Sean, Industry Editor

Oct 31, 2025

You need a clear picture of what your business is worth. Enterprise value gives you that perspective.

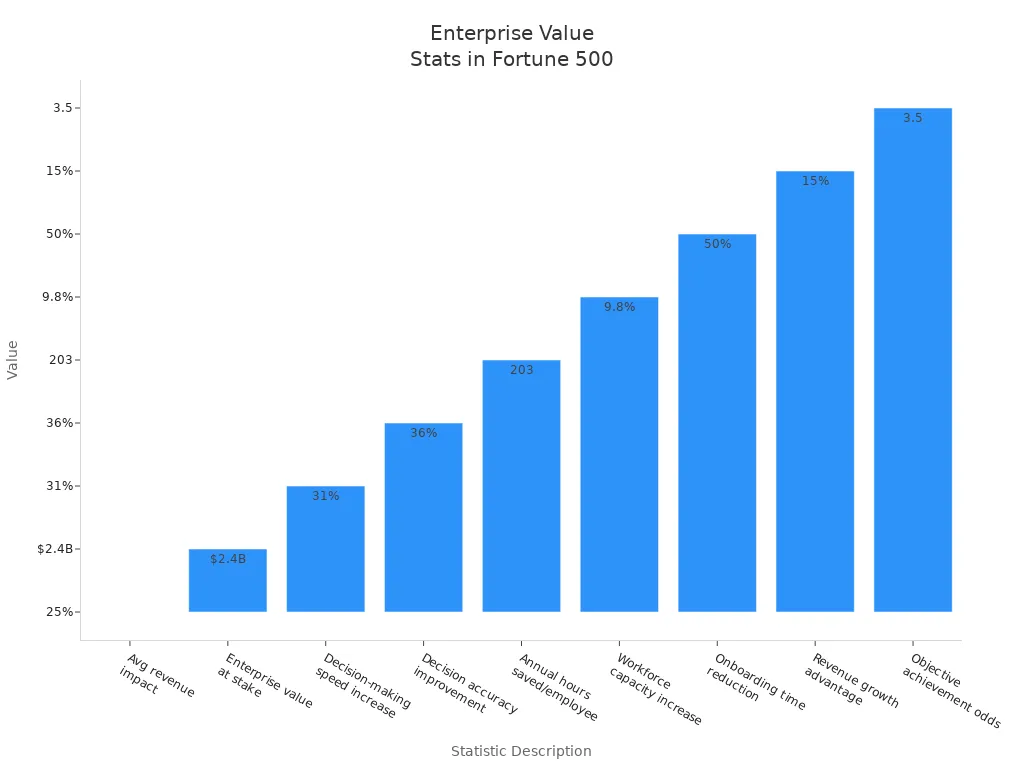

This metric matters. Companies that use enterprise value in their analysis gain a 31% speed boost in decision-making and see a 36% improvement in accuracy. The chart below shows how Fortune 500 firms leverage enterprise value for better business outcomes.

