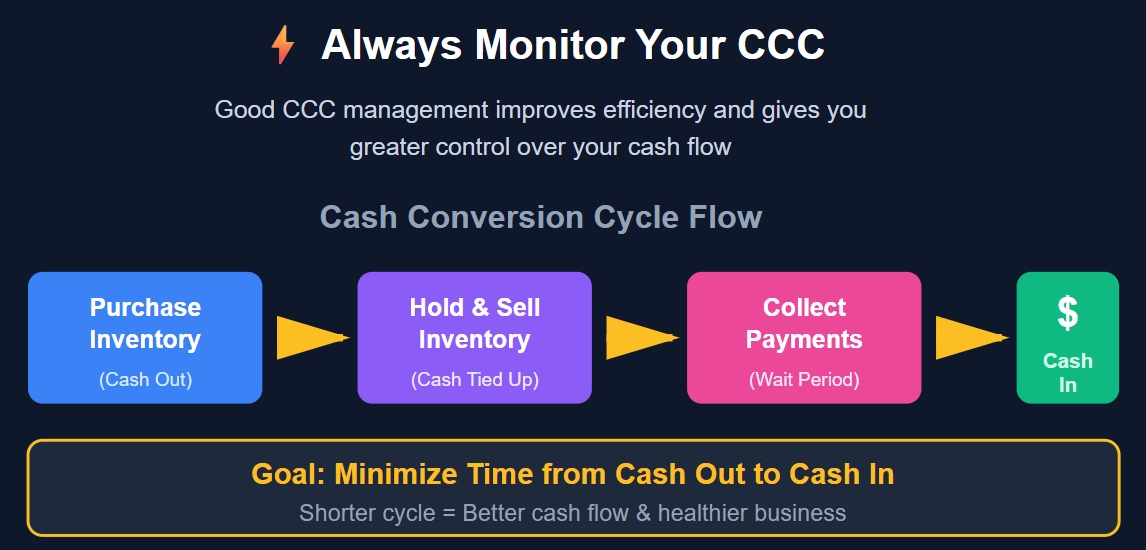

You need to know how quickly your business turns investments into cash. The cash conversion cycle shows you this process. This metric helps you measure how long it takes to buy inventory, sell products, and collect payment. You can use it to track cash flow and improve operational efficiency. When you shorten the cycle, you free up cash flow for growth. A shorter cycle also means you boost operational efficiency and keep your business running smoothly. If you want better efficiency, focus on understanding and managing your cash conversion cycle.

You can think of the cash conversion cycle as a timer that tracks how long your money stays tied up in your business operations. The cycle starts when you pay for inventory and ends when you collect cash from customers. The goal is to keep this cycle as short as possible so you have more cash available for daily needs and growth.

Here are the main components of the cash conversion cycle:

| Component | Description |

|---|---|

| Inventory Conversion Period | The time it takes to turn raw materials into finished goods and sell them. |

| Average Collection Period | The time it takes to collect payment from customers after a sale. |

| Payables Payment Period | The time you take to pay your suppliers after buying inventory. |

You calculate the ccc by adding the inventory conversion period and the average collection period, then subtracting the payables payment period. This formula helps you see how quickly you turn investments in inventory into cash flow.

