YOY means comparing business or financial results from one year to the next. You use year-over-year analysis to track changes in revenue, profit, or other metrics, making it easier to spot patterns and trends. YOY helps you evaluate performance, highlight strengths and weaknesses, and anticipate future results by looking at past years. This approach removes seasonal effects and gives you reliable comparisons for financial planning. You can apply year over year analysis to many business areas, including revenue growth and market share, to make smarter decisions.

YOY stands for "year-over-year." In finance and business, you use this metric to compare a value from one year to the same value in a previous year. This approach helps you measure changes in revenue, profit, or other important metrics over time. You can see how your business performs by looking at the same period each year, which gives you a clear picture of growth or decline.

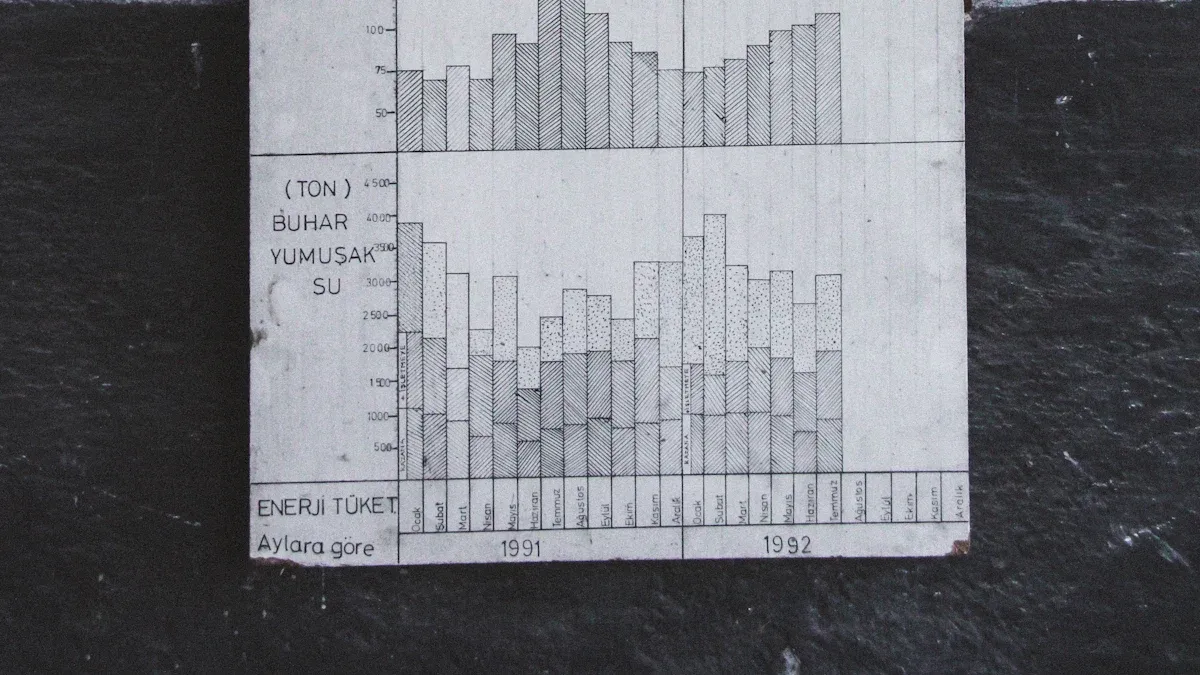

Year-over-year (YoY) is a metric that refers to the 12-month change of a particular value and compares it to the change in a different period. In other words, it is the change in annualized returns between two comparable periods. Year-over-year analysis is most commonly used when discussing financial or economic data, especially regarding growth.

You often see YOY used in financial reports, business updates, and market analysis. For example, you might compare your company's revenue in the first quarter of this year to the first quarter of last year. This method helps you understand if your business is moving in the right direction. YOY growth shows whether your revenues, profits, or other key numbers are increasing or decreasing over time.