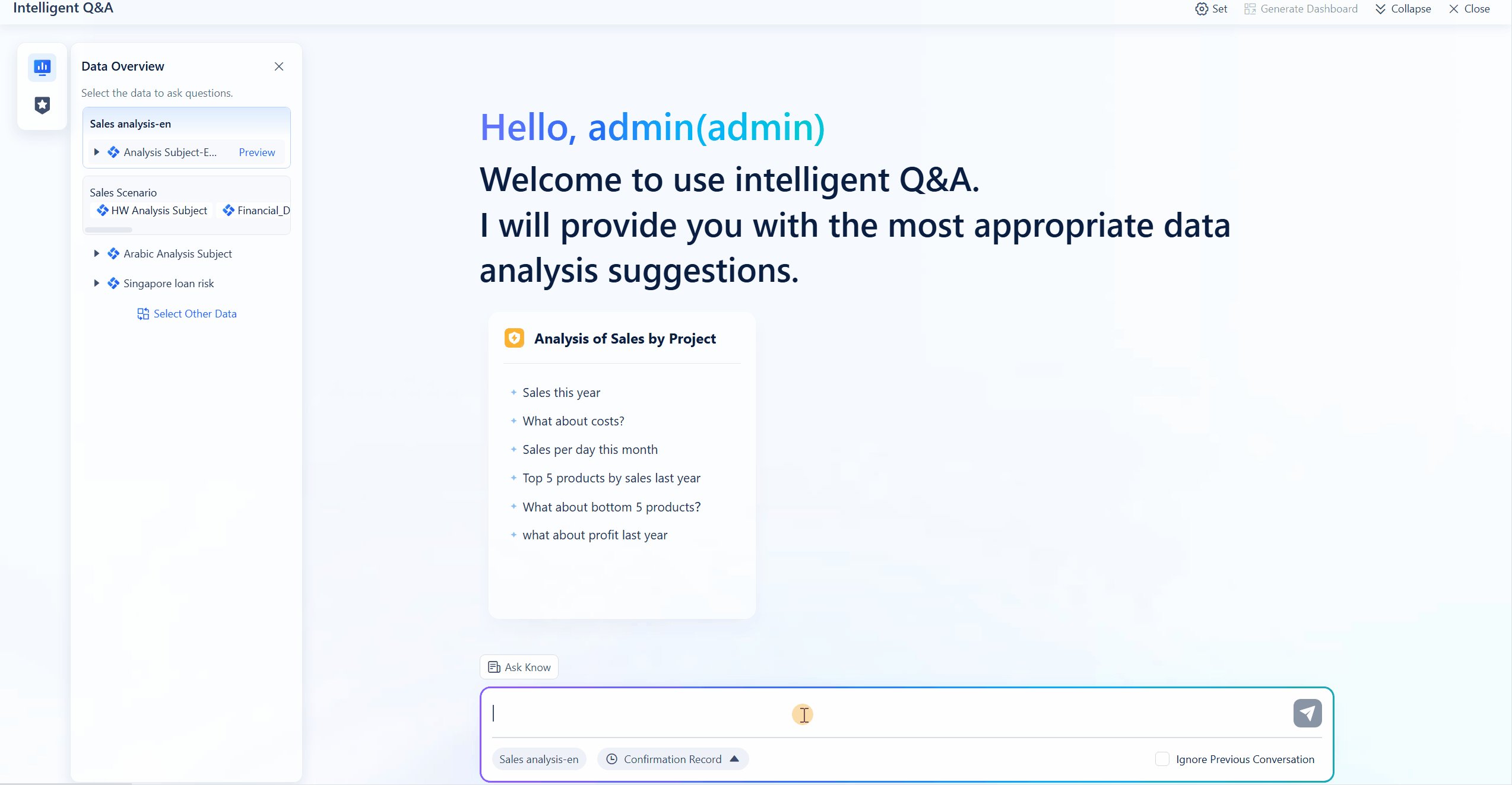

FanRuan’s FineBI help you analyze enterprise value with real-time insights and intuitive dashboards.

You need to understand what enterprise value means before you can use it in your analysis. Enterprise value measures the total value of a business. It combines the market value of equity, the value of debt, and subtracts cash and cash equivalents. Leading financial institutions use enterprise value as a core metric in their valuation models. They apply it in discounted cash flow models and relative valuation techniques. These methods rely on financial statements prepared under international standards. By using enterprise value, you can estimate future cash flows and the fair value of a company. This approach helps you see the true worth of a business, not just its stock price.

Enterprise value stands out because it includes both equity and debt. Market capitalization only shows the value of a company’s shares. Enterprise value gives you a more complete picture. It tells you what it would cost to buy the whole company, including its debts and minus its cash. This makes enterprise value a key figure for investors and analysts.

