Imagine trying to make sense of a company’s financial data spread across spreadsheets, emails, and reports. You need more than intuition to make the right decisions. Financial analytics gives you the tools to create ad hoc analysis, answer specific business questions, and forecast future scenarios.

Financial analytics gives you the ability to examine financial data and transform it into actionable insights. You use financial analytics to evaluate your company’s financial health, spot trends, and make informed decisions. Industry experts define financial analytics as the process of analyzing both structured and unstructured financial data to support business leaders. You can use financial analytics to assess the viability and profitability of business activities, improve cash flow, and manage assets more effectively.

Financial analytics synthesizes qualitative and quantitative financial data. You can analyze operational data alongside external information, such as market trends or customer feedback, to guide your decisions. This approach helps you answer specific questions, forecast future scenarios, and shape your company’s strategy.

You rely on financial analytics to:

Financial analytics includes several main types, each serving a unique purpose. You can use these types to answer different questions about your financial data and guide your decision-making process.

| Type of Analytics | Description | Application in Financial Analytics |

|---|---|---|

| Descriptive | Summarizes historical financial data to answer 'What happened?' | Tracking monthly reports, summarizing feedback, analyzing sales trends |

| Diagnostic | Investigates trends and uncovers relationships to answer 'Why did it happen?' | Pinpointing causes behind outcomes, analyzing performance |

| Predictive | Uses historical financial data to answer 'What’s likely to happen next?' | Forecasting revenue, assessing risk, planning market expansion |

| Prescriptive | Provides recommendations based on predictive analytics | Suggesting actions, optimizing budgets, planning investments |

You can see how each type of financial analytics supports different business needs:

| Type of Financial Analytics | Common Use Cases | Real-Life Example |

|---|---|---|

| Descriptive | Internal reporting, board presentations, variance tracking | A retail company analyzes last year’s sales by region and product category to determine which locations and SKUs performed best during Q4. |

| Diagnostic | Identifying underperforming units, analyzing profitability drops, understanding overspending | A SaaS company sees a 15% drop in monthly recurring revenue. Diagnostic analytics reveals that most churn came from customers on annual plans who didn’t renew due to lack of product support. |

| Predictive | Revenue forecasting, risk assessment, market expansion planning, inventory forecasting | A fintech company uses five years of customer repayment history to build a credit risk model that predicts the likelihood of new borrowers defaulting within the next 12 months. |

| Prescriptive | Budget reallocation, capital investment planning, dynamic pricing, expense optimization | An e-commerce CFO uses prescriptive analytics to simulate multiple promotional strategies for the festive season and chooses the one that maximizes profit without hurting margins. |

Financial analytics also includes risk analytics, which helps you identify, measure, and manage financial risk. You use risk analytics to protect your organization from unexpected losses and to ensure compliance with regulations.

Recent trends show that financial analytics is evolving rapidly. You see financial institutions investing in advanced data initiatives and adopting cloud accounting for better security and accessibility. Companies use predictive analytics to improve fraud detection and tailor services. Advanced data analytics tools enable better forecasting and visualization, while customer-centric analytics helps you understand and improve customer loyalty.

You benefit from financial analytics by gaining a clearer view of your financial data, making smarter decisions, and staying competitive in a fast-changing market.

Financial analytics transforms the way you manage your organization’s financial health. You gain the ability to analyze financial data from multiple sources, which helps you understand your company’s strengths and weaknesses. When you use financial analytics, you improve your decision-making strategies and set your business up for long-term success.

You can see the impact of financial analytics in several areas:

Financial analytics also streamlines budgeting and forecasting activities. You automate tasks and free up time for strategic initiatives. Access to real-time metrics empowers you to make proactive decisions and respond quickly to changes in the market.

FineReport’s financial analytics solution addresses common industry challenges. You often face fragmented financial data and manual reporting processes. FineReport integrates data from multiple sources, automates report generation, and provides intuitive visualization tools. You can perform deep financial analysis and cross-reference data, which improves operational efficiency and supports strategic financial planning.

Organizations measure the return on investment from financial analytics solutions using several frameworks:

| Framework/Methodology | Description |

|---|---|

| ROI Calculation | Compares the value derived from data initiatives against total investment, revealing monetary gains and other benefits. |

| Business Value Creation | Evaluates the impact of analytics on decision-making and customer satisfaction. |

| Cost Analysis | Assesses the total cost of delivering insights to determine the net return. |

You identify the business value created by analytics efforts, determine the total cost of delivering insights, and calculate ROI using the formula: Return divided by Investment.

