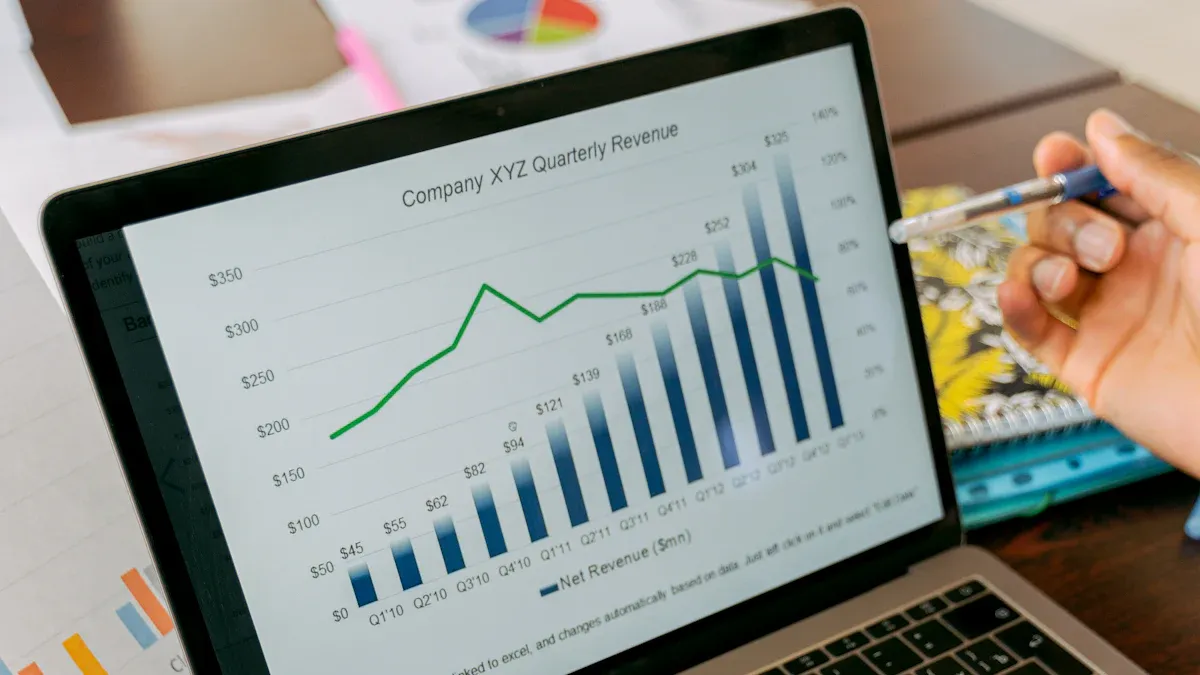

Financial reporting tools are indispensable for business success. These tools streamline data collection, align budgets, conduct reconciliations, facilitate financial close and consolidation, and craft accurate financial statements. Here are the 6 best financial reporting tools you can explore:

By employing automation and analysis, financial reporting software turbocharges the reporting process, assisting finance teams in tackling fundamental accounting responsibilities. The use of these tools offers numerous benefits such as saving time, reducing errors, providing real-time insights into a company’s financial health, automating processes, optimizing performance, and reducing the risk of human error. Choosing the right tool is crucial for maximizing efficiency and making informed decisions quickly.

Financial reporting tools are essential for businesses seeking to optimize their financial processes. These tools, such as financial reporting software, play a pivotal role in enhancing the efficiency and accuracy of financial reporting tasks. By automating data collection, aligning budgets, facilitating reconciliations, and generating precise financial statements, these tools empower finance teams to make informed decisions swiftly.

Financial reporting tools encompass a range of software solutions designed to streamline the financial reporting process. Businesses rely on these reporting tools to ensure accurate and timely reporting, enabling them to comply with regulatory requirements and gain valuable insights into their financial performance.

