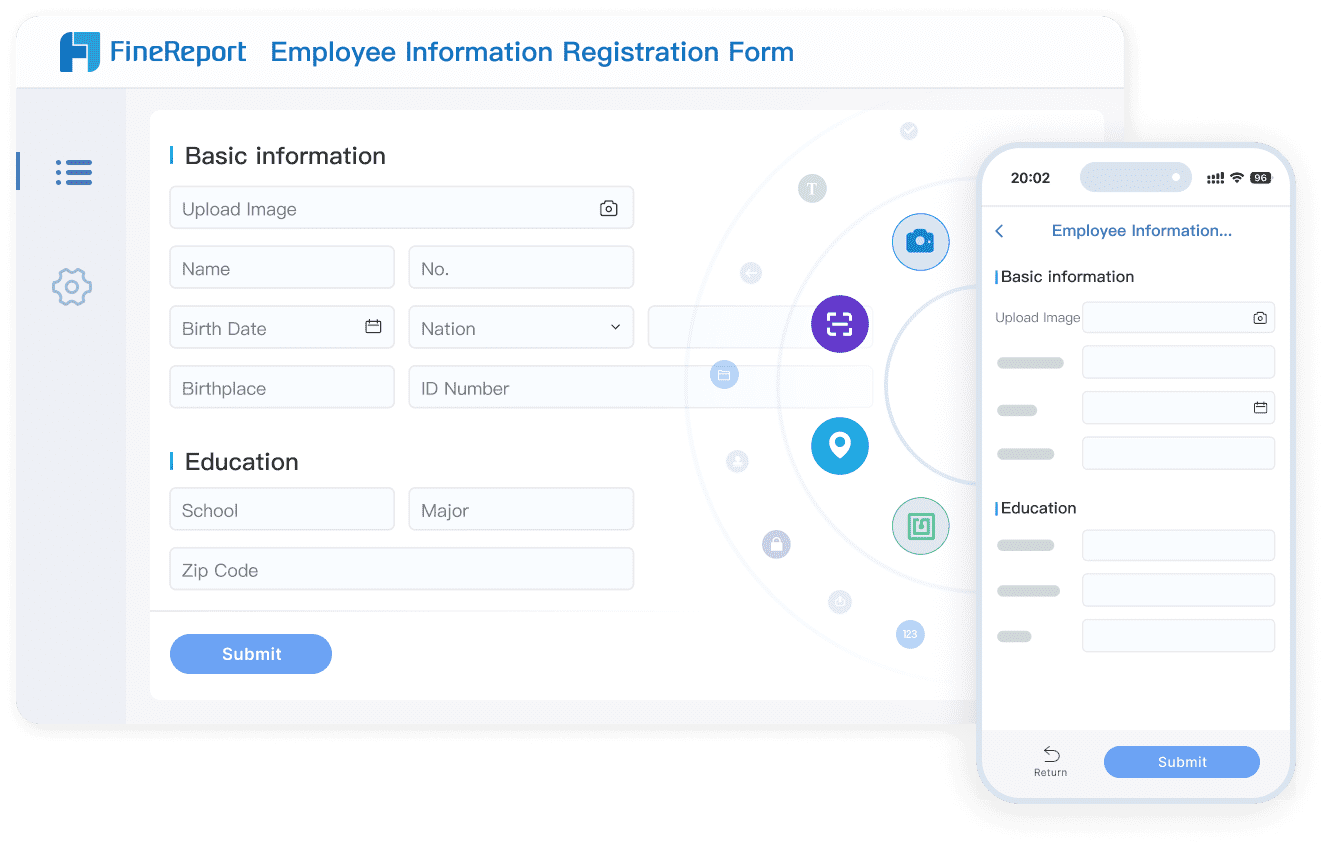

EBITA helps you find out how much profit a company makes. It looks at money from the main business only. EBITA means Earnings Before Interest, Taxes, and Amortization. This number tells you how well a company does its daily work. EBITA does not count costs like interest, taxes, or losing value from patents. When you check EBITA, you see how strong the business is. You can use FineReport from FanRuan to make reports about EBITA. These reports show which parts of the business do best.