Industry reports show that companies using advanced financial analytics tools experience significant improvements:

Regulatory requirements also influence the adoption of financial analytics tools. Regulators mandate the use of digital reporting standards like XBRL, develop taxonomies for compliance, and promote international collaboration. You benefit from improved data quality and easier compliance with financial regulations.

Financial analytics gives you the power to make informed decisions based on accurate financial data. You use analytics to forecast future scenarios, identify discrepancies, and optimize resource allocation. Accurate forecasting is crucial for global operations, and financial analytics helps you stay competitive.

You improve access to financial data, which enables you to make timely decisions. Enhanced risk management allows you to detect potential financial risks early and take action to protect your organization. Real-time analysis of financial performance supports proactive decision-making and helps you respond to market changes.

Financial analytics also improves risk assessment and performance measurement. Predictive analytics used by insurance companies recommends policy plans based on customer data, enhancing risk management. In logistics, financial analytics optimizes supply chain management and reduces operational costs.

You can see the benefits of financial analytics in these examples:

FineReport's financial analytics platform empowers you to manage financial health across departments. You can create executive dashboards, automate reporting, and integrate data from various sources. The platform supports multi-dimensional analysis, allowing you to drill down into financial data and uncover underlying issues. You use visualization tools to make complex financial data accessible to non-financial managers, improving communication and collaboration.

When you adopt financial analytics, you streamline budgeting, forecasting, and reporting. Automation increases efficiency and reduces errors. You gain a comprehensive view of financial performance, enabling you to make smarter decisions and drive growth.

Tip: Financial analytics is not just about numbers. You use it to understand your business, manage financial risks, and plan for the future. With the right tools, you turn financial data into actionable insights that support your organization’s success.

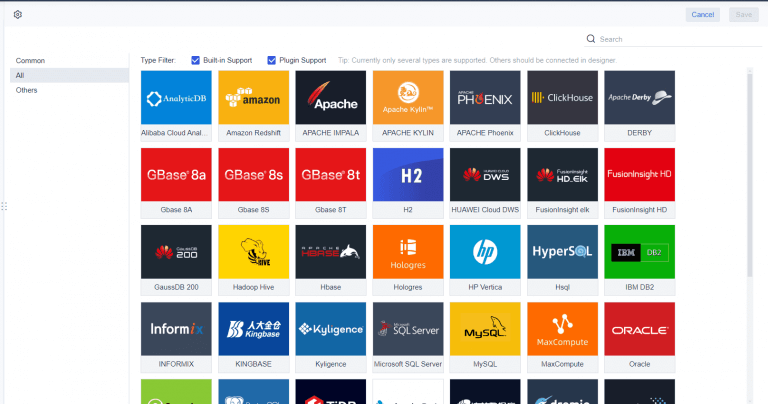

You use data analysis as the foundation of financial analytics. This process helps you transform raw financial data into actionable insights. You monitor market trends to manage risk and forecast potential scenarios. You evaluate financial performance by benchmarking against industry standards. This approach allows you to identify strengths and weaknesses, leading to targeted improvements and increased profitability. FineReport supports you with multi-source integration, enabling you to collect and analyze financial data from various databases and files. You can automate data entry and reporting, which streamlines your workflow and improves accuracy.

Financial modeling is a core concept in financial analytics. You build models to forecast outcomes and analyze scenarios. This helps you assess risk, allocate resources, and align strategies with your organization’s goals. You use financial modeling to simulate different market conditions and prepare for uncertainties. FineReport's reporting tools allow you to create dynamic models and adjust variables easily. You can import Excel models, integrate real-time financial data, and visualize results instantly.