Financial reporting tools are dynamic solutions that leverage automation and analysis to expedite the generation of financial reports. These tools enable organizations to collect, consolidate, and analyze financial data efficiently, providing a comprehensive view of their financial health.

Businesses require financial reporting tools to enhance the reliability, speed, compliance, analysis, and scalability of their financial reporting processes. By utilizing these tools, organizations can improve decision-making processes, meet regulatory standards, and optimize overall financial performance.

When selecting financial reporting tools, businesses should consider several key features that can significantly impact their effectiveness:

Automation capabilities are crucial for reducing manual intervention in the financial reporting process. By automating data aggregation, report generation, and analysis tasks, these tools enable finance teams to focus on strategic initiatives rather than routine administrative work.

Seamless integration with other systems, such as ERP platforms or BI tools, is essential for ensuring data consistency across different organizational functions. The ability of financial reporting software to integrate with existing systems streamlines data flow and enhances collaboration among departments.

A user-friendly interface is paramount for ensuring the widespread adoption of financial reporting tools within an organization. Intuitive dashboards, customizable reports, and interactive data visualization make it easier for users at all levels to access and interpret financial data effectively.

Website: https://www.fanruan.com/en/finereport

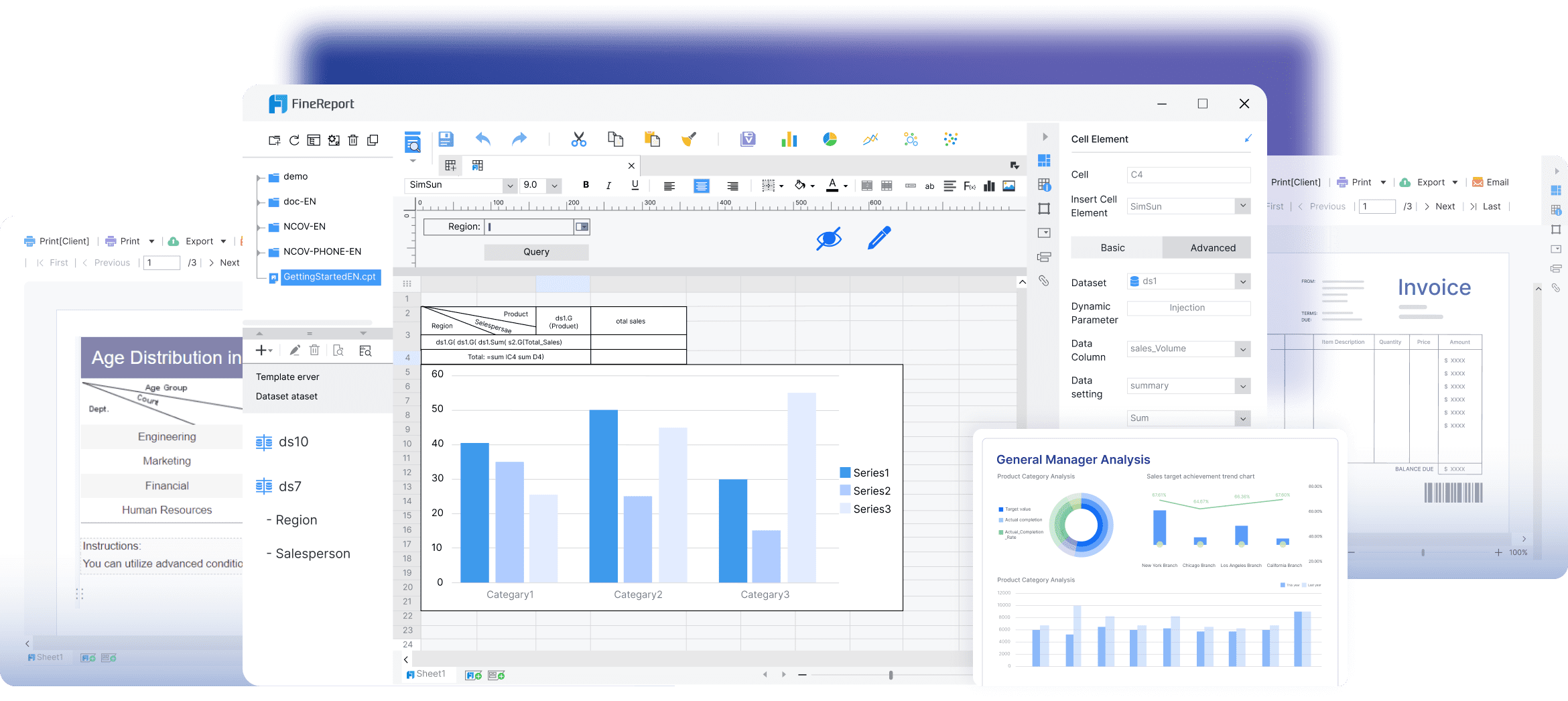

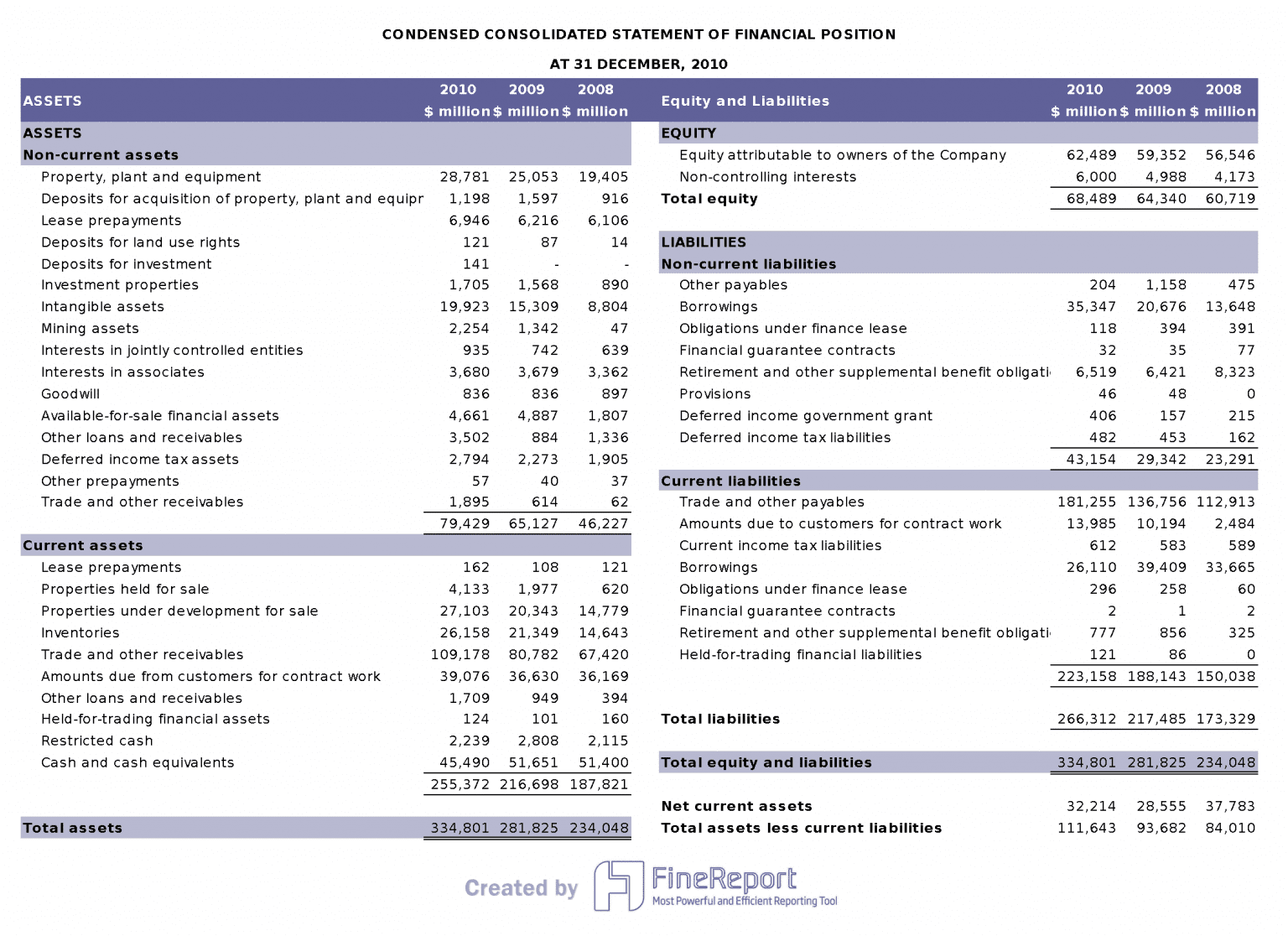