YOY analysis matters because it gives you a reliable way to track business performance. When you compare results from the same period in different years, you remove the effects of seasonality. This makes it easier to spot real trends in your financial data.

Year-over-year analysis is particularly effective because it compares a company's performance in a specific period to the same period in the previous year, which mitigates the impact of seasonal variations. This method provides a clearer perspective on long-term trends and performance changes, unlike metrics such as Quarter-over-Quarter (QoQ), which can be skewed by seasonal effects.

You can use YOY analysis in many areas of business:

You rely on YOY comparisons for several reasons:

You find YOY analysis especially useful in these scenarios:

When you use YOY growth as a key metric, you gain a better understanding of your business's financial health. This approach helps you make informed decisions, set realistic goals, and communicate progress to stakeholders. Year over year comparisons are essential for anyone who wants to track revenue, profit, or other financial metrics in a meaningful way.

You can calculate YOY growth using a simple formula. This formula helps you compare your business or financial results from one year to the next. Here is the standard way to calculate year-over-year growth:

You can also express the result as a percentage by multiplying by 100. This formula works for revenue, profit, or any other metric you want to track. Using this method, you can see how your financial performance changes each year.

Tip: Always use accurate and consistent data for your YOY analysis to avoid misleading results.

Let’s walk through a practical example of YOY growth calculation for revenue:

Your YOY growth in revenue is 17.94%. This calculation helps you understand how your revenues change from year to year and supports better financial planning.

FineReport can automate these YOY calculations for you. You can set up reports that compare each year’s values, visualize trends, and generate dashboards. This saves time and reduces errors in your finance team’s reporting process.

You need to avoid several common mistakes when performing YOY analysis in business:

You can improve your YOY comparisons by using tools like FineReport. FineReport ensures data accuracy, aligns periods correctly, and helps you visualize year over year trends for better business decisions.

| Consideration Type | Description |

|---|---|

| Contextual Analysis | Consider market conditions and industry trends that affect your performance. |

| Data Accuracy | Use accurate and consistent data for reliable YOY analysis. |

| Professional Services | Seek expert help for complex financial reporting and record-keeping. |

By following these steps and using the right tools, you can make your YOY growth calculations more accurate and meaningful for your business and finance needs.

You use YOY analysis in financial reporting to compare your company’s performance from one year to the next. This method helps you track changes in key metrics such as revenue, profits, and other financial indicators. When you review year-over-year results, you gain a benchmark for measuring business performance and economic growth.

YOY comparisons allow you to spot trends and patterns that might not be visible in shorter time frames. You can use this approach to evaluate whether your financial performance is improving, staying steady, or declining. This insight is essential for both internal management and external stakeholders who want to understand your company’s growth.

You rely on YOY analysis to make informed decisions and drive strategic planning. By smoothing out short-term volatility, YOY analysis gives you a clearer picture of sustainable growth.

When you analyze year-over-year growth, you can identify which areas of your business need improvement and which strategies deliver the best results. This approach supports better forecasting and risk management, helping you stay competitive in the finance industry.