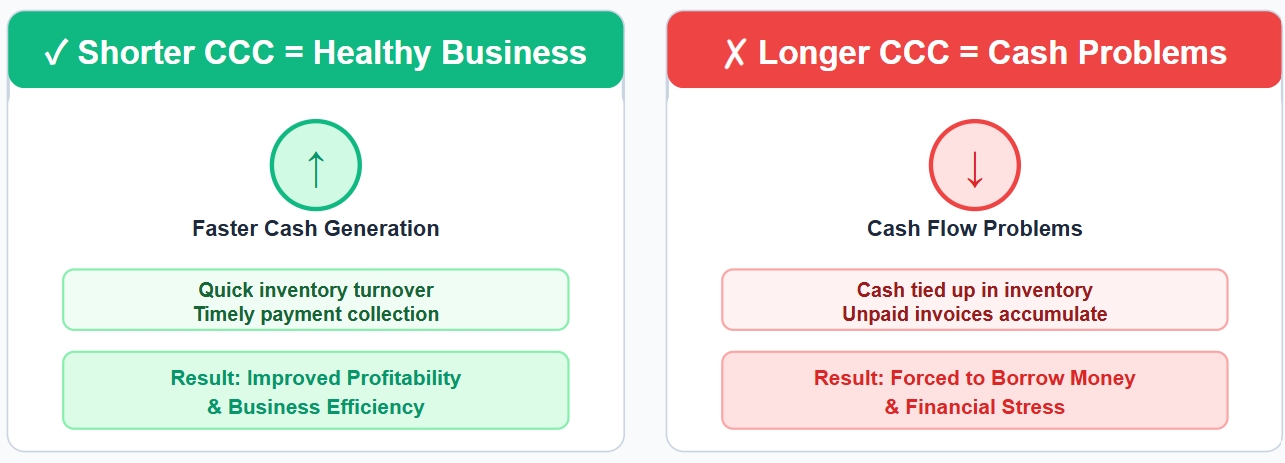

You need to manage your ccc carefully because it directly affects your cash flow. When you shorten the cash conversion cycle, you free up cash faster. This means you can pay bills, invest in new products, or handle emergencies without relying on loans.

Seasonal changes can also impact your cash conversion cycle. For example:

You should always monitor your ccc to keep your business healthy. Good management of the cash conversion cycle improves efficiency and gives you more control over your cash flow.

You can measure how efficiently your business turns investments into cash by calculating the cash conversion cycle. The ccc formula combines three important metrics: Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO). Each metric tracks a different part of your business process.

Here is a simple table that shows how these components work together:

| Component | Description |

|---|---|

| Days Inventory Outstanding (DIO) | Measures the average number of days inventory is held before sold. |

| Days Sales Outstanding (DSO) | Indicates the average number of days it takes to collect payment after a sale. |

| Days Payable Outstanding (DPO) | Reflects the average number of days a company takes to pay its suppliers. |

| Cash Conversion Cycle (CCC) | CCC = DIO + DSO - DPO |

You can use this formula to see how quickly your business moves cash through operations. A lower ccc means you get cash back faster. A higher ccc means your money stays tied up longer.

Tip: Many successful companies focus on keeping their ccc as low as possible. For example, Walmart and Costco have ccc values close to zero, while Amazon even has a negative ccc. This means they collect cash from customers before paying suppliers, which gives them a big advantage in cash flow management.

You need to understand each part of the formula to manage your cash conversion cycle effectively. Here is what each metric means and how you can calculate it:

DSO = (Accounts Receivable × Number of Days) / Total Credit SalesDPO = (Average Accounts Payable ÷ Cost of Goods Sold) × 365Note: If you increase DPO, you can shorten your ccc. If you reduce DSO or DIO, you also make your cash conversion cycle shorter. Each improvement helps you free up cash for other business needs.

Here is a quick look at how these numbers compare in different industries:

| Industry | DIO (Days) | DPO (Days) |

|---|---|---|

| Retail | 30 - 60 | 30 - 45 |

| Manufacturing | 50 | 50 - 70 |

You can see that industry benchmarks vary. Some companies, like Amazon, have a negative ccc. This means they get paid by customers before they pay suppliers. Others, like Macy’s, may have a much longer ccc, which can tie up cash and slow growth.

If you want to improve your cash flow, focus on reducing DIO and DSO, or increasing DPO where possible. Each change will help you move cash through your business faster and keep your operations running smoothly.