Enterprise value matters because it gives you a better way to compare companies. You can use it to judge financial health and spot good investment opportunities. Here are some reasons why enterprise value is important:

You also use enterprise value in mergers and acquisitions. It helps you decide if the price is fair and what the real cost of a takeover will be. The table below shows how enterprise value influences key decisions:

| Aspect | Explanation |

|---|---|

| Comprehensive Measure | Enterprise value gives a holistic view by including debt and cash. |

| Informed Comparisons | It lets you compare companies and assess financial health. |

| Fair Pricing in M&A | Enterprise value helps set a fair price in mergers and acquisitions. |

| Cost of Takeover | It shows the total cost to acquire a company, including financing. |

When you use enterprise value, you make smarter investment choices and better business decisions.

Image Source: pexels

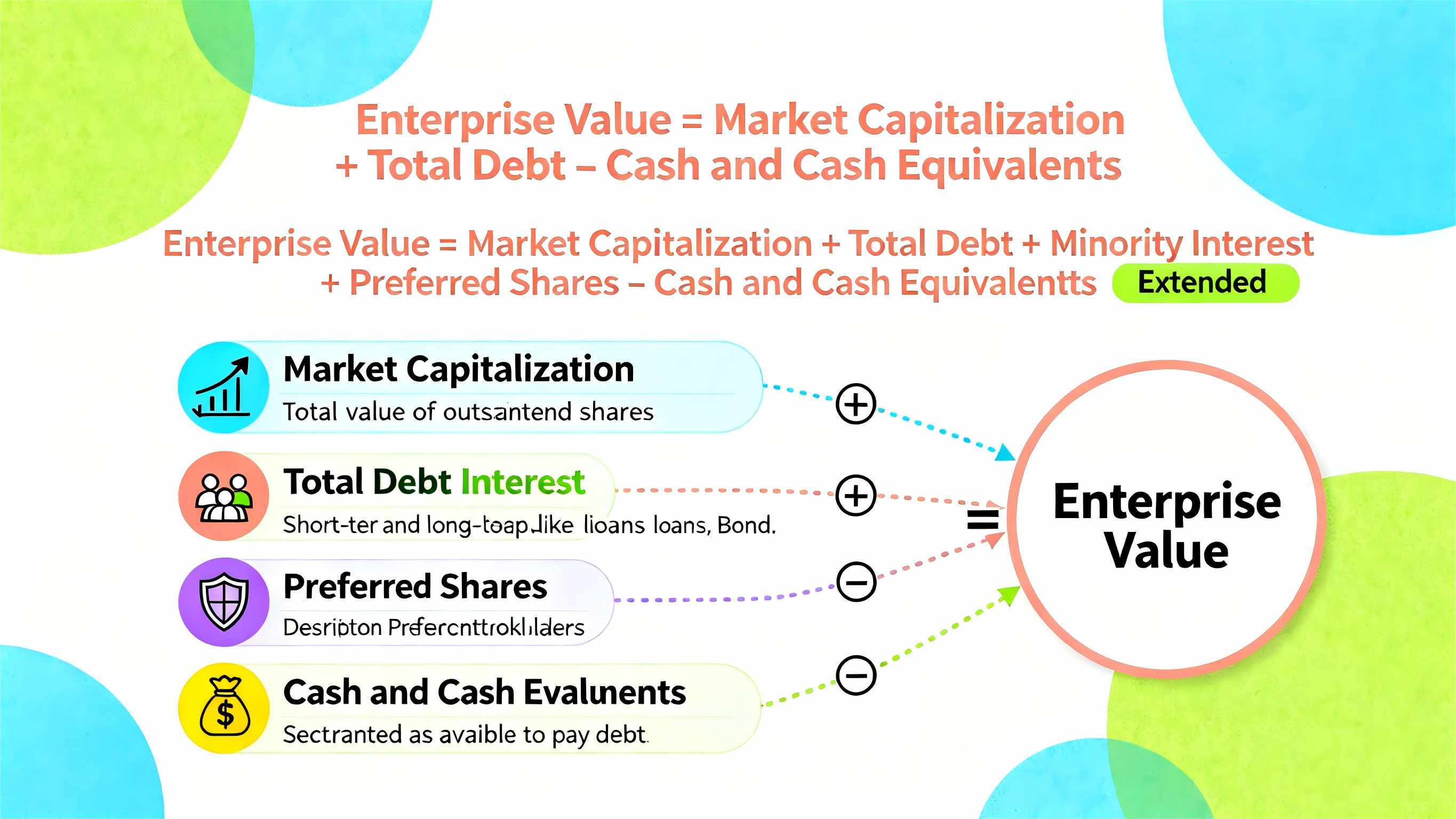

You need to know the enterprise value formula to understand what a company is truly worth. The basic formula for enterprise value looks like this:

Enterprise Value = Market Capitalization + Total Debt – Cash and Cash Equivalents

This formula gives you a starting point. It shows you the total value of a business, not just the value of its shares. When you use the enterprise value formula, you include both the money a company owes and the cash it holds. This approach helps you see the real cost to buy the entire company.

Sometimes, you need to use the extended formula for enterprise value. This version adds minority interest and preferred shares. These items matter if the company owns less than 100% of a subsidiary or has preferred stockholders. Here is a table that shows the main components of the ev formula and their descriptions:

| Component | Description |

|---|---|

| Market Capitalization | The total value of all outstanding shares of a company’s stock. |

| Total Debt | Both short-term and long-term obligations, such as bank loans and bonds. |

| Minority Interest | Included when relevant, especially for firms with significant non-controlling stakes. |

| Preferred Shares | Included when relevant, especially for firms with preferred stockholders. |

| Cash and Cash Equivalents | Subtracted, as this money is immediately available to pay down debt. |

You can see that the enterprise value formula covers more than just the stock price. It gives you a complete view of a company’s financial position.

You need to look at each part of the enterprise value formula to calculate enterprise value correctly. Here are the main components of the ev formula and where you can find them:

| Component | Description |

|---|---|

| Market Capitalization | Multiply the total number of shares by the current stock price. |

| Market Value of Debt | Add up all short-term and long-term debts from the balance sheet. |

| Cash and Equivalents | Find the most liquid assets, which reduce the cost of buying the company. |

| Preferred Stock | Add the value of any preferred shares, which act like debt in an acquisition. |

| Noncontrolling Interest | Include the value of any part of a subsidiary not owned by the parent company. |

You can find these numbers in a company’s financial statements. Market capitalization comes from the stock market. Debt, cash, and preferred stock appear on the balance sheet. Minority interest shows up if the company owns less than 100% of another business.

When you calculate enterprise value, you add debt and subtract cash. Cash lowers the cost because you can use it to pay off some of the debt. Debt raises the cost because you must pay it when you buy the company. Preferred stock and minority interest also increase the total value, since you need to account for all claims on the company.

Tip: Always double-check these numbers in the financial statements. Mistakes can lead to wrong valuations and poor decisions.