FineReport, developed by FanRuan Software, is a powerful enterprise-level reporting and dashboard software that transforms the way businesses handle complex reporting needs. With its intuitive drag-and-drop interface, FineReport simplifies the creation of fixed reports, allowing users to effortlessly design, customize, and deploy comprehensive reports. This software is tailored specifically for IT departments, offering a highly flexible platform that supports a wide range of reporting formats and styles. FineReport not only enhances enterprise management through seamless report generation but also enables organizations to integrate data from multiple sources, ensuring that decision-makers have access to accurate, real-time information. By bridging the gap between data and actionable insights, FineReport empowers businesses to optimize their operations and drive strategic outcomes.

Ready to revolutionize your reporting process? Click the banner below to try FineReport for free and unlock powerful data insights today!

Website: https://planful.com/

Website: https://www.anaplan.com/

Website: https://www.workday.com/en-hk/products/adaptive-planning/overview.html

Workday Adaptive Planning stands out as a robust financial reporting tool that offers a wide array of features tailored to meet the diverse needs of businesses. With its intuitive interface and advanced capabilities, Workday Adaptive Planning streamlines financial processes, enabling organizations to make data-driven decisions efficiently.

Website: https://www.datarails.com/

When it comes to agile financial reporting solutions, Datarails emerges as a top contender in the market. Its lightweight Excel-based platform caters to various FP&A use cases such as budgeting, planning, financial forecasting, and variance analysis. By combining flexibility with powerful features, Datarails empowers finance teams to drive accurate and timely reporting processes.

Website: https://www.jedox.com/en/