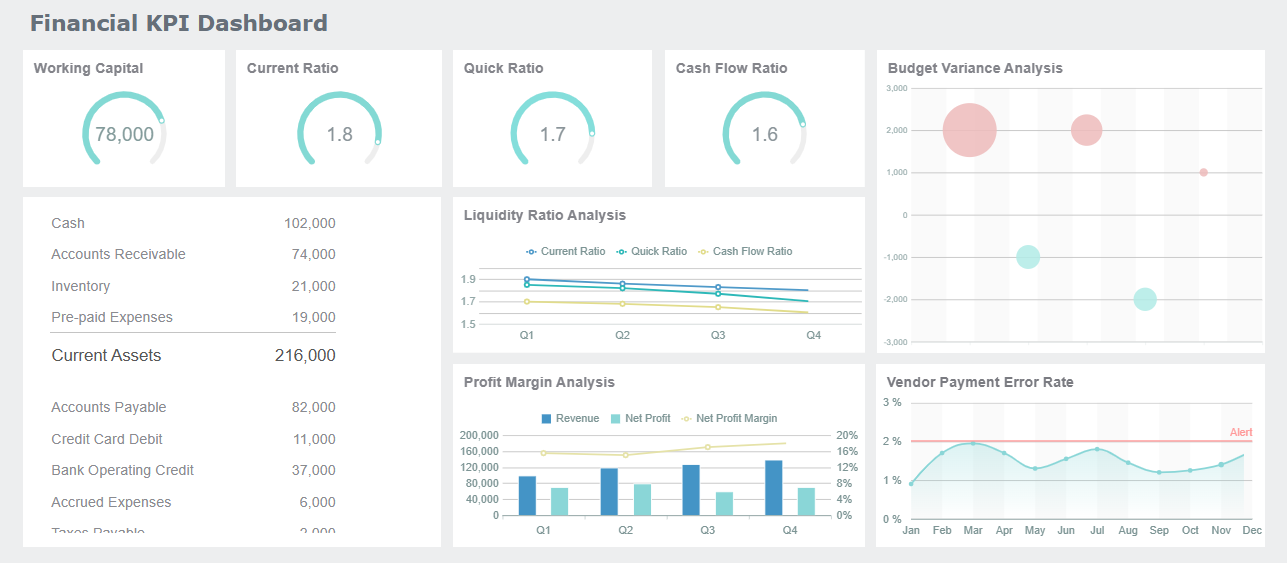

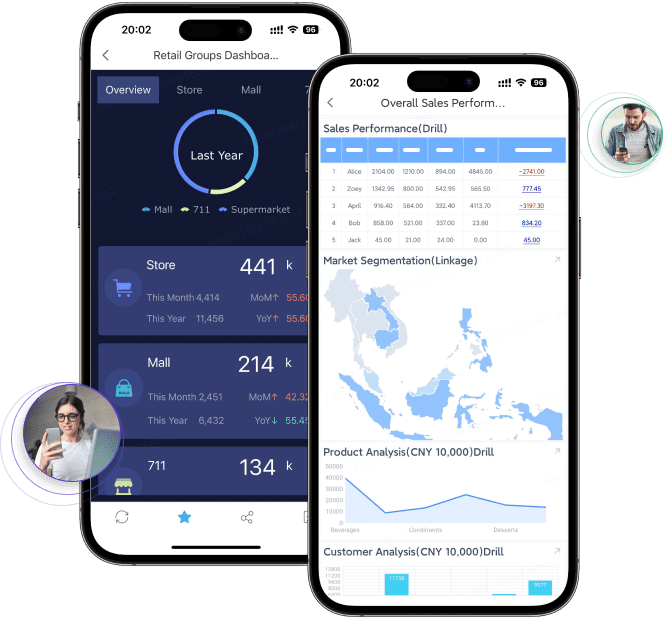

FineReport empowers you to automate YOY analysis and streamline financial reporting. You can create dashboards and reports that visualize year-over-year growth, making it easier to monitor business performance in real time. The platform offers features that support efficient YOY analysis:

| Feature | Description |

|---|---|

| Data Visualization | Summarizes business performance visually and monitors ongoing operations. |

| Integration with Data Sources | Combines data from multiple sources for comprehensive analysis. |

| User-friendly Reporting Tools | Allows you to create reports or dashboards quickly using drag & drop. |

| Real-time Data Entry | Improves efficiency in updating real-time data for financial dashboards. |

| Customization via Open APIs | Enables IT to customize reporting systems to meet specific needs. |

| Rich Chart Options | Provides over 50 styles of HTML5 charts for enhanced data presentation. |

| Data Input Controls | Facilitates massive data input with validation and temporary storage. |

You benefit from FineReport’s financial management solution, which integrates data from various sources and automates report generation. Many companies, such as Founder Securities, have improved their business operations and decision-making by using FineReport for YOY analysis. You can leverage these tools to gain deeper insights into revenue trends, financial performance, and business growth, ensuring your organization stays ahead in a competitive market.