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. You use EBITDA to see how much money a company makes before paying interest, taxes, and losing value from equipment and patents. EBITDA helps you focus on how much cash the main business brings in. Many people use EBITDA to compare companies in the same field. If a company has good EBITDA, it runs well and makes strong profits. FineReport lets you build dashboards to show EBITDA right away. You can watch changes and see trends fast.

Tip: If you want to know how much cash a company can make, look at EBITDA. This number takes away costs that do not change cash flow.

It is important to know how EBITA and EBITDA are different. EBITA leaves out interest, taxes, and amortization. EBITDA leaves out interest, taxes, depreciation, and amortization. So, EBITDA gives you a bigger view of cash flow. You can use both numbers to compare companies, but EBITDA is better for seeing cash. A good EBITDA means the business is healthy.

Here is a table to help you see the differences:

| Metric | Full Form | What It Measures |

|---|---|---|

| EBITA | Earnings Before Interest, Taxes, and Amortization | Profit from main business, without some extra costs |

| EBITDA | Earnings Before Interest, Taxes, Depreciation, and Amortization | Profit and cash flow, without more extra costs |

FineReport from FanRuan helps you watch both EBITA and EBITDA. You can use its dashboards and reports to see these numbers together. This helps you find strong and weak parts in any business.

You can figure out how ebitda is calculated by using some simple steps. EBITDA tells you the profit from your main business before paying interest, taxes, or counting asset value loss. To find ebitda, begin with net income. Next, add interest expense, taxes, depreciation, and amortization. Doing this helps you see the real money made from business work.

Here is an easy way to find ebitda:

1. Begin with net income. 2. Add interest expense. 3. Add taxes. 4. Add depreciation. 5. Add amortization.

Tip: Use this method to compare companies and see which ones do well.

The ebitda formula is:

EBITDA = Net Income + Interest Expense + Taxes + Depreciation + Amortization

You can check the main parts in this table:

| Component | Description |

|---|---|

| Net Income | Total profit from all business activities |

| Interest Expense | Money paid for loans or borrowed funds |

| Taxes | Money paid to the government |

| Depreciation | Loss in value of physical assets over time |

| Amortization | Loss in value of intangible assets over time |

FineReport lets you do the ebitda calculation automatically. FineReport helps you sort your financial statements, figure out ebitda, and make reports fast. You can see charts, graphs, and notes that show how your business is doing. This makes it simple to watch ebitda and share results with your team.

You might ask how to figure out EBITA. The steps are almost the same as ebitda, but you do not add depreciation. You start with net income, then add interest expense, taxes, and amortization. EBITA helps you look at profits from your main business, without thinking about loans, taxes, or losing value from patents.

FineReport lets you make reports that show EBITA and ebitda together. You can use dashboards to compare these numbers and see patterns. This helps you make smart choices and learn about your company’s strong points.

Note: Using FineReport to do your financial math saves time and stops mistakes. You get clear and correct results every time. Click to engage.

You use ebita to see how your main business is doing. This number shows money made from daily work. Ebita helps you see profit without interest, taxes, or asset changes. You can compare your company’s main results to others. Ebita is a strong way to check financial health.

EBITDA is also important for business analysis. It shows how much cash your business makes before paying loans, taxes, or asset loss. Many companies use ebitda margin to compare with others. A high ebitda margin means your company controls costs well and can grow.

Here is a table that shows how ebitda helps you study your business:

| What EBITDA Shows | Why It Matters in Business Analysis |

|---|---|

| Shows main business results | Lets you see how your main business works |

| Makes comparing easy | Helps you compare companies in different places |

| Points out strong profits | A high ebitda margin means better profits and growth |

| Takes away outside things | Focuses only on how well your business runs |

Tip: To see how your company compares, check your ebitda margin. This number helps you find strong and weak spots in your work.

You can use FineReport from FanRuan to watch key numbers like ebita and ebitda. FineReport lets you make dashboards with revenue, costs, and margins. You get clear charts and tables that make profit easy to see. This helps you find ways to do better and save money.