Jedox, a versatile financial reporting tool, offers a range of features that cater to the diverse needs of businesses. Its adaptable platform ensures seamless integration with various business requirements, empowering finance teams to drive accurate and timely reporting processes.

When considering financial reporting tools, businesses must first evaluate their unique requirements to ensure optimal performance. The size of the business plays a crucial role in determining the scalability and functionality needed from a reporting tool. Smaller enterprises may benefit from streamlined solutions that focus on core financial processes, while larger corporations require robust platforms capable of handling complex data sets and extensive reporting requirements.

Understanding the specific reporting requirements is equally essential for selecting the right tool. Different industries and business models demand varying levels of detail and customization in financial reports. By identifying key metrics, regulatory standards, and internal reporting structures, organizations can pinpoint tools that align with their precise needs, ensuring accurate insights and compliance across all financial activities.

Cost considerations are paramount when investing in financial reporting tools. While advanced features offer significant benefits, businesses must weigh the cost of the tool against their budget constraints to achieve a balance between functionality and affordability. Cloud-based solutions often provide scalable pricing models that cater to businesses of all sizes, offering flexibility in cost management without compromising on essential features.

Assessing the potential ROI is another critical aspect of selecting financial reporting tools. Organizations should analyze how implementing a new tool will impact efficiency, accuracy, and overall financial performance. By calculating potential time savings, error reduction rates, and improved decision-making capabilities, businesses can determine the long-term value proposition of each tool before investing.

