Sean, Industry Editor

Sep 01, 2024

Insurance telematics uses technology to collect and analyze data about how you drive. This system helps insurers understand your driving habits by tracking speed, braking, and distance. As a driver, you may benefit from fairer pricing and personalized coverage. Insurance companies use this data to improve risk assessment and offer usage-based policies. The insurance telematics market has grown quickly in recent years. New connected vehicles, government support, and a focus on real-time driving data have all helped drive this growth.

Insurance telematics is a technology-driven approach that helps you and your insurer understand driving behavior. You use devices or apps that collect data from your vehicle. This data includes speed, braking, mileage, and engine diagnostics. Insurance telematics does not track your every movement. Instead, it focuses on driving habits and vehicle condition. Many drivers believe telematics voids warranties or signals distrust from insurers. These are common misconceptions. Telematics programs are opt-in and approved by automakers. You can choose to participate and benefit from personalized insurance rates.

Insurance telematics relies on several core components. You can see how each part works together in the insurance industry:

You interact with both hardware and software in insurance telematics. Hardware includes telematics devices installed in your vehicle or accessed through mobile apps. These devices use GPS and sensors to collect data. Software platforms process this data and generate reports and insights for you and your insurer.

Tip: Insurance telematics does not tamper with your vehicle. You can use it without affecting your warranty.

Insurance telematics systems collect and transmit driving data using advanced technology. You install a telematics device in your car or download a mobile app. The device uses GPS tracking and onboard diagnostics to capture real-time data. It records metrics such as speed, braking behavior, engine performance, and idle time. The system sends this data to your insurance company through secure cloud storage.

You benefit from insurance telematics because it provides a detailed picture of your driving habits. Insurers use this information to evaluate your risk profile. If you drive safely and avoid harsh braking or speeding, you may qualify for lower premiums. Insurance telematics also helps insurers design usage-based policies. These policies reward safe drivers and encourage responsible behavior.

The data collection process in insurance telematics involves several steps:

| Step | Description |

|---|---|

| Data Collection | Devices gather driving data from your vehicle |

| Data Transmission | Data is sent to the insurer via the cloud |

| Data Processing | Insurer analyzes and models your data |

| Policy Adjustment | Insurer adjusts your rates based on analysis |

Insurance telematics merges GPS tracking with engine diagnostics. You get feedback on your driving, and insurers gain insights into vehicle performance. This system supports fairer pricing and personalized coverage. You can monitor your own driving habits and make improvements to qualify for better rates.

Note: Insurance telematics programs are voluntary. You decide whether to participate and share your driving data.

Insurance telematics relies on several types of devices to collect driving data. You may encounter three main categories: black box devices, plug-in devices, and smartphone apps. Each device type offers unique features and benefits for both drivers and insurers.

| Feature | Black Box | Plug-in Device | Smartphone App |

|---|---|---|---|

| Installation | Professional, fixed | User, plug-and-play | Download and install |

| Portability | Not portable | Portable | Highly portable |

| Data Tracked | Driving behavior, accidents | Speed, fuel, engine diagnostics | Speed, braking, acceleration |

| User Interaction | Low | Moderate | High |

Insurance telematics devices collect a wide range of data from your vehicle. The most frequently collected data includes:

These devices have improved significantly over the past decade. They now extract real-time data from your vehicle’s sensors. This allows for accurate measurement of speed, braking, and acceleration. The use of insurance telematics reduces observer bias and encourages natural driving behavior. Machine learning analyses often assess these driving behaviors, making speed, braking, and acceleration key metrics for evaluating your driving.

Insurance telematics programs collect this data continuously. You benefit from detailed feedback on your driving habits. Insurers use this information to assess risk and personalize your insurance policy. The data helps identify safe driving patterns and areas for improvement.

Tip: Insurance telematics devices do not track your every move. They focus on driving behavior and vehicle health, not your personal life.

Insurance telematics generates large volumes of data. You may find it challenging to interpret this information without the right tools. Insurers also face difficulties managing and analyzing the overwhelming amount of telematics data. Regular attention and human involvement are necessary to make telematics programs effective. Many insurers struggle with data sharing, high implementation costs, and ongoing management.