Visualization plays a vital role in financial analytics. You present financial data in charts, graphs, and dashboards, making complex information accessible to all stakeholders. Visualization enhances clarity, improves storytelling, and reveals patterns that might be missed in raw data. FineReport offers interactive dashboards and customizable layouts, helping you communicate financial insights effectively.

| Benefit | Description |

|---|---|

| Clarity and Accessibility | Communicates financial information clearly, making it easier for a wider audience to understand. |

| Enhanced Presentation | Makes financial reports more engaging and appealing, encouraging stakeholders to revisit them. |

| Improved Storytelling | Guides users through data, helping them understand assumptions, risks, and constraints. |

| Pattern Recognition | Reveals patterns and trends that may be missed, simplifying complex data relationships. |

| Enhanced Decision-Making | Simplifies decision-making by providing key insights at a glance, improving efficiency. |

You use visualization to get a clear picture of your financial status, illustrate potential outcomes, and track progress toward objectives. FineReport’s dashboards and reporting features help you present financial analytics in a way that supports informed decision-making.

You need robust tools to manage financial analytics effectively. FineReport offers a comprehensive suite of features designed to streamline financial reporting, data analysis, and investment decision-making. The platform enables you to create interactive reports and dashboards that visualize key financial indicators. You can integrate real-time data from multiple sources, which supports accurate financial analytics and reporting.

| Feature | Description |

|---|---|

| Interactive Reports | Create dynamic financial reports that you can customize and manipulate in real time. |

| Dashboards | Design dashboards to visualize financial data and key business indicators. |

| Real-time Data Integration | Connect to various data sources for up-to-date financial analytics and reporting. |

| Multi-dimensional Analysis | Analyze financial data from multiple perspectives to enhance investment decisions. |

| User-friendly Interface | Use drag-and-drop tools for easy report and dashboard creation without coding. |