User feedback serves as a valuable resource for evaluating the effectiveness of financial reporting tools in real-world scenarios. Understanding the importance of user feedback allows organizations to gain insights into usability, performance, and overall satisfaction levels with different software solutions. By reviewing testimonials from industry peers and exploring case studies showcasing successful implementations, businesses can make informed decisions based on practical experiences rather than theoretical features.

Real-world examples offer tangible evidence of how financial reporting tools have transformed organizations' operations and outcomes. From increased productivity to enhanced decision-making processes, case studies provide concrete illustrations of the benefits derived from choosing the right tool for specific business needs. By studying these examples closely, companies can envision how similar tools could drive positive changes within their own financial departments.

Artificial Intelligence (AI) and automation are revolutionizing the landscape of financial reporting tools, offering unparalleled efficiency and accuracy. By harnessing the power of AI algorithms, businesses can streamline data processing, identify trends, and generate insights at an unprecedented pace. The integration of automation into financial reporting processes eliminates manual errors, ensuring that reports are error-free and compliant with regulatory standards. This transformative shift towards AI-driven tools empowers finance teams to focus on strategic analysis and decision-making, rather than mundane administrative tasks.

OneStream Software: OneStream Software introduces an automated narrative reporting approach within its platform, enhancing the speed and accuracy of financial reporting processes. By leveraging AI capabilities, OneStream Software enables organizations to generate comprehensive reports swiftly while maintaining data integrity.

SplashBI GL Connect: SplashBI launched GL Connect, an enhanced financial reporting app that leverages AI technology to upgrade existing reporting tools significantly. With advanced analytics features, SplashBI GL Connect provides real-time insights into financial performance metrics, enabling informed decision-making across all levels of the organization.

Microsoft Copilot for Finance: Microsoft's Copilot for Finance is a role-based AI toolset designed to empower finance teams with intelligent automation capabilities. By automating routine tasks such as data entry, reconciliation, and report generation, Copilot for Finance accelerates the financial reporting process while minimizing errors and improving overall efficiency.

The integration of blockchain technology into financial reporting tools offers unprecedented security and transparency in data management. Blockchain's decentralized ledger system ensures that financial information remains tamper-proof and immutable, reducing the risk of fraud or unauthorized alterations. By leveraging blockchain technology, businesses can enhance the trustworthiness of their financial reports, providing stakeholders with verifiable data that instills confidence in the organization's operations.

Advanced analytics tools play a pivotal role in shaping the future of financial reporting by enabling organizations to extract actionable insights from vast datasets. These tools utilize machine learning algorithms to identify patterns, trends, and anomalies within financial data, empowering finance teams to make data-driven decisions efficiently. By integrating advanced analytics into financial reporting tools, businesses can gain a competitive edge through predictive modeling, risk assessment, and performance optimization strategies based on real-time analysis.

Enhance your financial reporting processes with the best tools of 2025. Streamline data collection, align budgets, and craft accurate financial statements effortlessly. Choose FineReport for accelerated reporting, Planful for modern FP&A, Anaplan for enhanced decision-making, Workday Adaptive Planning for streamlined processes, Datarails for agile solutions, Jedox for adaptability, and Syntellis for advanced analytics. Empower your business by selecting the right tool tailored to your unique needs and witness a transformation in your financial operations. Make the smart choice today!

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Top 10 Best Automation Reporting Tool Picks for Businesses

Compare the top 10 best automation reporting tool options to streamline business data, automate reports, and boost decision-making efficiency.

Lewis

Jan 03, 2026

Top 10 Reporting Systems and Tools for Businesses

See the top 10 reporting systems that help businesses automate data, build dashboards, and improve decision-making with real-time analytics.

Lewis

Jan 03, 2026

What is integrated reporting and why is it important

Integrated reporting combines financial and non-financial data, offering a full view of value creation, transparency, and stakeholder trust.

Lewis

Dec 12, 2025