You might wonder how to calculate free cash flow step by step, especially if you’re new to finance. Here’s the simple formula: Free Cash Flow equals Cash from Operations minus Capital Expenditures. First, find the operating cash flow. Next, identify the capital expenditures. Finally, subtract capital expenditures from operating cash flow. You don’t need advanced skills or a finance degree—just follow these steps and you’ll get the answer. With a little practice, you can calculate free cash flow for any company or personal project.

You might hear the term free cash flow often when learning how to calculate free cash flow step by step. Free cash flow is the money left over after a business pays for its operating expenses and capital expenditures. In simple words, it’s the cash you can use after covering the costs needed to keep the business running and investing in equipment or property. Free cash flow shows how much money a company has available for growth, paying off debt, or giving back to shareholders.

Here’s what free cash flow means for you:

Many beginners think profits equal cash flow, but that’s not always true. Profits on paper do not always mean you have cash in hand. Accounts receivable are future payments, not actual cash. Even small businesses need to manage free cash flow regularly, not just once a year.

Free cash flow matters for both businesses and personal finance. If you want to understand how to calculate free cash flow step by step, you need to know why it’s important. For companies, free cash flow is a key sign of financial health. Analysts use it to figure out if a business can grow, pay debts, or reward shareholders. Positive free cash flow means a company has extra money to invest or distribute, which boosts its value.

For your personal finances, free cash flow helps you plan for retirement, compare financial strategies, and manage income and expenses. You can use it to control debt, automate savings, and prepare for life changes. It also helps you balance short-term needs with long-term goals.

Free cash flow analysis looks different for large corporations and small businesses. Big companies have teams to manage liquidity and plan for different outcomes. Small businesses often react to cash flow issues after they happen, making it even more important to track free cash flow closely.

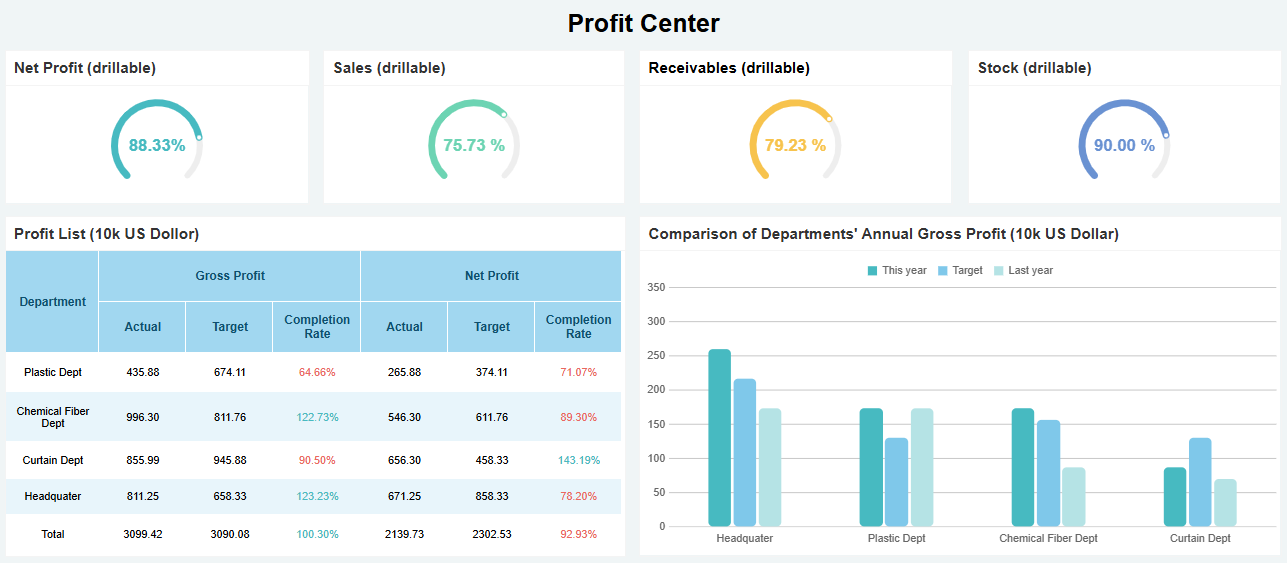

FineReport makes understanding free cash flow easier. You can use its dashboards and reports to see your financial data in clear, simple formats. FineReport helps you collect data, automate reports, and visualize cash flow trends. This way, you spend less time on manual calculations and more time making smart decisions.