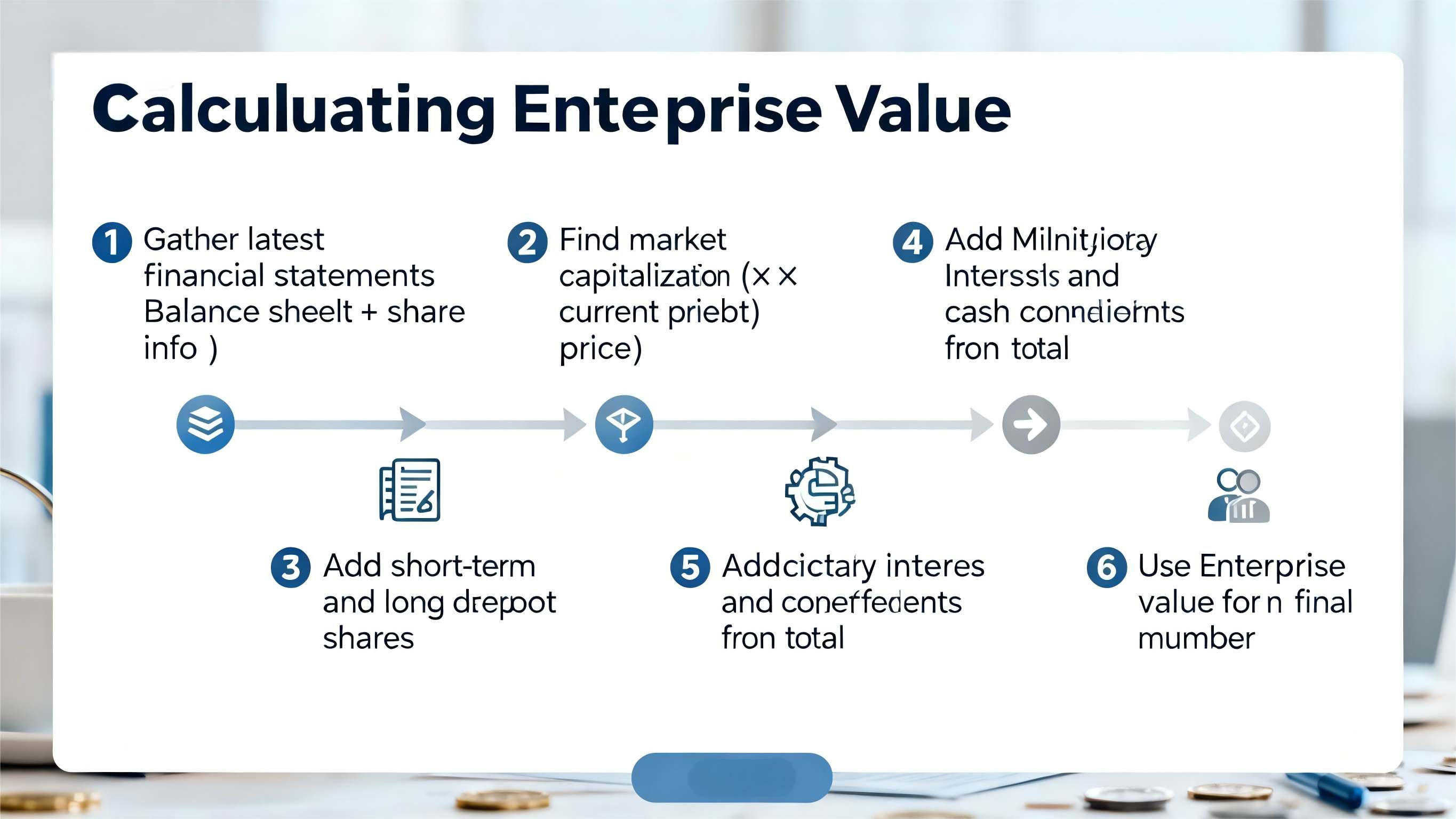

You can follow a simple process to calculate enterprise value. Here is a step-by-step guide:

Let’s look at an example:

Calculation:

Enterprise Value = 700,000,000 + 300,000,000 + 40,000,000 + 30,000,000 – 70,000,000 = USD 1,000,000,000

You can use this process for any company. Make sure you use the right numbers and update them as new financial data comes out.

Note: Many analysts use enterprise value for important ratios like EV/EBITDA and EV/Sales. These ratios help you compare companies, even if they have different capital structures.

If you want to avoid mistakes, remember these common errors:

You can make this process easier with tools like FineBI. FineBI lets you connect to your financial data, automate calculations, and build dashboards. You can visualize enterprise value over time, compare it across companies, and spot trends quickly. This saves you time and helps you make better decisions.

FineBI’s self-service analytics and real-time dashboards help you calculate enterprise value with confidence. You can focus on analysis, not manual data entry.

When you understand the enterprise value formula and its components, you can analyze companies more accurately. You can use this knowledge for mergers, acquisitions, and investment decisions. FineBI gives you the tools to automate and visualize these calculations, making your work faster and more reliable.

You might think market capitalization tells you everything about a business. It shows you the price the market puts on its shares. However, enterprise value goes further. It reveals the total value of a company by including both debt and cash. This makes it a broader financial measure and a stronger tool for analyzing a business’s true size.