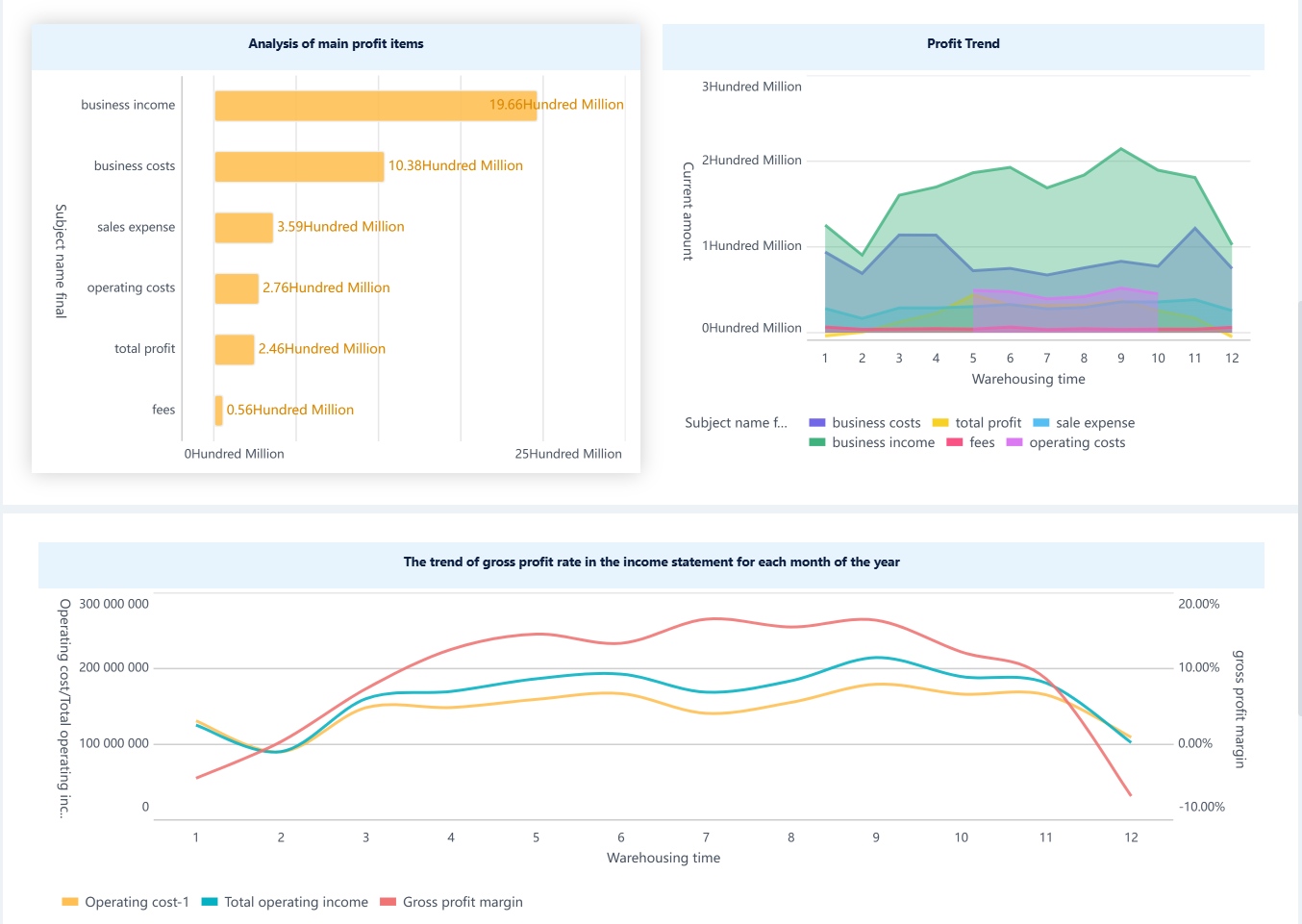

You can use FineBI to track every part of your inventory and accounts receivable process. FineBI connects to your business systems and brings all your data together. This gives you a clear view of how long products stay in inventory and how quickly customers pay their invoices. You can spot slow-moving items and see which customers delay payments. With this information, you can make better decisions to reduce inventory days and speed up collections.