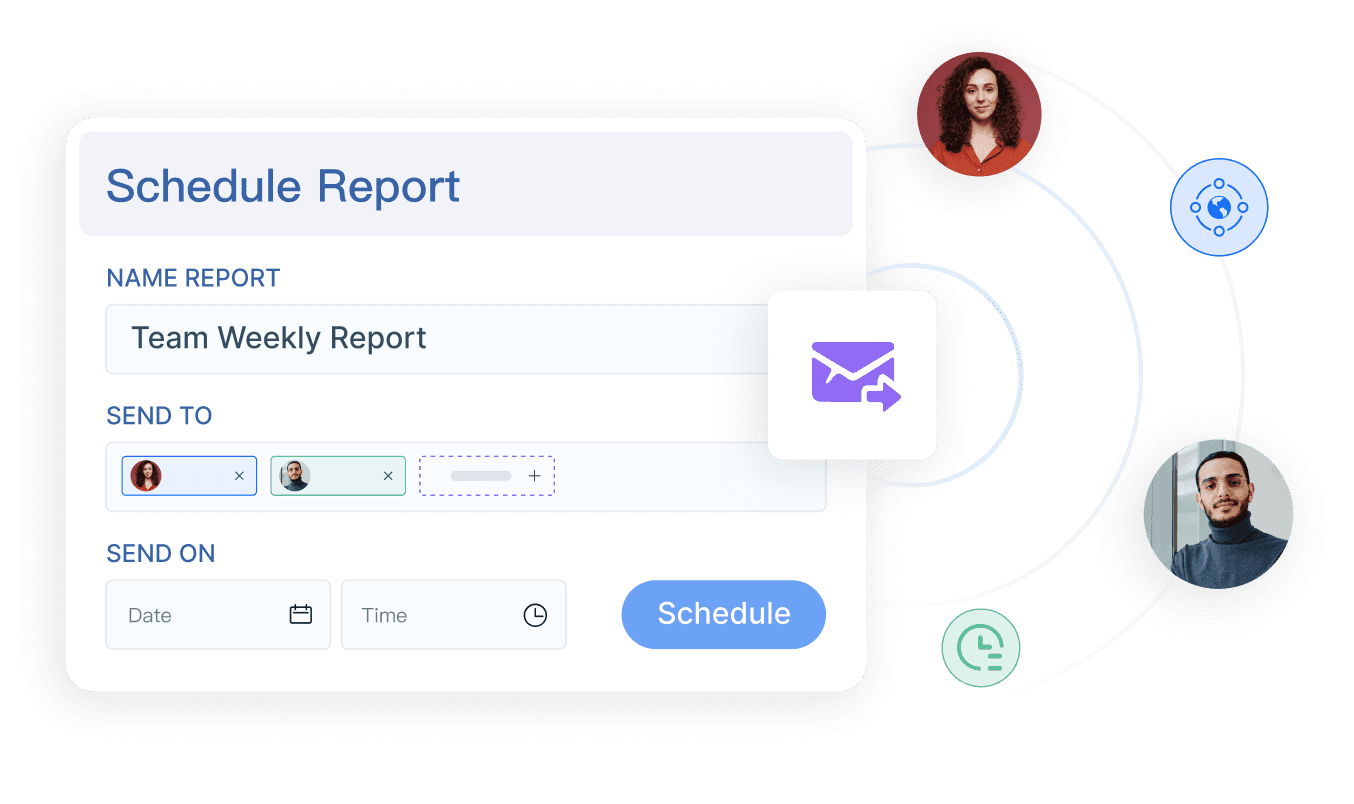

| Scheduling Report Generation | Automate financial reporting and ensure timely delivery to stakeholders. |

| Comprehensive Reporting Functions | Access a wide range of reporting capabilities beyond traditional tools like Excel. |

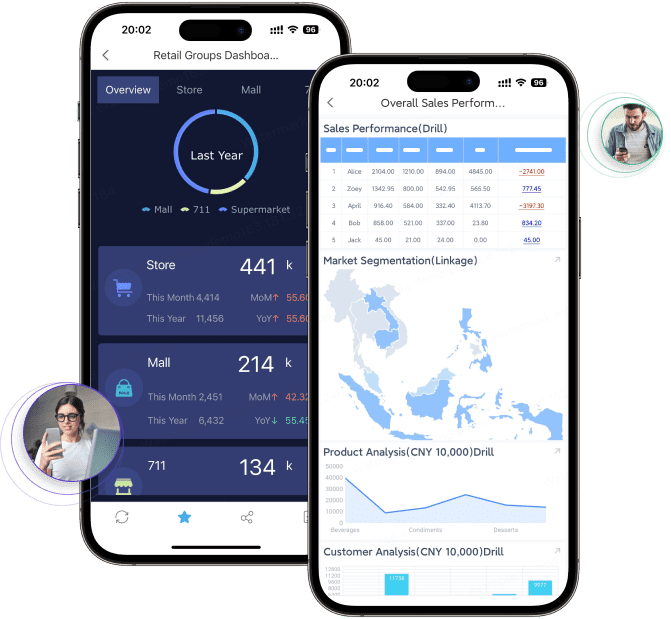

FineReport also supports seamless integration with existing systems, such as OA, CRM, or MES. You can build a management cockpit for comprehensive financial analytics and investment oversight. The mobile BI feature allows you to track business performance and financial data anywhere, anytime, using native iOS and Android apps. This instant accessibility ensures you always have the latest financial analytics at your fingertips.

You can apply FineReport’s financial analytics tools to a variety of financial management scenarios. For budgeting, you use real-time data entry and automatic aggregation to streamline the budgeting process. In financial reporting, you automate report generation and distribution, reducing manual workload and improving accuracy. Performance analysis becomes more effective with dashboards that provide live data, enabling you to respond quickly to changing financial conditions.

FineReport addresses common financial analytics challenges, such as fragmented financial data and limited analytics capabilities. You benefit from centralized access to key performance indicators, which improves decision speed and accuracy. Reliable data connections and routine updates ensure your financial analytics and reporting are always based on current information. By using FineReport, you minimize risk, maximize investment returns, and support strategic financial planning.

When you work with financial analytics, you often face several common challenges that can slow down your progress and affect your results. These issues can make it difficult to get accurate insights from your financial data.

You may also experience these problems:

Data complexity adds another layer of difficulty. Poor data quality and operational inefficiencies can result. When your systems lack integration, you may lose visibility and misallocate resources. Inconsistent data lowers your confidence in financial analytics, making decision-making harder. Analysts often spend too much time preparing data instead of analyzing it. Poor data quality can even harm customer experiences and damage your brand’s credibility.

You can overcome these barriers by using automation, integration, and visualization features in modern financial analytics tools like FineReport. Automation reduces manual work and errors. Integration brings all your financial data together, giving you a unified view. Visualization helps you spot trends and risks quickly.