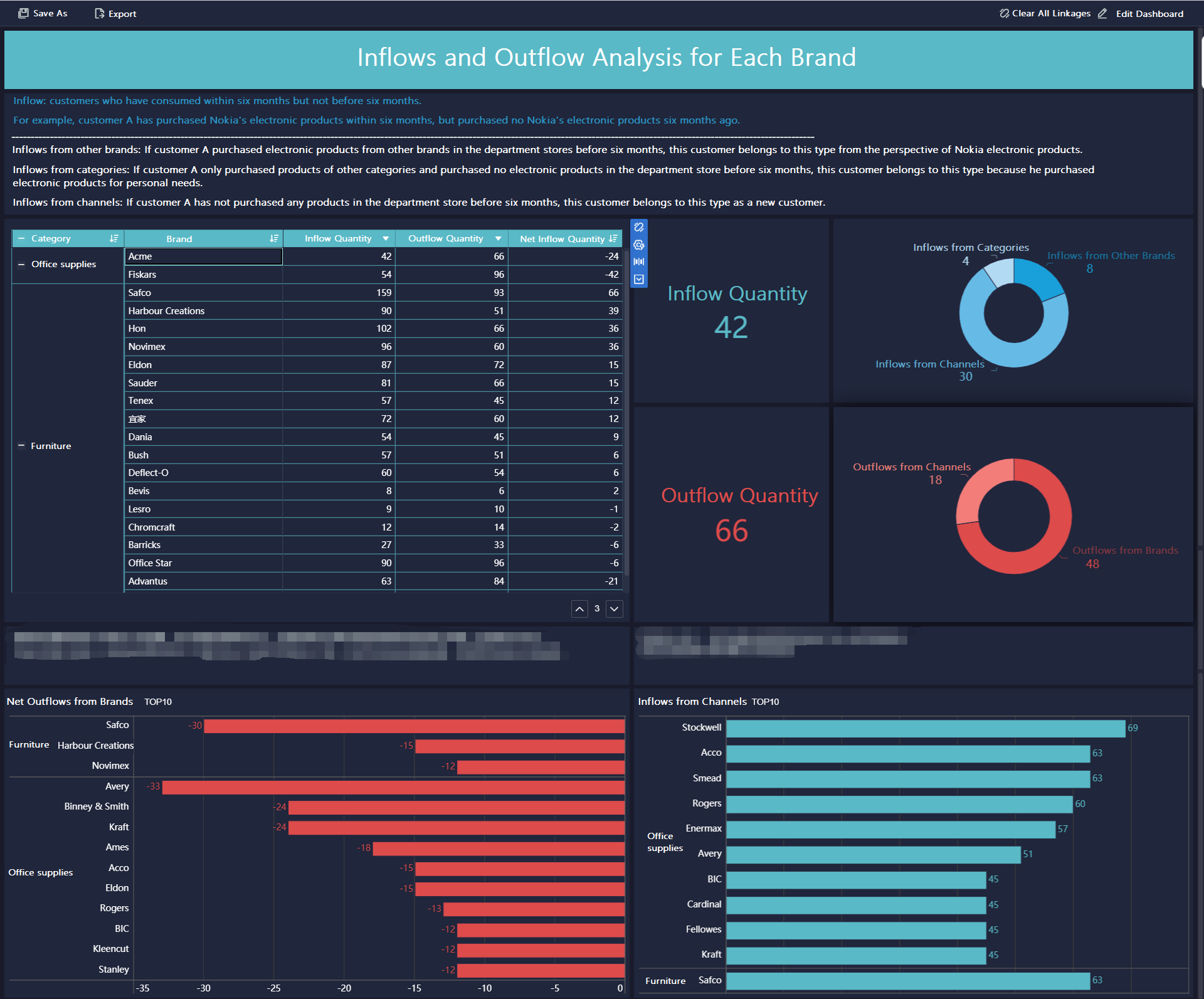

FineBI offers a powerful solution for integrating, processing, and visualizing insurance telematics data. You can connect FineBI to various data sources, including databases, cloud platforms, and APIs. This allows you to bring together telematics data from black box devices, plug-in modules, and smartphone apps.