Here is a quick comparison:

| Metric | Calculation | Interpretation |

|---|---|---|

| Enterprise Value | Market Cap + Total Debt – Cash | Shows the total value of a company, including the impact of debt and available cash. |

| Market Capitalization | Latest Stock Price × Total Shares Outstanding | Focuses only on equity, reflecting what the market thinks the business is worth. |

Enterprise value provides a more complete picture compared to market capitalization.

When you study different businesses, you want the full story, not half of it. Enterprise value gives you several advantages:

If a business uses lots of borrowed money, market capitalization can hide the real risks. Enterprise value avoids this problem, so you see the real worth. You also get a better foundation for comparing companies with different capital structures.

No single measure is perfect. You need to know that enterprise value has limits:

Tip: Use enterprise value as a guide, but always look for extra details behind the numbers.

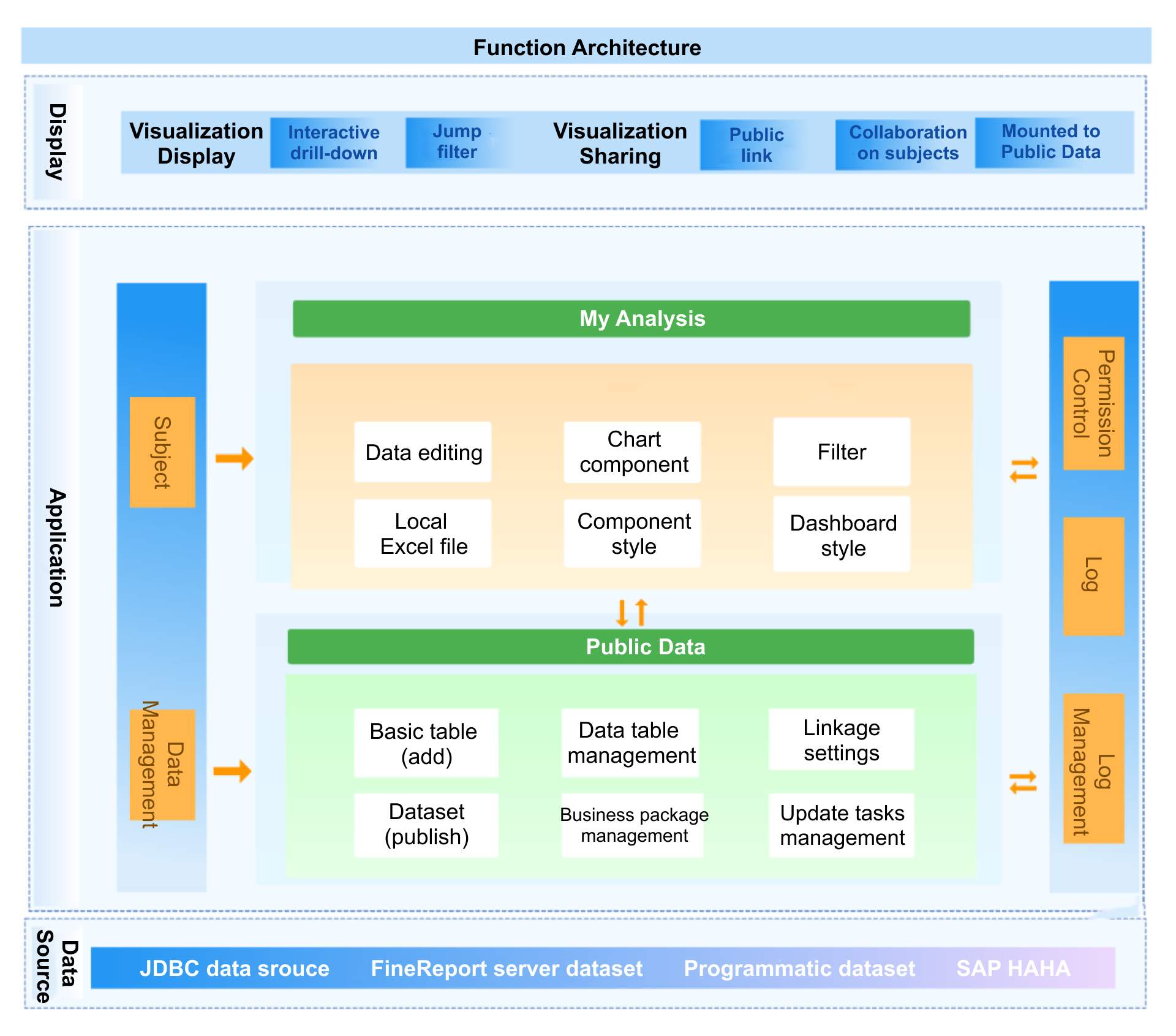

You can streamline enterprise value calculation with FineBI. FineBI connects to your financial data sources and brings all your information together for analysis. You get two main engines to handle your data needs:

| Feature | Description |

|---|---|

| BI-Real-time Engine | Connects directly to big data platforms for real-time processing of massive data without extraction. |

| BI-Extraction Engine | Pre-extracts data for offline calculation, enabling high-performance queries on large datasets. |

FineBI lets you build dashboards that visualize enterprise value over time. You can track changes, compare companies, and spot trends. The platform helps you overcome common challenges like poor data quality or large data volumes. You can set up a data governance framework and use scalable storage solutions to keep your analysis accurate and efficient.

FineChatBI makes enterprise value analysis more interactive. You can ask questions in plain language and get instant answers. This tool bridges the gap between business users and IT teams. You do not need technical skills to query data or explore insights. FineChatBI sits on top of your BI platform and improves data accessibility for everyone.

| Feature | Description |

|---|---|

| Natural Language Interface | Allows business users to query data easily without needing technical skills. |

| Integration with BI Platforms | Sits on top of existing BI platforms to enhance data accessibility. |