Tip: If you want to master how to calculate free cash flow step by step, try using FineReport’s tools to track your numbers and spot trends quickly.

When you want to learn how to calculate free cash flow step by step, you need to start with the right formula. The most common way is:

| Formula | Description |

|---|---|

| FCF = Operating Cash Flow – Capital Expenditures | Subtract capital expenditures from cash flow from operations to get free cash flow. |

You might see other formulas in financial textbooks or online. Here are a few examples:

| Formula | Description |

|---|---|

| FCF = Net Operating Profit After Taxes − Required Investments in Operating Capital | Focuses on profit after taxes and investments needed to keep the business running. |

| FCF = Sales Revenue − (Operating Costs + Taxes) − Required Investments in Operating Capital | Breaks down free cash flow using sales and costs. |

| FCF = Net income + (Depreciation/Amortization) – Working Capital – CapEx | Adjusts net income for non-cash items and investments. |

For beginners, stick with the simple formula: free cash flow equals cash flow from operations minus capital expenditures. This method is the easiest way to understand how to calculate free cash flow step by step.

Let’s break down the key terms so you can follow how to calculate free cash flow step by step:

Here’s a quick guide to help you locate these numbers:

| Item | Where to Find It |

|---|---|

| Cash flow from operations | Cash flow statement (top section) |

| Capital expenditures | Cash flow statement (investing activities) or balance sheet (property, plant, and equipment) |

Remember, cash flow from operations is not the same as net income. Net income appears on the income statement and uses accrual accounting, while cash flow from operations shows actual cash movement. This difference matters when you want to get an accurate picture of free cash flow.

If you want to make this process even easier, tools like FineReport can help you pull these numbers automatically and visualize your free cash flow trends. This saves you time and helps you focus on making smart financial decisions.

Learning how to calculate free cash flow step by step can feel overwhelming at first, but you can break it down into three simple steps. Let’s walk through each one together so you can do this calculation with confidence.

The first step in how to calculate free cash flow step by step is to find your operating cash flow. This number shows how much cash your business brings in from its main activities, like selling products or providing services. You can find operating cash flow at the top section of the cash flow statement.

Operating cash flow includes money from sales, purchases, and expenses. Most companies use either the direct or indirect method to show this number. The direct method lists cash received and paid out. The indirect method starts with net income and adjusts for non-cash items, like depreciation, and changes in working capital.

Here are the typical line items you might see in operating cash flow:

You can calculate operating cash flow using this formula:

Cash Flow from Operations = Net Income + Non-Cash Expenses +/– Changes in Working Capital

If you want to find accurate operating cash flow data, check these sources:

| Source | Description |

|---|---|

| Best Practices for Accurate Cash Flow Forecasting | Offers tips for improving cash flow forecasting accuracy. |

| The CFO'S Perspective | Explains why having the right process for cash flow forecasting matters. |

| The CFO’s Guide to Cash Flow Statement Analysis and Strategic Forecasting | Shares insights for strategic planning using cash flow data. |

FineReport can help you pull operating cash flow numbers directly from your financial system. With its data connectors, you can automate the process and avoid manual errors.

The next step in how to calculate free cash flow step by step is to identify your capital expenditures, often called CapEx. These are the funds you spend to buy or upgrade long-term assets, like equipment, vehicles, or buildings. You can find capital expenditures in the investing activities section of the cash flow statement or in the property, plant, and equipment section of the balance sheet.