With FineBI, you can:

FineBI’s advanced analytics features help you uncover insights from insurance telematics data. You can track key performance indicators, identify risky driving patterns, and predict future outcomes. Real-time filtering and responsive design ensure you access insights anytime, on any device.

Note: FineBI empowers both insurers and drivers to make data-driven decisions. You can use its dashboards to monitor your driving habits, while insurers can improve risk assessment and policy pricing.

Insurance telematics data often comes from different devices and formats. FineBI’s flexible integration capabilities make it easy to consolidate this information. You can upload files, connect to databases, or fetch data from APIs. FineBI’s data cleaning tools help you standardize field names, handle missing values, and ensure data quality.

By using FineBI, you transform raw insurance telematics data into actionable insights. You gain a clearer understanding of driving behavior, risk factors, and policy performance. This supports fairer pricing, safer roads, and better customer experiences.

You can choose from several pay-as-you-go models when considering usage-based insurance. These models use insurance telematics to track your driving and adjust your premiums. The most widely used models in the telematics market include:

Pay-as-you-drive has become the most popular segment. Many drivers prefer this model because it links your insurance costs directly to how much you drive. Insurance telematics devices or apps collect real-time data such as speed, mileage, hard braking, and travel times. This information helps insurers understand your driving habits.

Pay-as-you-go insurance charges you based on your actual driving and mileage. Insurers use telematics technology to monitor your vehicle through plug-in devices or mobile apps. The data is sent securely to your insurer, who analyzes it to assess risk and set your premium. You pay a minimum premium to cover your car when it is not in use. Insurers then add a price per kilometer or per minute, depending on your driving profile and experience. They also consider accident risks and your previous driving record.

Usage-based insurance models reward safe and low-mileage drivers. You can lower your costs by driving less or practicing safe habits. This approach gives you more control over your insurance expenses.

You will find different telematics insurance options, each with unique data requirements and pricing structures. Insurance telematics combines data from driver behavior, vehicle diagnostics, and environmental factors. This integration allows insurers to create personalized pricing based on your real-time driving.

| Aspect | Description |

|---|---|

| Data Sources | Telematics data, driver analytics, vehicle diagnostics, environmental data |

| Pricing Models | Personalized pricing based on real-time driving behavior |

| Data Quality | Reliable devices with regular calibration and testing |

Usage-based insurance relies on accurate and high-quality data. Insurers use this data to offer tailored products and fairer premiums. You benefit from insurance that matches your driving style and habits. As telematics technology advances, you can expect even more flexible and personalized insurance options.

Note: Usage-based insurance gives you the chance to save money and encourages safer driving. You can choose the model that best fits your lifestyle and needs.

Insurance telematics offers many advantages for both you and your insurer. You can save money on your car insurance by participating in telematics programs. Many drivers report an average savings of 922 per year. These savings reward you for responsible driving and encourage safer behavior.

Insurance telematics also helps reduce accident rates. Statistical studies show a 35% decrease in road casualty rates among drivers aged 17-19 who use telematics insurance. The overall driving population saw a 16% reduction. This means insurance telematics is especially effective for young drivers who face higher risks.

Insurers benefit from insurance telematics in several ways. The technology provides accurate data on driver behavior and vehicle performance. This helps insurers assess risk more precisely and adjust rates fairly. You receive personalized feedback and lower rates for safe driving, which improves customer satisfaction. Insurers also use telematics data to plan fleet routes, manage resources, and send maintenance alerts. These features increase operational efficiency and reduce loss ratios.

| Benefit | Description |

|---|---|

| Enhanced Risk Assessment | Accurate data on driver behavior and vehicle performance. |

| Improved Customer Engagement | Rewards for safe driving and personalized feedback. |

| Increased Operational Efficiency | Better fleet management and resource planning. |

| Proactive Maintenance Alerts | Early warnings for vehicle issues, reducing claims. |

| Real-time Data for Property Insurance | Improved underwriting and pricing accuracy. |

| Decreased Loss Ratios | Fewer losses due to proactive issue identification. |

Insurance telematics helps you drive safer, save money, and receive fairer insurance rates.