| Addresses User Pain Points | Reduces the bottleneck between business users and IT teams in data querying. |

You can use FineChatBI to analyze enterprise value quickly and make better decisions. Financial teams gain more control and flexibility in their analysis.

You see the impact of enterprise value analysis in many industries. In finance, companies like Founder Securities use FineBI to empower employees and improve decision-making. They migrated 50,000 user accounts during a merger with precise data analysis and risk control. In manufacturing, organizations use these tools to monitor performance and drive growth.

Tip: When you use FineBI and FineChatBI, you can overcome challenges like data integration, large data volumes, and resistance to change. You build a data-driven culture and support smarter business decisions.

You now understand enterprise value as a key measure of a company’s total worth, including equity and debt. The formula is simple: market capitalization plus total debt minus cash.

| Key Aspect | Description |

|---|---|

| Definition | Enterprise value shows a company’s full value, including debt and equity. |

| Calculation | EV = Market Cap + Total Debt – Cash and Cash Equivalents. |

| Importance | EV helps you compare companies and guides M&A decisions. |

FanRuan’s FineBI and FineChatBI make your analysis faster and more accurate. You can boost decision-making speed by using advanced analytics and regular strategy reviews.

Explore FineBI solutions to elevate your financial insights.

FanRuan

https://www.fanruan.com/en/blogFanRuan provides powerful BI solutions across industries with FineReport for flexible reporting, FineBI for self-service analysis, and FineDataLink for data integration. Our all-in-one platform empowers organizations to transform raw data into actionable insights that drive business growth.

Enterprise value includes debt and subtracts cash. Market capitalization only shows the value of a company’s shares. You get a more complete picture of a company’s worth with enterprise value.

Enterprise value lets you compare companies with different capital structures. You see the total cost to acquire a business. This helps you make better investment decisions.

You can find most data in a company’s financial statements. Look for market capitalization on stock exchanges. Check the balance sheet for debt, cash, and minority interest.

FineBI connects to your data sources and automates calculations. You can build dashboards to visualize enterprise value trends. This saves you time and reduces errors.