Common types of capital expenditures for small businesses include:

For example, a bakery might buy a new oven, while a tech startup could invest in servers and workstations. Capital expenditures are important because they help your business grow and stay competitive. Even though they reduce free cash flow in the short term, they often lead to higher revenue and efficiency over time.

FineReport makes it easy to track capital expenditures by letting you import data from Excel or other sources. You can create custom reports to monitor your spending and see how these investments affect your cash flow.

Now you’re ready for the final step in how to calculate free cash flow step by step. Take your operating cash flow from Step 1 and subtract your capital expenditures from Step 2. The result is your free cash flow.

Let’s look at a simple example:

To calculate free cash flow, use the formula:

FCF = Operating Cash Flow – Capital Expenditures

FCF = $50,000 – $10,000 = $40,000

Sarah’s Bakery has $40,000 in free cash flow. This means she has money left over after covering all expenses and investments. She can use this cash to grow her business, pay off debt, or save for the future.

Capital expenditures play a big role in long-term growth. Investing in new equipment or technology can boost productivity and give your business a competitive edge. Managing these investments wisely helps you balance short-term cash needs with long-term goals.

FineReport can automate the entire process. You can set up dashboards to track operating cash flow, capital expenditures, and free cash flow in real time. The software pulls data from multiple sources, creates visual reports, and helps you spot trends quickly. This way, you spend less time on manual calculations and more time making smart decisions.

Tip: If you want to master how to calculate free cash flow step by step, try using FineReport’s automated reports. You’ll get accurate numbers and clear visuals, making financial management much easier.

If you want to improve free cash flow, you need to focus on a few key habits. Many businesses struggle with cash flow because they overlook simple steps. Here are some practical ways you can boost your free cash flow:

You should also avoid common mistakes that hurt free cash flow. Watch out for impulse spending, payment errors, and neglecting accounts receivable. Don’t confuse profit with cash. Always track your cash inflows and outflows to stay on top of your finances.

Tip: Improving free cash flow is not just about cutting costs. It’s about making smart choices every day.

You can make managing free cash flow much easier with the right tools. FineReport stands out as a powerful solution for financial management. It helps you track, analyze, and report your cash flow in real time.

| Feature | Description |

|---|---|

| User-friendly report designer | Create detailed reports with simple drag-and-drop actions. |

| Data source support | Connect to many databases like Oracle, SQLServer, MySQL, and more. |

| Direct database connections | Access real-time data for up-to-date cash flow analysis. |

| Report server functionality | Enter and view data through web browsers for instant updates. |

| Caching and connection management | Handle large amounts of data quickly and efficiently. |

FineReport’s financial management solution streamlines your cash flow analysis. You can enter data in real time, automate your reporting, and visualize trends with clear dashboards. This means you spend less time on manual work and more time making decisions that help your business grow. FineReport brings all your financial data together, so you always know where your cash stands.

If you want to improve free cash flow, using a tool like FineReport can give you a big advantage. You get accurate numbers, faster insights, and a clear view of your financial health.

You can master how to calculate free cash flow by following three simple steps:

Anyone can do this with the right guidance. Try using your own numbers and see how easy it is. FineReport helps you get accurate results and clear reports. Take control of your financial future today.

What Is a Quarterly Report and Why Investors Should Care

How to Use Inventory Report for Better Business Decisions

How to Build a Service Report Template for Your Business

What Is a Research Report and Why Does It Matter

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Top 10 Best Automation Reporting Tool Picks for Businesses

Compare the top 10 best automation reporting tool options to streamline business data, automate reports, and boost decision-making efficiency.

Lewis

Jan 03, 2026

Top 10 Reporting Systems and Tools for Businesses

See the top 10 reporting systems that help businesses automate data, build dashboards, and improve decision-making with real-time analytics.

Lewis

Jan 03, 2026

What is integrated reporting and why is it important

Integrated reporting combines financial and non-financial data, offering a full view of value creation, transparency, and stakeholder trust.

Lewis

Dec 12, 2025