Insurance telematics also presents some challenges, especially regarding privacy. Insurers collect large amounts of personal data, including your driving location and time. Consumer advocacy groups recommend clear standards for data collection and usage. They urge insurers to be transparent about algorithms and to study any discriminatory impacts. You should know how your data is used and have rights to protect your privacy.

Some concerns include:

Insurers address these risks by offering opt-in solutions. You choose whether to share your telematics data. Both you and your insurer receive the same data, which improves transparency. Regulatory frameworks continue to evolve to protect your data privacy and security.

| Method | Description |

|---|---|

| Opt-in Solutions | You decide whether to share your telematics data. |

| Data Transparency | Both you and your insurer see the same data, building trust. |

| Evolving Regulations | Laws and rules adapt to ensure privacy and security in telematics data handling. |

You should review your insurer’s privacy policy and understand your rights before joining an insurance telematics program.

You may benefit from telematics insurance if you want your premiums to reflect your actual driving behaviour. This type of insurance telematics program rewards safe habits and gives you more control over your costs. Younger drivers often see the greatest advantages. Studies show that younger drivers engage more with telematics insurance, while older drivers participate less.

| Demographic Group | Engagement Level with Telematics Insurance |

|---|---|

| Younger Drivers | Stronger engagement |

| Older Drivers | Less engagement |

Telematics insurance programs reward you for positive driving behaviour. You can lower your premiums by:

Programs like Progressive Insurance’s Snapshot show how telematics insurance can help you save. These programs collect data on your speed, acceleration, and braking. If you drive safely, you can earn lower rates. Telematics insurance also helps you monitor your driving behaviour and make improvements over time.

Telematics insurance may not suit everyone. If you drive long distances, travel on risky routes, or often drive at night, you may not see significant savings. Some policies set mileage limits or penalize certain driving patterns. The table below shows which drivers may not benefit as much from telematics insurance:

| Type of Driver | Reason for Limited Benefits |

|---|---|

| Drivers covering long distances | Policies may impose mileage limits, leading to higher premiums for high annual mileage. |

| Routes with higher risk | Regular travel on accident-prone roads can negatively affect a driver's telematics score. |

| Frequent night-time driving | Some policies may penalize driving late at night due to curfews, impacting those who drive overnight. |

Privacy concerns also play a role. Many drivers worry about sharing personal data with insurers. About 70% of drivers express concern about the privacy of their data, and 59% question the accuracy of driving data. Some states require insurers to disclose their tracking practices. Insurers may limit the data they collect to address these concerns.

Many drivers feel that the level of access to personal data required by telematics insurance is intrusive and risky.

Telematics insurance works best for you if you drive safely, cover moderate distances, and value feedback on your driving behaviour. If you have privacy concerns or drive in higher-risk conditions, you may want to consider traditional insurance options.

Insurance telematics gives you a data-driven way to manage your car insurance. You gain fairer rates and feedback on your driving. Tools like FineBI help you and insurers turn complex telematics data into clear insights. Industry experts see AI and telematics transforming insurance with better products and efficiency. Before you join a telematics program, think about your driving habits, privacy concerns, and how your data may affect your rates. As Robin Harbage notes, understanding the value of sharing data helps you make the best choice for your needs.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

Insurance telematics uses telematics devices or a car insurance tracker to monitor your driving habits. You receive personalized driving feedback on speed, braking, and acceleration. This data helps you understand your driving behavior and can improve your driving score over time.

A safe driving app or mobile telematics insurance tracks your driving habits using your smartphone’s sensors. You see your driving score and receive tips to improve. These tools promote safer driving and help you avoid risky driving behaviour, which may lead to the potential for lower premiums.

Black box car insurance uses a device installed in your vehicle to record driving habits and driving behavior. If you want your premiums to reflect how you drive, or if you are a new driver, you may benefit from this option.

Pay how you drive insurance bases your premium on your driving habits and driving score. The insurer reviews your driving behavior, such as speed and braking. Safer habits and a higher driving score can result in the potential for lower premiums.

Yes, insurance telematics provides personalized driving feedback and tracks your driving habits. You can see your driving score and learn how to avoid risky driving behaviour. This approach promotes safer driving and helps you become a better driver.