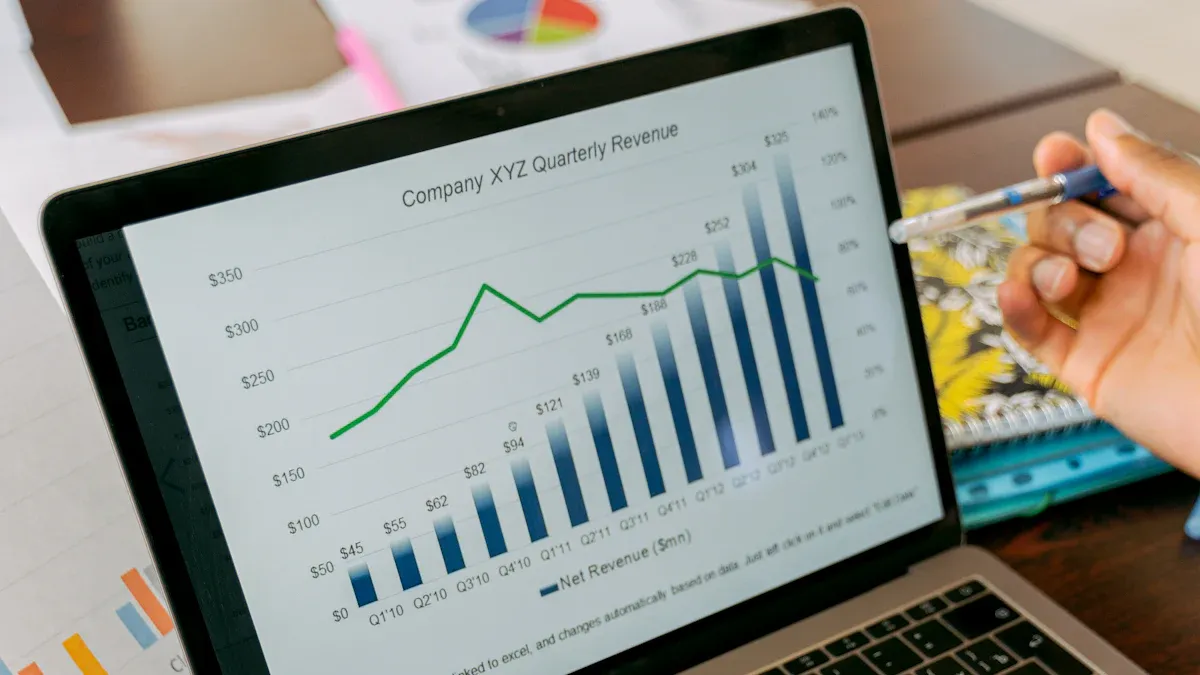

You often start your year-over-year analysis by looking at YOY revenue growth. This metric compares your revenue from one year to the same period in the previous year. For example, if your business earned $500,000 last year and $600,000 this year, you see a YOY increase in revenues of 20%. Tracking YOY revenue growth helps you understand if your sales strategies work and if your business expands over time. Many companies use this metric to measure financial performance and set future goals. You can also break down revenue by product or service to see which areas drive the most growth.

YOY profit is another key metric for evaluating business success. You calculate this by comparing net profit from one year to the next. If your net profit was $80,000 last year and $100,000 this year, your YOY profit growth is 25%. This metric shows how well you control costs and increase efficiency. By tracking YOY profit, you can spot trends, identify challenges, and make better decisions for your business. YOY comparisons for profit help you see if your strategies improve your bottom line.

You can track many other year-over-year metrics to get a complete view of your business. Common uses of year-over-year analysis include:

These metrics help you measure growth, efficiency, and customer engagement. Year over year analysis gives you a clear picture of changes across different areas.