Many businesses struggle with inventory mismanagement and receivable delays. These problems can tie up cash and slow down your cash conversion cycle. FineBI helps you solve these issues by providing real-time dashboards and alerts. For example, you can set up a dashboard to monitor accounts receivable aging. This lets you act quickly if a customer misses a payment. In manufacturing and retail, companies like BOE have used FineBI to reduce inventory costs and improve operational efficiency. You can follow their lead to keep your cash flow healthy.

| Challenge | Description |

|---|---|

| Inventory Mismanagement | Poor inventory control can lead to excess stock or stockouts, complicating cash flow management. |

| Receivable Delays | Late customer payments create cash flow gaps, straining operational funds. |

| Data Invisibility | Lack of real-time visibility into cash flow metrics can hinder effective decision-making and forecasting. |

FineBI also gives you powerful tools to manage payables and accounts payable. You can track how long it takes to pay suppliers and see the impact on your cash flow. By analyzing accounts payable data, you can find the best time to pay bills without hurting supplier relationships. FineBI lets you compare payment terms, spot trends, and avoid late fees.

You may face pressure to balance supplier payments with your need for liquidity. FineBI helps you see the full picture. You can set alerts for upcoming due dates and monitor accounts payable turnover. This helps you avoid missing payments and keeps your cash conversion cycle on track. In the retail sector, companies use FineBI to manage accounts payable across multiple locations, making sure cash flow stays steady.

With FineBI, you gain real-time insights into every part of your cash conversion cycle. You can act quickly to fix problems and keep your business running smoothly.

You can take several steps to make your business more efficient and keep cash flowing. Start by focusing on accounts receivable and inventory management. Here are proven strategies:

In fact, more than half of companies in a recent J.P. Morgan study shortened their CCC by improving their days payable outstanding. Automation and better payment terms can make a big difference.

You can use data analytics platforms like FineBI to monitor and improve your efficiency. FineBI connects your business systems and gives you real-time insights into accounts receivable, inventory, and payables. You can visualize trends, spot bottlenecks, and act quickly.

| Best Practice | Description |

|---|---|

| Automate and Integrate Finance Ops | Use FineBI to automate invoice generation and integrate ERP systems. |

| AI-Based Cash Forecasting | Predict cash shortfalls and plan ahead with advanced analytics. |

| Real-Time Data Tracking | Monitor CCC components for better visibility and faster decisions. |

FineBI helps you map your current CCC, identify inefficiencies, and set performance metrics. You can use predictive analytics to forecast trends and make proactive decisions. For example, a mid-sized retailer reduced its CCC by 10 days and freed up $500,000 for new investments by automating invoicing and using predictive analytics. Real-time tracking and automated alerts keep your business agile and responsive.

FanRuan’s solutions support continuous monitoring and decision-making. You gain the ability to connect, analyze, and visualize data efficiently. This leads to better cash flow management and improved business performance.

You need to understand and manage your cash flow to keep your business strong. When you track your cycle, you improve liquidity and reduce costs. You also make your company more attractive to lenders and investors. Regular monitoring helps you spot trends and adjust quickly. FineBI from FanRuan gives you real-time insights and easy-to-use dashboards. With these tools, you can compare your results to industry peers, set smart targets, and build a more resilient business. Stay proactive and use data analytics to support your financial health.

Companies that focus on sustainability and smart working capital strategies often see better long-term results and resilience.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

You should aim for a cash conversion cycle that is as short as possible. Most healthy businesses keep their cycle under 60 days. Compare your results to industry benchmarks for better insight.

You need to review your cash conversion cycle every month. Regular checks help you spot problems early and keep your cash flow strong.

Yes, FineBI connects to your systems and updates dashboards in real time.

You see CCC changes instantly and get alerts for unusual trends.

Yes, you can use the cash conversion cycle in service businesses. Track how long it takes to deliver services and collect payments. This helps you manage cash flow and plan for growth.