When you make money choices, ebita gives you a clear view of your company’s health. You see which parts of your business do best. Money managers use ebita to find ways to work better. They look at ebita margins to spot risks and plan ahead.

EBITDA margin is also key for making choices. You use it to guess future earnings and set company value. By watching ebitda margin over time, you can manage risks and make smart investment choices. If your ebitda margin drops, you know to check costs or train your team.

Here are some ways ebitda analysis helps your business:

Money managers often change ebitda to show real profit. They take out one-time costs and owner costs. This helps buyers and investors see your company’s true value. Good records of these changes build trust and help with deals.

Note: Changing EBITDA can change your company’s value a lot. Even small changes in ebitda can make a big difference in what your business is worth.

Industry factors also change how you use ebita and ebitda. Market changes, rules, and growth rates all matter. For example, fast-growing companies may have higher ebitda multiples. Where you work and how you run things can also change what these numbers mean.

FineReport helps money managers by making analysis easy. You can make reports, watch ebitda margin, and compare results in different groups. FineReport’s dashboards help you see trends and make quick choices. You get tools to manage risks and do better.

Tip: Use FineReport to keep your money data neat. This makes it easier to find problems and fix them fast.

When you want to know if your company is healthy, you should look at EBITA and other numbers. Each number tells you something special about your business. If you use more than one number, you get a better idea of how your company is doing.

Operating profit shows how much money your main business makes after paying for daily costs. It does not count interest, taxes, or other outside costs. You use operating profit to see if your main business is working well. Here are some important things to know:

| Aspect | Operating Profit | EBITA |

|---|---|---|

| Focus Area | Core business efficiency | Operational performance |

| Excludes | Interest, taxes | Interest, taxes, amortization |

| Use Case | Pricing and cost control | Comparing companies |

Tip: Use operating profit to see if your business runs well. Use EBITA when you want to compare with other companies.

Gross profit tells you how much money you make after paying for the goods you sell. It does not count other costs like rent or salaries. Gross profit is good for checking if your sales cover your direct costs. EBITA and ebitda go further by removing more costs, so you see a bigger picture.

Adjusted ebitda takes out one-time or unusual costs. This helps you see how your business really does over time. You get a clearer view of your regular cash flow. Many investors use adjusted ebitda to compare companies in the same industry.

Note: Adjusted ebitda removes things that do not happen every year, so you can spot real trends.

FineReport lets you see all these numbers in one dashboard. You can track EBITA, ebitda, gross profit, and more. This helps you make smart choices and compare your business with others. You get clear charts and tables, making it easy to see your company’s strong and weak points.

FineReport combines dynamic data visualization dashboards with powerful data entry capabilities—helping you track trends and manage data seamlessly.

When you use EBITA, you learn more about how a business works. EBITA lets you compare companies and find what they do best. If you know about EBITA and EBITDA, you can make better plans. You can also set budgets and see if a company can grow. FineReport from FanRuan helps you with money tasks. It lets you make reports, see data in pictures, and keep all your info in one place.

| Feature | Benefit |

|---|---|

| Automated Data Generation | Saves time and cuts down on extra work |

| Data Integration | Puts all business data together for better study |

| Data Presentation | Makes things easier to understand with pictures |

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

EBITA means Earnings Before Interest, Taxes, and Amortization. You use EBITA to check how much profit your main business makes. This is before you pay interest, taxes, or write off things like patents.

EBITA helps you look at your company’s main business. Net income counts every cost. EBITA takes away interest, taxes, and amortization. This shows how your main business is really doing.

FineReport lets you make dashboards and reports. You can watch EBITA, EBITDA, and other important numbers. The tool helps you spot trends, compare results, and share what you find with your team.

No, EBITA and operating profit are not the same. EBITA takes out amortization, but operating profit does not. EBITA gives you a clearer look at how a business is doing, especially when you compare companies.

Yes! FineReport can help you automate EBITA calculations. The software gets data from many places, does the math, and updates your reports. This saves you time and helps you make fewer mistakes.