FineReport dashboards and reports make it easy to visualize these YOY metrics. You can use the flexible report designer to create custom dashboards that show YOY growth for revenue, profit, and other key indicators. The platform offers diverse visualization types, interactive analysis, and mobile BI access. You can connect data from multiple years and sources, making your YOY analysis accurate and actionable.

| Feature | Description |

|---|---|

| Flexible Report Designer | Rapidly build dashboards to visualize YOY metrics. |

| Diverse Visualization | Display YOY data with charts and graphs. |

| Interactive Analysis | Explore trends and compare year-over-year results easily. |

| Data Entry | Input and update data for accurate YOY comparisons. |

| Deployment & Integration | Gather YOY data from different periods and sources. |

| Mobile BI | Access YOY metrics on any device, anytime. |

By using FineReport, you can track and present all your important YOY metrics, helping you make informed decisions and drive business growth.

You gain several advantages when you use YOY analysis in business and finance. YOY measurements help you track trends in key financial metrics over time. This approach gives you a clear view of growth or decline across years. Here are some main benefits:

Tip: Use YOY percentage change to quickly spot patterns and make better forecasts for your business.

| Benefit of YOY Analysis | Explanation |

|---|---|

| Comprehensive view of long-term growth patterns | YOY analysis compares metrics over a 12-month period, providing insights into overall performance. |

| Identifies strengths and weaknesses | This method helps you pinpoint areas of success and those needing improvement. |

| Assesses performance without seasonality influence | YOY analysis mitigates the impact of seasonal fluctuations, allowing for a more accurate assessment. |

While YOY analysis is powerful, you should know its limitations in financial reporting:

| Limitation | Description |

|---|---|

| Reliance on historical data | YOY analysis uses past data, which may not reflect current market conditions. |

| Subjectivity in accounting practices | Different accounting methods can lead to varying interpretations of the same data. |

| Lack of non-financial information | YOY analysis does not include qualitative factors that can impact business performance. |

| Potential manipulation | Companies may use practices that distort financial results, affecting reliability. |

You often compare YOY with other time-based metrics in finance. Each metric serves a different purpose:

| Metric | Description | Purpose |

|---|---|---|

| YOY | Compares results over comparable periods annually | Provides a broader annual perspective, mitigating seasonality |

| YTD | Measures performance from the start of the year to the current date | Allows for interim assessments of performance |

| QOQ | Focuses on changes between one fiscal quarter and the previous one | Reflects short-term performance shifts |

| MoM | Highlights recent fluctuations in performance | Useful for tracking immediate changes |

YOY analysis helps you see long-term growth and reduces the impact of seasonal changes. YTD gives you an accurate picture of current year performance. QOQ and MoM are useful for tracking short-term shifts and immediate changes.

Best practice: Combine YOY with other metrics like MoM or QOQ for a complete view of your business trends.

FineReport helps you overcome common YOY analysis challenges. You can use flexible formula calculations to support accurate YOY growth rates. FineReport allows you to fetch data from various business databases, making your YOY reporting more comprehensive. Multi-dimensional dashboards enable you to analyze YOY performance deeply and make better decisions for your business.

Understanding YOY gives you a clearer view of business performance by neutralizing seasonal effects and aligning timeframes. You can use YOY analysis to compare growth, shape business strategies, and make informed decisions.

What Is a Quarterly Report and Why Investors Should Care

How to Use Inventory Report for Better Business Decisions

How to Build a Service Report Template for Your Business

What Is a Research Report and Why Does It Matter

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Top 10 Best Automation Reporting Tool Picks for Businesses

Compare the top 10 best automation reporting tool options to streamline business data, automate reports, and boost decision-making efficiency.

Lewis

Jan 03, 2026

Top 10 Reporting Systems and Tools for Businesses

See the top 10 reporting systems that help businesses automate data, build dashboards, and improve decision-making with real-time analytics.

Lewis

Jan 03, 2026

What is integrated reporting and why is it important

Integrated reporting combines financial and non-financial data, offering a full view of value creation, transparency, and stakeholder trust.

Lewis

Dec 12, 2025