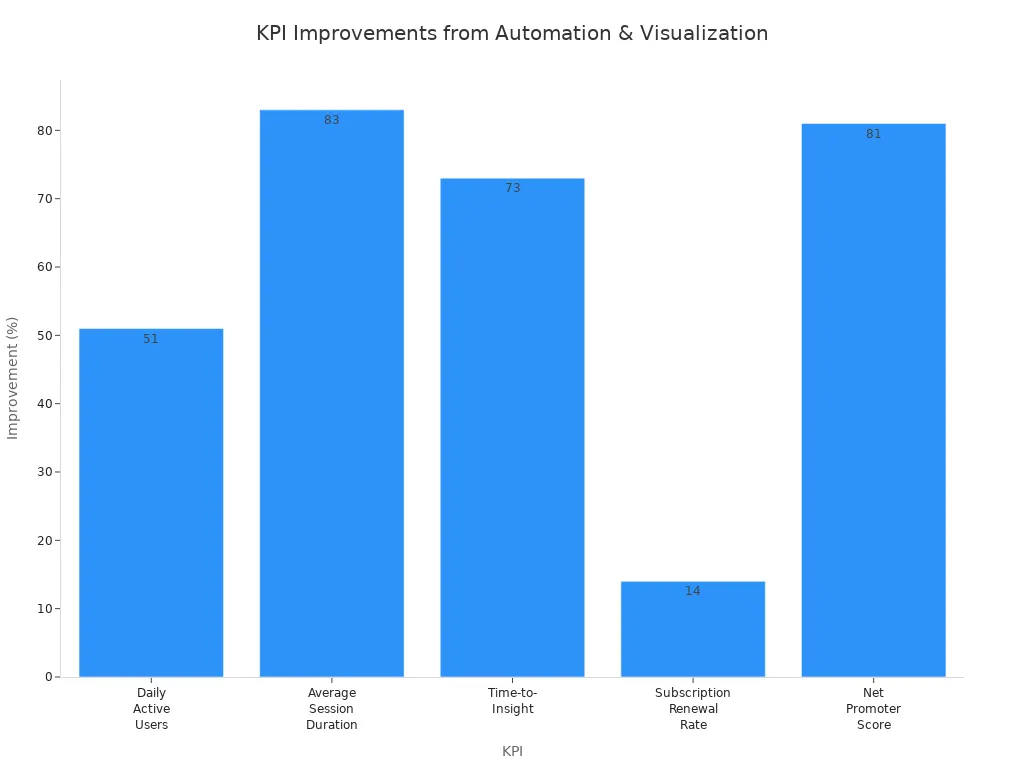

FineReport’s automation and visualization features have delivered measurable improvements for users:

| KPI | Improvement |

|---|---|

| Daily Active Users (DAU) | Increased by 51% |

| Average Session Duration | Rose by 83% |

| Time-to-Insight | Reduced by 73% |

| Subscription Renewal Rate | Increased by 14% |

| Net Promoter Score (NPS) | Rose by 81% |

Small and medium-sized businesses often face barriers such as financial concerns and insufficient expertise. These challenges can slow down the adoption of financial analytics. FineReport addresses these issues by offering user-friendly interfaces and low-code solutions, making it easier for you to implement advanced financial analytics without needing deep technical skills.

By centralizing your data, automating routine tasks, and using clear visualizations, you can improve your financial analytics process. This approach helps you manage risk, ensure data quality, and make better financial decisions.

Financial analytics gives you the power to make smarter decisions and drive better business outcomes. You gain accurate insights that help you optimize sales performance and align financial planning with your strategy. Advanced tools like FineReport provide real-time data access and simplify KPI tracking, making financial analysis faster and more reliable. Automation and integration improve efficiency and reduce errors. When you choose a financial analytics solution, you enhance stakeholder communication, support compliance, and identify growth opportunities.

Start exploring financial analytics solutions today to improve efficiency and support strategic planning for your organization.

How to Do Retention Analysis for Business Success

What is Pareto Chart and How Does it Work

How DuPont Analysis Helps You Understand Your Business

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Self-Service Analytics Defined and Why You Need It

Self-service analytics lets you analyze data without IT help, empowering faster, data-driven decisions and boosting agility for your business.

Lewis

Jan 04, 2026

Best Self-Service Tools for Analytics You Should Know

See which self-service tools for analytics let business users access data, build dashboards, and make decisions faster—no IT help needed.

Lewis

Dec 29, 2025

Understanding Predictive Analytics Services in 2026

Predictive analytics services use data and AI to forecast trends, helping businesses make informed decisions, reduce risks, and improve efficiency in 2026.

Lewis

Dec 30, 2025